32 IRS Tax Forms Every US Accounting Firm Must Know in 2026

[Last Updated on 1 month ago]

For U.S. accounting firms, staying current with IRS documentation isn’t just about compliance — it’s about delivering value, avoiding penalties, and guiding clients through a complex federal tax system.

Many firms now rely on AI Tax Assistants to track IRS updates, form changes, and filing requirements without manual checking, such as CPA Pilot.

Whether you’re preparing returns for high-income earners, small business owners, gig workers, or retirees, understanding which federal tax forms, IRS schedules, and information returns apply is essential.

This listicle breaks down 32 critical IRS forms, including key schedules attached to Form 1040, income reporting documents like the 1099 series, and deduction claim forms like 1098 and 8863.

Each section includes direct IRS links, so your firm can download and use each form with confidence.

Built for tax preparers, certified public accountants, and enrolled agents, this is your go-to checklist for the 2026 tax season.

Let’s start with the foundation — the five core income tax forms that power nearly every individual tax return.

Table of Contents

- List of IRS Tax Forms 2026 [Quick Summary]

- Core Individual Income Tax Forms Used by Accounting Firms

- IRS Schedules Attached to Form 1040

- Income and Withholding Reporting Forms (W-2 and 1099 Series)

- Credit and Deduction Forms for Clients

- Compliance, Coverage, and Paper Filing Forms

- How CPA Pilot Helps Accounting Firms Manage IRS Tax Forms in 2026?

- Essential IRS Tax Forms FAQs

List of IRS Tax Forms 2026 [Quick Summary]

| Form Number | Purpose | Who Uses It | Filed By |

|---|---|---|---|

| Form 1040 | Reports total individual income and tax liability | Employees, freelancers, retirees, investors | Individual taxpayer |

| Form 1040-SR | Simplified tax return for seniors | Taxpayers age 65+ | Individual taxpayer |

| Form 1040-NR | Reports U.S. income for nonresident aliens | Foreign students, visa holders, investors | Nonresident taxpayer |

| Form 1040-X | Amends a previously filed return | Taxpayers correcting prior filings | Individual taxpayer |

| Form 1040-ES | Pays quarterly estimated taxes | Freelancers, business owners, investors | Individual taxpayer |

| Schedule 1 | Reports additional income and adjustments | Taxpayers with unemployment or other income | Individual taxpayer |

| Schedule A | Claims itemized deductions | Homeowners and high-deduction filers | Individual taxpayer |

| Schedule B | Reports interest and dividend income | Investors and savers | Individual taxpayer |

| Schedule C | Reports business income and expenses | Freelancers, sole proprietors | Individual taxpayer |

| Schedule D | Reports capital gains and losses | Investors selling assets | Individual taxpayer |

| Schedule SE | Calculates self-employment tax | Self-employed individuals | Individual taxpayer |

| Schedule R | Claims credit for elderly or disabled | Qualifying seniors or disabled taxpayers | Individual taxpayer |

| Form W-2 | Reports wages and tax withholding | Employees | Employer |

| Form W-4 | Sets federal withholding instructions | Employees | Employee |

| Form W-9 | Provides taxpayer ID for reporting | Contractors and vendors | Contractor |

| Form 1099-NEC | Reports nonemployee compensation | Freelancers and contractors | Business |

| Form 1099-MISC | Reports miscellaneous income | Landlords, attorneys, licensors | Business |

| Form 1099-INT | Reports interest income | Savers and bondholders | Financial institution |

| Form 1099-DIV | Reports dividends and distributions | Investors | Brokerage or corporation |

| Form 1099-R | Reports retirement distributions | Retirees and IRA holders | Financial institution |

| Form 1099-B | Reports securities sales | Investors | Brokerage |

| Form 1098 | Reports mortgage interest paid | Homeowners | Lender |

| Form 1098-T | Reports tuition and education expenses | Students and parents | Educational institution |

| Form 1098-E | Reports student loan interest | Student loan borrowers | Lender |

| Form 8863 | Claims education tax credits | Parents, students, professionals | Individual taxpayer |

| Form 2441 | Claims child and dependent care credit | Working parents and caregivers | Individual taxpayer |

| Form 5695 | Claims residential energy credits | Homeowners | Individual taxpayer |

| Form 4868 | Requests filing extension | Taxpayers needing more time | Individual taxpayer |

| Form 1095-A | Reports marketplace health coverage | ACA marketplace enrollees | Health Insurance Marketplace |

| Form 1095-B | Reports minimum essential coverage | Insured individuals | Insurance provider |

| Form 1095-C | Reports employer health coverage offers | Large-employer employees | Employer |

| Form 1096 | Summarizes paper-filed information returns | Businesses filing paper 1099s | Business |

This table highlights the most commonly used IRS forms. Detailed explanations and edge-case forms are covered in the sections below.

Core Individual Income Tax Forms Used by Accounting Firms

These foundational forms are essential to nearly every individual federal tax return in the United States. Whether your clients are salaried professionals, retirees, international taxpayers, or freelancers making estimated payments, these documents form the backbone of their annual filing obligations.

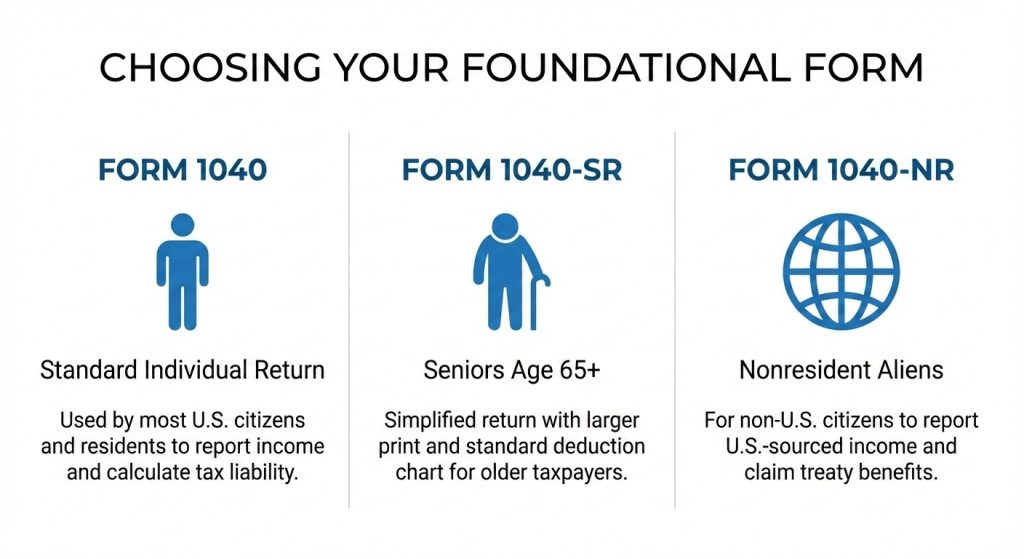

1. Form 1040 – U.S. Individual Income Tax Return

Form 1040 is the central tax form used to report personal income to the IRS. It summarizes wages, investment income, credits, deductions, and total tax liability.

Nearly all individual income tax filers use this form (or a 1040 variant) for their annual federal return. For 2026, Form 1040 remains the default starting point for clients with employment income, side businesses, or multiple income sources.

Who uses this: Salaried employees, retirees, investors, freelancers, and most U.S. individual taxpayers.

📖 Read Instructions for Form 1040

2. Form 1040-SR – Senior Tax Return for Taxpayers Age 65+

Form 1040‑SR is an alternative, large‑print version of Form 1040 for taxpayers aged 65 and over, with a clearer layout and an on‑form standard deduction chart. It features larger text and includes common deductions and income types for retirees. It is ideal for older clients receiving Social Security, pension distributions, or annuity income.

Who uses this: Seniors age 65 or older receiving Social Security, pensions, or retirement income.

3. Form 1040-NR – U.S. Nonresident Alien Income Tax Return

Form 1040‑NR is generally required for nonresident aliens with U.S.source income, subject to treaty provisions and limited exceptions. This includes foreign students, temporary visa holders, and international investors with rental or business income in the U.S. Understanding residency status under IRS rules is essential when using this form.

Who uses this: Nonresident aliens with U.S.-source income, including foreign students and visa holders.

4. Form 1040-X – Amended U.S. Individual Tax Return

File Form 1040-X when you need to correct a previously submitted tax return. This includes adjustments for missed income, new deductions, or a change in filing status. Form 1040‑X can be e‑filed for the most recent years using approved software and must include an explanation of the changes; some situations may still require paper filing.

Who uses this: Taxpayers correcting previously filed federal returns.

📖 Read Instructions for Form 1040-X

5. Form 1040-ES – Quarterly Estimated Tax Payments for Individuals

Form 1040-ES is used by freelancers, business owners, and investors to pay estimated taxes quarterly. It helps clients avoid underpayment penalties by pre-paying taxes not withheld through payroll. Calculating accurate estimates is crucial for high-income individuals and self-employed professionals.

Who uses this: Freelancers, business owners, investors, and taxpayers without payroll withholding.

Now that we’ve covered the primary tax forms every accountant uses during initial return preparation, let’s move into the supporting IRS schedules that often accompany Form 1040, depending on income complexity and deductions.

IRS Schedules Attached to Form 1040

While Form 1040 serves as the primary document for filing personal taxes, most individuals require additional IRS schedules to report specific income types, deductions, or credits. These schedules enable detailed disclosure and ensure that the taxpayer’s situation is accurately reflected.

6. Schedule 1 – Additional Income and Income Adjustments

Schedule 1 is used to report income not listed directly on Form 1040, such as unemployment compensation, gambling winnings, rental income, and business income. It also includes common adjustments like student loan interest, educator expenses, and health savings account deductions.

Who uses this: Taxpayers with unemployment income, rental income, or above-the-line deductions.

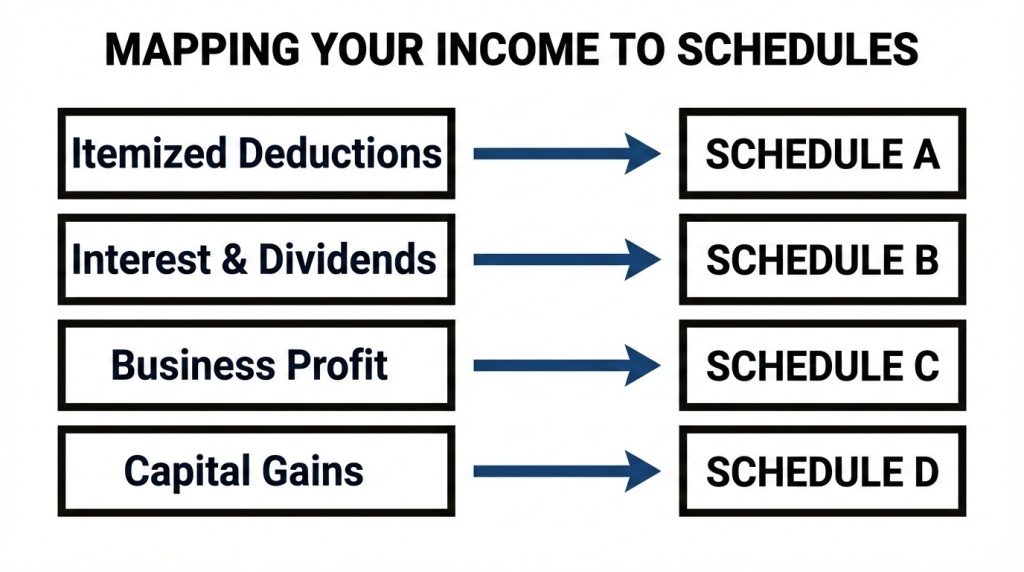

7. Schedule A – Itemized Deductions for Individuals

Schedule A allows taxpayers to claim deductions for mortgage interest, property taxes, medical expenses, and charitable contributions. Clients who exceed the standard deduction threshold should use this form to reduce their taxable income and potentially increase refunds.

Who uses this: Homeowners and taxpayers whose deductions exceed the standard deduction.

8. Schedule B – Interest and Dividend Income Reporting

Schedule B is required when a taxpayer earns over $1,500 in interest or dividends during the year. It’s commonly used for clients with savings accounts, stock portfolios, or mutual fund investments. It also flags accounts with foreign banks, a key compliance issue for international asset holders.

Who uses this: Investors earning over $1,500 in interest or dividends or holding foreign accounts.

9. Schedule C – Business Income and Expenses for Sole Proprietors

Schedule C is used by sole proprietors and independent contractors to report self-employment income and expenses. It’s essential for clients in consulting, gig economy work, and small businesses. Ensure accurate record-keeping to support deductions and avoid audits.

Accurate Schedule C reporting supports deductions covered in small business tax deduction strategies, especially for pass-through entities.

Who uses this: Freelancers, sole proprietors, gig workers, and single-member LLC owners.

10. Schedule D – Capital Gains and Capital Loss Reporting

Schedule D is used to report gains or losses from the sale of assets, including stocks, mutual funds, real estate, and digital assets like cryptocurrency. Capital gains tax calculations depend on holding periods and income level, so accurate reporting is critical.

Capital gains reporting may also trigger Alternative Minimum Tax (AMT) or SALT deduction limitations, depending on income and jurisdiction.

Who uses this: Taxpayers selling stocks, real estate, cryptocurrency, or other capital assets.

11. Schedule SE – Self-Employment Social Security and Medicare Tax

Schedule SE calculates the Social Security and Medicare taxes owed by self-employed individuals. It works alongside Schedule C to ensure proper contributions are made in the absence of employer withholding. This form is particularly important for freelancers and digital nomads.

This often ties directly into pass-through entity tax treatment and planning considerations.

Who uses this: Self-employed individuals paying Social Security and Medicare taxes.

12. Schedule R – Credit for the Elderly or Permanently Disabled

Schedule R allows eligible seniors or permanently disabled individuals to claim a tax credit. While fewer clients qualify due to income limits, it’s a valuable tool for low-income retirees who meet IRS guidelines. It’s often paired with Form 1040-SR for seniors.

Who uses this: Low-income seniors or permanently disabled taxpayers who meet IRS thresholds.

Having covered the IRS schedules that expand the scope of Form 1040, we’ll now move into the next layer: the income and withholding forms that feed data into the return — especially for wage earners, contractors, and investors.

Income and Withholding Reporting Forms (W-2 and 1099 Series)

These forms are issued by employers, financial institutions, or payers and serve as essential inputs for accurate return preparation.

They report earnings, withholdings, retirement distributions, and investment gains, and are required for income matching by the IRS.

13. Form W-2 – Employee Wage and Tax Statement

Form W-2 reports wages paid to employees and the taxes withheld throughout the year. Every employer must issue it by January 31st. This form is the backbone of returns for salaried individuals and is used to calculate Social Security, Medicare, and federal withholding credits.

Who uses this: Employees receiving wages from an employer.

14. Form W-4 – Employee Federal Tax Withholding Certificate

Form W-4 is submitted by employees to instruct employers on how much federal income tax to withhold. This form is crucial during onboarding or when a taxpayer’s financial situation changes. It affects tax refunds or liabilities at year-end tax planning.

When income or credits change mid-year, it’s important to understand how to adjust W-4 withholding correctly.

Who uses this: Employees adjusting federal tax withholding with their employer.

15. Form W-9 – Request for Taxpayer Identification Number

Businesses and clients use Form W-9 to request a contractor’s Social Security Number or EIN. This form is not submitted to the IRS but is used to generate 1099s. It’s essential for any client working with freelancers, landlords, or vendors.

Who uses this: Independent contractors, vendors, landlords, and service providers.

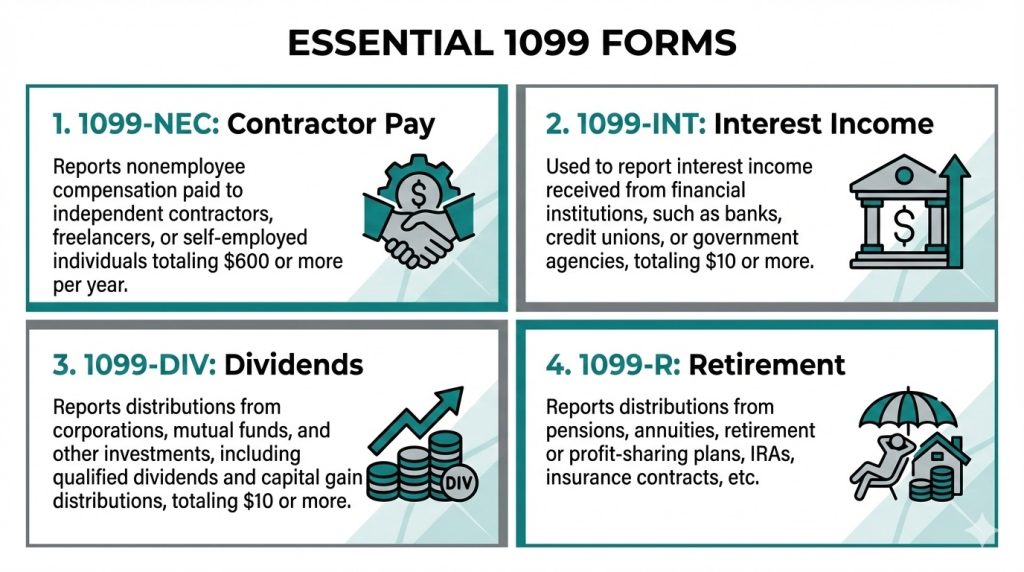

16. Form 1099-NEC – Independent Contractor and Freelancer Payments

Form 1099-NEC is used to report payments of $600 or more to nonemployees such as independent contractors or freelancers. Businesses must file this form with the IRS and furnish it to recipients by January 31st.

Who uses this: Businesses paying freelancers or contractors $600 or more.

17. Form 1099-MISC – Rent, Royalties, and Miscellaneous Income

Form 1099-MISC reports rent, legal settlements, royalties, and other miscellaneous payments not covered under 1099-NEC. It remains useful for real estate owners, attorneys, and content creators receiving licensing revenue.

Who uses this: Property owners, attorneys, licensors, and royalty recipients.

18. Form 1099-INT – Interest Income Reporting

Banks and other financial institutions issue Form 1099-INT to report interest earned on savings accounts, CDs, or government bonds. This form is crucial for clients with passive income or interest-bearing investments.

Who uses this: Taxpayers earning interest from banks, credit unions, or bonds.

19. Form 1099-DIV – Dividend and Capital Gain Distributions

Form 1099-DIV is used to report dividends paid by corporations and capital gain distributions from mutual funds. It is essential for tax planning and investment reporting, especially for clients in upper-income brackets or with brokerage accounts.

Who uses this: Investors receiving dividends or capital gain distributions.

20. Form 1099-R – Retirement, Pension, and IRA Distributions

Form 1099-R reports distributions from IRAs, pensions, annuities, and retirement plans. Clients over 59½ may take distributions without penalties, while others must justify early withdrawals. It’s also key to Required Minimum Distribution (RMD) compliance.

Who uses this: Retirees and individuals withdrawing from IRAs, pensions, or annuities.

21. Form 1099-B – Brokerage Transactions and Capital Asset Sales

Form 1099-B reports gains or losses from the sale of stocks, bonds, and other securities. It includes the cost basis, holding period, and sale proceeds — all required for accurate capital gains reporting on Schedule D.

Who uses this: Investors selling securities through brokerage accounts.

Now that we’ve reviewed the most important income and information returns that feed directly into the IRS 1040, let’s look at the forms that help reduce tax liability — specifically through credits and deductions.

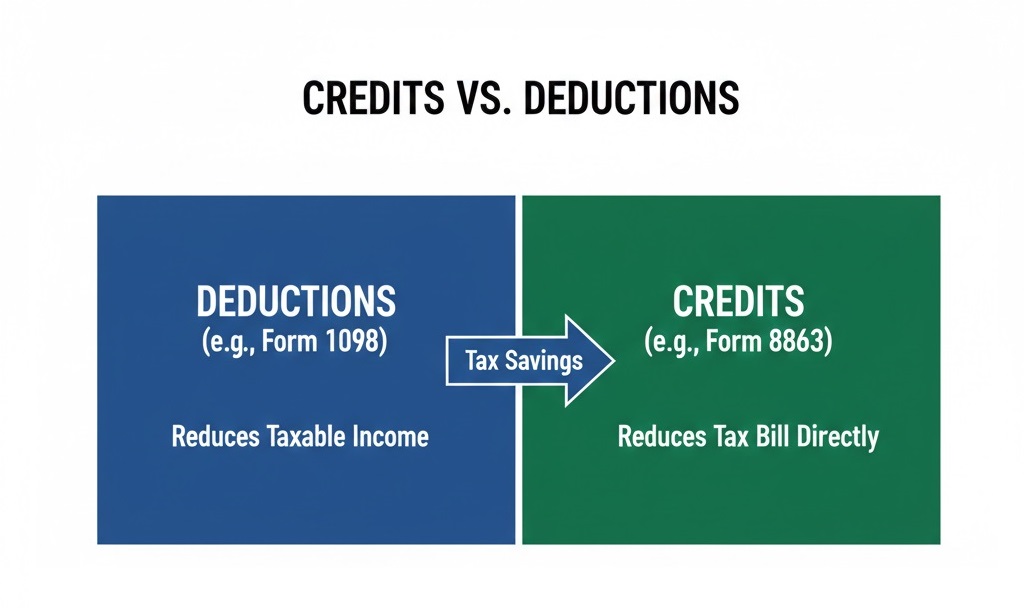

Credit and Deduction Forms for Clients

Helping clients reduce their taxable income or qualify for tax credits can significantly impact their refund or liability.

These IRS forms support deductions for education, homeownership, caregiving, and energy-efficient investments. They are often attached to Form 1040 or integrated into tax software calculations.

22. Form 1098 – Mortgage Interest Deduction Statement

Form 1098 is issued by lenders to report mortgage interest paid by the borrower throughout the tax year. Homeowners can deduct qualified interest payments on Schedule A if they itemize deductions. This form is crucial for clients with first-time home loans or refinanced mortgages.

Who uses this: Homeowners claiming mortgage interest deductions.

23. Form 1098-T – Tuition and Education Expense Reporting

Educational institutions issue Form 1098-T to students to report qualified tuition and related expenses. This form is used to claim education credits like the American Opportunity Credit or Lifetime Learning Credit through Form 8863.

Who uses this: Students and parents claiming education tax credits.

24. Form 1098-E – Student Loan Interest Deduction

Form 1098-E is issued by lenders to report interest paid on qualified student loans. Taxpayers may deduct up to $2,500 of student loan interest as an adjustment to income, even if they don’t itemize.

Who uses this: Borrowers paying interest on qualified student loans.

25. Form 8863 – Education Tax Credits (AOTC and LLC)

Form 8863 allows taxpayers to claim the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC). These credits reduce tax liability directly and are often used by parents of college students or working professionals enrolled in career training.

Who uses this: Parents, students, and professionals claiming AOTC or LLC credits.

26. Form 2441 – Child and Dependent Care Credit

Form 2441 helps working taxpayers claim the Child and Dependent Care Credit. It covers daycare, after-school programs, and other care services required for parents to work or attend school. The form also captures the provider’s EIN or SSN.

Who uses this: Working parents or caregivers paying for dependent care.

27. Form 5695 – Residential Clean Energy and Efficiency Credits

Form 5695 supports tax credits for qualified home energy improvements, such as solar panels, insulation, and energy-efficient windows or doors. Clients making sustainable home upgrades can lower their tax bill while contributing to environmental goals.

Who uses this: Homeowners making energy-efficient or solar improvements.

With deduction and credit forms complete, the next focus is on compliance tools, health coverage reporting, and summary forms — critical for managing extensions, amended returns, and employer filings.

Compliance, Coverage, and Paper Filing Forms

Beyond income and deductions, tax professionals must help clients stay compliant with filing deadlines, coverage mandates, and documentation for paper-submitted informational returns.

These forms close the loop on return accuracy, healthcare reporting, and IRS transmittal obligations.

28. Form 4868 – IRS Tax Filing Extension Request

Form 4868 gives taxpayers an automatic six-month extension to file their federal return. However, it does not extend the time to pay. Filing this form by the April deadline avoids late filing penalties for clients who need more time to organize or receive tax documents.

Extensions are often used alongside time-saving tax workflows designed to reduce filing errors:

Who uses this: Taxpayers needing more time to file their return.

29. Form 1095-A – Health Insurance Marketplace Coverage Statement

Issued by the Health Insurance Marketplace, Form 1095-A reports coverage details for individuals who received health insurance subsidies. This form is required to reconcile the Premium Tax Credit (PTC) and must be attached to returns claiming it.

Who uses this: Individuals receiving subsidized ACA marketplace coverage.

30. Form 1095-B – Proof of Minimum Essential Health Coverage

Form 1095-B is provided by insurers and reports minimum essential coverage. While not typically attached to returns, clients should retain it in case of IRS inquiries about health coverage for the year.

Who uses this: Taxpayers enrolled in minimum essential health coverage.

31. Form 1095-C – Employer-Provided Health Insurance Reporting

Large employers issue Form 1095-C to employees detailing coverage offered under the ACA. Clients who worked for companies with 50+ full-time employees may receive this form. It is used for employer reporting and ACA compliance review.

Who uses this: Employees of large employers subject to ACA reporting.

32. Form 1096 – Annual Summary for Paper-Filed Information Returns

Form 1096 serves as the annual summary and transmittal for certain paper‑filed information returns, including specific Forms 1097, 1098, 1099, 3921, 3922, 5498, and W‑2G. Businesses or accounting firms filing forms via mail must include this summary. It consolidates totals and filer data for IRS processing.

Who uses this: Businesses or accounting firms filing paper 1099 or 1098 forms.

How CPA Pilot Helps Accounting Firms Manage IRS Tax Forms in 2026?

Managing dozens of IRS forms across client profiles increases the risk of errors and outdated filings. Many firms now automate Form 1040 preparation and form matching using AI-driven workflows. CPA Pilot helps your firm work with the latest IRS guidance and form requirements by surfacing up‑to‑date information inside your workflow. CPA Pilot also supports AI-powered tax research and IRS notice response, helping firms stay compliant as regulations evolve:

With CPA Pilot, your firm can:

- Reduce manual checks by letting CPA Pilot highlight the current forms and requirements relevant to each client profile.

- Use smart form-matching that recommends required forms based on client type (e.g., W‑2 employee, freelancer, retiree)

- Pre-fill and validate entries to reduce errors and e-file rejections

- Store and track client-specific forms across tax years in a secure, cloud-based environment

- Receive alerts when the IRS releases revised instructions or deadlines change

Whether you’re handling Schedule C filings for gig workers or 1099 reporting for contractors, CPA Pilot gives your team the tools to stay ahead—without digging through government PDFs or worrying about outdated templates.

Simplify tax season before it begins. 👉Get started with CPA Pilot today — and run your firm, not just your software.

Essential IRS Tax Forms FAQs

How do accounting firms track IRS form changes for each tax year?

Accounting firms track IRS form changes by monitoring IRS releases, updated instructions, and revision dates. Many firms use tax research platforms that surface form updates automatically to avoid filing with outdated versions.

What happens if the wrong IRS form or schedule is filed?

Filing the wrong IRS form or schedule can trigger IRS notices, delayed refunds, penalties, or amended return requirements. Accurate form selection ensures income matching, proper credit claims, and faster return processing.

How do accounting firms decide which IRS forms apply to each client?

Accounting firms determine required IRS forms based on income type, filing status, entity structure, and credits claimed. Automating form matching reduces manual review and helps ensure no required schedules are missed.

Are IRS forms different for freelancers, small businesses, and employees?

Yes. Employees typically use W-2 and Form 1040, freelancers rely on Schedule C, Schedule SE, and 1040-ES, while businesses may issue 1099 forms. The client’s income structure determines the required IRS forms.

How can accounting firms reduce errors when managing multiple IRS forms?

Accounting firms reduce IRS form errors by standardizing workflows, validating data across forms, and using tools that recommend required forms per client profile. This improves accuracy and lowers rework during tax season.

Disclaimer: This article is provided by CPA Pilot for educational purposes. While we may offer tax software/services, the information here is general and may not address your specific facts and circumstances. It does not constitute individual tax, legal, or accounting advice. U.S. federal and State Tax laws change frequently; please consult a qualified tax professional before acting on any information.

![Florida Tax Planning – Residency, IRS & Multi-State Risk [2026 Guide]](https://www.cpapilot.com/blog/wp-content/uploads/2026/02/Florida-Tax-Planning.png)