CPA Pilot vs Claude for Tax Research – Which AI Should CPAs Trust?

[Last Updated on 2 months ago]

Why Are CPAs Comparing CPA Pilot and Claude for Tax Research?

CPAs are comparing CPA Pilot and Claude because both use AI—but only one is built specifically for professional U.S. tax research and planning.

TL;DR – Claude vs CPA Pilot for Tax Research

- Claude is a general-purpose AI that explains tax concepts but lacks filing structure awareness, authoritative citations, and CPA workflow alignment.

- CPA Pilot is built specifically for CPAs and EAs, with IRS-aligned reasoning, tax planning insights, and audit-ready research outputs.

- Claude falls short in:

- Supporting real tax filings (e.g., 1040, 1120S)

- Providing IRC citations or risk analysis

- Aligning with CPA ethics and audit standards

- CPA Pilot is preferred for:

- Performing professional tax research

- Structuring planning decisions for clients

- Reducing non-billable admin and email drafting

- Real-world scenarios show:

- Claude helps with understanding

- CPA Pilot helps with execution

- Bottom Line:

- Use Claude for concept explanation

- Use CPA Pilot for trusted, filing-aware tax research

Artificial intelligence is now part of daily tax work. During tax season, CPAs and Enrolled Agents rely on AI to interpret IRS guidance, analyze scenarios, respond to client questions, and work faster under tight deadlines. As a result, many professionals test general AI tools like Claude alongside tax-focused platforms like CPA Pilot.

The real comparison isn’t “AI vs AI.” It’s a comparison between:

- Tax-native AI, trained and structured around IRS rules, CPA workflows, and planning logic

- General-purpose AI, designed for broad reasoning, writing, and document analysis across industries

Why this distinction matters: Tax research requires more than correct-sounding answers. It demands:

- IRS-aware reasoning

- Conservative, risk-aware responses

- Planning-oriented insights

- Alignment with CPA ethics and compliance standards

This comparison focuses on which tool actually works better for professional tax research, not which AI sounds smarter. So let’s get started!

Table of Contents

- What is Claude and how is it used for Tax Research?

- What is CPA Pilot and Why Is It Built Specifically for CPAs?

- CPA Pilot vs Claude: Feature-by-Feature Comparison for Tax Research

- CPA Pilot vs Claude in Real-World CPA Scenarios

- Which AI Boosts Daily Tax Productivity: CPA Pilot or Claude?

- Final Verdict: CPA Pilot vs Claude for Tax Research

- CPA Pilot vs Claude FAQs

What is Claude and how is it used for Tax Research?

Claude is a general-purpose AI assistant developed by Anthropic that helps professionals analyze documents, reason through concepts, and generate written explanations—but it is not built specifically for U.S. tax research or CPA workflows.

Claude is a large language model designed for long-form reasoning, document understanding, and safe, policy-aware responses across many industries, including law, finance, education, and technology.

Claude’s core strength lies in its ability to:

- Read and summarize very large documents

- Explain complex topics in plain English

- Reason through abstract or hypothetical scenarios

It is not designed as tax software, tax research software, or a CPA-specific tool.

How CPAs Use Claude in Tax Research Workflows?

CPAs and Enrolled Agents typically use Claude as a supporting research assistant, not a primary tax research system.

Common use cases include:

- Summarizing IRS publications and long tax documents

- Explaining tax concepts for internal understanding

- Rewriting technical tax language for client-friendly explanations

- Brainstorming questions or scenarios before formal research

Claude is often used before or alongside traditional tax research tools—not as a replacement.

Where Claude Excels in Tax Research and Communication?

Claude performs best when tax work requires reading, interpretation, or explanation, rather than authoritative decision-making.

Key strengths:

- Long-document comprehension: Can process full IRS publications or guidance in one prompt

- Conceptual clarity: Explains tax ideas in simple, structured language

- Neutral tone: Conservative, cautious phrasing reduces aggressive interpretations

These strengths make Claude useful for learning and communication, especially for junior staff or client-facing explanations.

Claude’s Limitations in Professional Tax Research?

Claude’s limitations become clear when used in real CPA workflows.

Key gaps:

- No built-in understanding of IRS filing structures ( 1040, 1120-S, 1065)

- No guaranteed access to current tax law or updates

- No authoritative citations to IRC sections, court cases, or IRS rulings

- No audit-defensible research trail

- No awareness of CPA ethics, risk thresholds, or compliance workflows

As a result, Claude cannot independently support:

- Tax position defense

- Planning strategy validation

- High-stakes compliance decisions

Claude’s Role in Tax Research: Support Tool, Not Copilot

Claude functions best as:

- A general AI assistant for reading and explaining tax content

- A secondary tool to support understanding and communication

Claude does not function as:

- A tax research platform

- A tax planning engine

- A CPA workflow assistant

This distinction becomes critical when comparing Claude to tax-native platforms like CPA Pilot.

Claude can help, but it isn’t built for risk-based tax planning. For real CPA support, explore what CPA Pilot offers. See the difference →

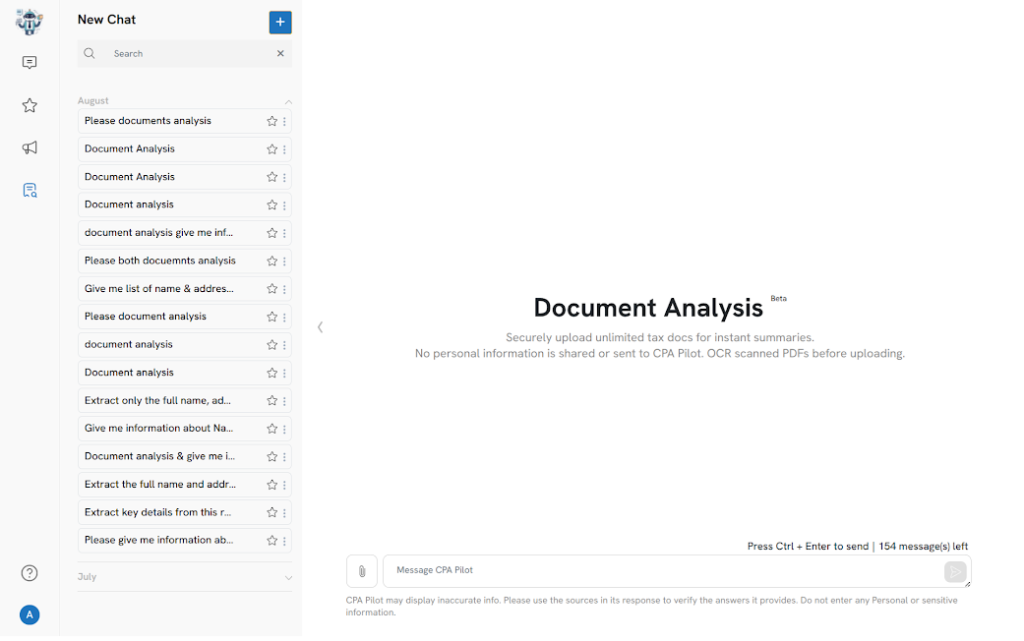

What is CPA Pilot and Why Is It Built Specifically for CPAs?

CPA Pilot is an AI tax planning and research assistant designed exclusively for US CPAs, Enrolled Agents, and tax firms to support real-world tax research, planning, and client communication workflows.

What is CPA Pilot?

CPA Pilot is a tax-native AI platform, not a general chatbot. It is purpose-built to help tax professionals handle U.S. federal tax research, planning, and advisory work more efficiently—especially during high-pressure tax seasons.

Unlike general AI tools, CPA Pilot is designed around:

- IRS terminology and reasoning patterns

- CPA-style tax questions

- Practical planning and compliance workflows

It acts like a digital tax copilot, supporting professionals throughout the tax lifecycle.

Who Should Use CPA Pilot for Tax Work?

CPA Pilot is built specifically for:

- Certified Public Accountants (CPAs)

- Enrolled Agents (EAs)

- Solo practitioners and small-to-mid tax firms

- Tax teams handling high volumes of 1040 and small-business returns

It is not designed for casual tax advice or consumer filing—it is built for professional use.

How CPAs Use CPA Pilot for Tax Research and Planning?

CPA Pilot supports day-to-day tax research and planning, not just explanations.

Common CPA use cases include:

- Researching deductions, credits, thresholds, and limitations

- Evaluating tax planning opportunities before year-end

- Comparing entity structures (LLC vs S-Corp vs C-Corp)

- Interpreting IRS guidance in a filing-aware context

- Reducing time spent on repetitive research questions

The system is structured to think the way CPAs think, using tax-first logic rather than open-ended prompts.

Why CPA Pilot Outperforms General AI Tools for Tax Research?

CPA Pilot is designed with tax risk and compliance in mind.

Key differentiators:

- Tax-aware reasoning: Answers are framed within IRS rules and CPA expectations

- Planning-first approach: Focuses on proactive tax strategies, not just explanations

- Workflow alignment: Supports real filing and advisory scenarios

- Conservative guardrails: Avoids speculative or aggressive interpretations

This makes CPA Pilot safer and more reliable for a professional tax environment than other general AI tools like ChatGPT or Gemini for tax research.

How CPA Pilot Supports Firm Productivity Beyond Research?

CPA Pilot extends beyond tax research into firm productivity.

It can also help with:

- Drafting clear, tax-safe client emails

- Explaining tax strategies in plain English

- Supporting junior staff learning and onboarding

- Reducing non-billable administrative time

This positions CPA Pilot as a practice-wide productivity tool, not just a research assistant.

CPA Pilot’s Role in Tax Research: Primary Tool for CPAs?

CPA Pilot functions as:

- A primary AI assistant for U.S. tax research and planning

- A workflow-aware copilot for CPAs and tax firms

- A bridge between research, planning, and client communication

CPA Pilot is built to be used inside real CPA workflows, not alongside them as an afterthought.

Ready to use AI that’s actually built for CPAs?

Start leveraging CPA Pilot for tax research that’s filing-aware, audit-defensible, and built for compliance. Try CPA Pilot now →

CPA Pilot vs Claude: Feature-by-Feature Comparison for Tax Research

CPA Pilot is better suited for professional tax research because it is built specifically for U.S. CPAs and tax workflows, while Claude is designed for general reasoning and document analysis.

| Feature | CPA Pilot | Claude |

|---|---|---|

| Core Design | AI tax research and planning tool for CPAs | General-purpose AI assistant |

| Tax-Specific Intelligence | Built around IRS rules and CPA use cases | Conceptual tax knowledge only |

| Workflow Awareness | Designed for real CPA research and planning workflows | Prompt-based, session-level responses |

| IRS Document Handling | Interprets guidance in planning and filing context | Reads and summarizes long documents |

| Tax Planning Orientation | Surfaces planning considerations and timing insights | Explains concepts when prompted |

| Entity Analysis | Structured comparisons for LLCs, S-Corps, C-Corps | High-level explanations |

| Risk & Compliance Guardrails | Conservative, CPA-aligned reasoning | General AI safety only |

| Citation Reliability | Research-framed, verification expected | No authoritative tax citations |

| Audit Readiness | Built for professional review environments | Not audit-defensible |

| Client Communication | Generates tax-safe client explanations | Manual drafting required |

| Team & Training Support | Standardizes tax reasoning across staff | Informal, inconsistent learning aid |

What CPAs Should Know Before Choosing an AI Tool?

This comparison shows a clear divide in intent and application:

- CPA Pilot is optimized for applying tax rules in real client and filing scenarios.

- Claude is optimized for explaining tax concepts in isolation.

Because tax research requires context, risk awareness, and workflow alignment, tax-native AI consistently performs better in professional environments.

Feature-rich AI made for real tax workflows.

Compare for yourself how CPA Pilot stacks up against Claude in practice—not just in theory. Start your CPA Pilot access now→

CPA Pilot vs Claude in Real-World CPA Scenarios

In real-world tax research scenarios, CPA Pilot performs better when CPAs need filing-aware, planning-oriented answers, while Claude performs better when CPAs need explanations or summaries of tax concepts.

Scenario 1: Solving a Complex 1040 Deduction with AI

Situation: A CPA needs to evaluate whether a client qualifies for a specific deduction and what limitations apply.

- CPA Pilot:

- Interprets the question in a 1040 context

- Highlights eligibility conditions and common limitations

- Flags planning considerations or follow-up checks

- Claude:

- Explains how the deduction works in general

- Does not connect the answer to filing structure or planning impact

Outcome: CPA Pilot supports faster, decision-ready research. Claude supports understanding only.

Scenario 2: Understanding IRS Guidance with Claude vs CPA Pilot

Situation: A CPA uploads a long IRS publication to understand a rule change.

- CPA Pilot:

- Extracts tax-relevant insights aligned to practical use

- Focuses on how guidance affects real filings

- Claude:

- Excels at summarizing long documents clearly

- Lacks tax-specific prioritization

Outcome: Claude is strong for reading. CPA Pilot is stronger for applying guidance.

Scenario 3: Entity Comparison for a Small Business Client

Situation: A CPA evaluates LLC vs S-Corp implications for a client.

- CPA Pilot:

- Frames analysis from a CPA planning perspective

Considers tax efficiency, compliance, and tradeoffs

- Frames analysis from a CPA planning perspective

- Claude:

- Provides high-level differences between entities

- Does not surface planning nuances

Outcome: CPA Pilot supports advisory decisions. Claude supports conceptual clarity.

Scenario 4: Writing Tax-Safe Client Emails with AI

Situation: A CPA needs to explain a tax outcome to a non-technical client.

- CPA Pilot:

- Drafts tax-safe, client-ready explanations

- Uses conservative language aligned with compliance

- Claude:

- Produces clear explanations

- Requires heavier review for tone and accuracy

Outcome: CPA Pilot reduces non-billable time. Claude increases editing effort.

Scenario 5: Onboarding and Training with CPA Pilot vs Claude

Situation: A junior tax professional needs help understanding a rule during prep.

- CPA Pilot:

- Reinforces CPA-style reasoning

- Encourages consistent firm-wide logic

- Claude:

- Explains concepts clearly

- May vary in depth or framing

Outcome: CPA Pilot standardizes learning. Claude supports ad hoc education.

Summary of Performance in CPA Workflows

Across common CPA scenarios:

- CPA Pilot performs best when tax research must lead to action

- Claude performs best when tax concepts need explanation

This is why most firms treat Claude as a supporting assistant and CPA Pilot as a primary tax research copilot.

🛠️ Real scenarios. Real results.

From 1040 deductions to client explanations, CPA Pilot delivers trusted outputs CPAs can rely on. Schedule a demo to know more!

Which AI Boosts Daily Tax Productivity: CPA Pilot or Claude?

CPA Pilot is more efficient for daily tax work because it is built into CPA workflows, while Claude requires manual prompting and additional review.

How They Compare in Daily Use

- CPA Pilot fits directly into tax research, planning, and client communication workflows.

- Claude works as a standalone assistant who requires careful prompts and validation.

Fast Comparison: CPA Workflow Fit of Claude vs CPA Pilot

| Area | CPA Pilot | Claude |

|---|---|---|

| Research Speed | Fast, tax-context aware | Slower, prompt-dependent |

| Context Awareness | Maintains tax workflow context | No persistent context |

| Repeat Tasks | Efficient for recurring questions | Repetitive prompting |

| Review Time | Lower | Higher |

| Team Consistency | High | Variable |

Bottom Line

- CPA Pilot reduces friction during high-volume tax work

- Claude adds value for explanations, not execution

- Workflow-aware AI delivers better productivity for CPAs

Final Verdict: CPA Pilot vs Claude for Tax Research

CPA Pilot is the better choice for professional tax research because it is built specifically for U.S. CPAs and real tax workflows, while Claude is best used as a secondary tool for explanations and document summaries.

🚀 Join tax professionals already using CPA Pilot.

If you’re a CPA, EA, or run a tax firm, you need a tool built for your world—not just a smart chatbot. Get started with CPA Pilot →

Which Tool Works Better for CPAs?

- Choose CPA Pilot if you are a CPA or EA who needs:

- Filing-aware tax research

- Planning-oriented insights

- Faster answers during tax season

- Consistent, workflow-aligned outputs

- Use Claude if you need:

- Clear explanations of tax concepts

- Summaries of long IRS publications

- Educational or internal learning support

Bottom Line

- CPA Pilot = primary AI copilot for tax research and advisory work

- Claude = supplementary AI for understanding and explanation

For professional tax work, tax-native AI consistently outperforms general-purpose AI.

CPA Pilot vs Claude FAQs

How does CPA Pilot handle data security and compliance compared to general AI tools?

CPA Pilot uses CPA-aligned security and compliance controls to support professional tax work, while general AI tools focus on broad safety and are not designed for regulated tax data handling.

Can CPA Pilot support onboarding and training for junior tax staff?

CPA Pilot supports junior tax professionals by standardizing tax reasoning and workflows, while general AI tools provide ad-hoc explanations without consistent CPA-specific guidance.

Does using AI for tax research create ethical or professional risks for CPAs?

AI creates risk only when used without judgment; CPA Pilot emphasizes conservative, CPA-aligned reasoning, while general AI tools lack awareness of professional tax ethics and compliance standards.

How do CPAs validate AI-generated tax research before relying on it?

CPAs validate AI research by reviewing outputs against IRS guidance and professional judgment; CPA Pilot structures answers for review, while general AI responses require heavier manual validation.

Is CPA Pilot suitable for year-round tax advisory work or only tax season?

CPA Pilot supports year-round tax planning, research, and advisory workflows, while general AI tools are typically used for occasional explanations rather than continuous professional

Disclaimer: This article is provided by CPA Pilot for educational purposes. While we may offer tax software/services, the information here is general and may not address your specific facts and circumstances. It does not constitute individual tax, legal, or accounting advice. U.S. federal and State Tax laws change frequently; please consult a qualified tax professional before acting on any information.

![Florida Tax Planning – Residency, IRS & Multi-State Risk [2026 Guide]](https://www.cpapilot.com/blog/wp-content/uploads/2026/02/Florida-Tax-Planning.png)

![CPA Pilot vs TaxGPT vs ChatGPT: Best AI Assistant For Tax Planning [2026]](https://www.cpapilot.com/blog/wp-content/uploads/2025/09/ChatGPT-vs-TaxGPT-vs-CPA-Pilot-Comparison.png)