State & Multistate Tax Planning for CPAs -Managing Nexus, Risk & Complexity

[Last Updated on 3 days ago]

Why State and Multistate Tax Planning Has Become Unavoidable for CPAs?

The short answer is that business activity no longer respects state borders. Remote work, economic nexus standards, and digital commerce have dramatically expanded the scope and timing of when and where tax obligations arise, often without clients realizing it.

TL;DR — State & Multistate Tax Planning for CPAs

- Multistate tax planning is unavoidable due to remote work, economic nexus, and digital commerce.

- Nexus often arises before clients realize it, triggered by remote employees, sales thresholds, or expansion.

- Multistate planning is interconnected, not state-by-state; positions in one state affect others.

- Risk compounds at scale, leading to missed filings, payroll mismatches, and audit exposure.

- Planning differs from compliance—planning reduces future exposure; compliance reports past activity.

- Entity type and state rules materially change outcomes, especially in high-complexity states.

- Structured, repeatable frameworks outperform ad-hoc research for managing multistate risk.

- Tools like CPA Pilot help CPAs apply consistent planning logic across clients and jurisdictions.

According to the Bureau of Labor Statistics 2023 American Time Use Survey (ATUS), 35% of employed persons did some or all of their work at home on days they worked.

Moreover, nearly every state now enforces economic nexus rules, meaning physical presence is no longer required to trigger filing obligations. (Source)

For CPAs, this environment has transformed state compliance from a periodic consideration into a continuous planning challenge.

A single client may operate in:

- Multiple jurisdictions,

- Employ remote workers in different states, or

- Generate revenue that unexpectedly crosses nexus thresholds.

When these factors combine across dozens of clients, risk compounds quickly, leading to missed filings, penalties, audit exposure, and difficult cleanup work.

This is why state and multistate tax planning has shifted from a technical specialty to a core competency for modern CPA firms. Effective planning requires more than understanding individual state rules in isolation.

It demands a structured approach to evaluating nexus, tracking jurisdictional exposure, and separating compliance tasks from proactive planning decisions across an entire client base.

Platforms like CPA Pilot support this shift by helping firms centralize research, surface state-specific considerations, and apply consistent planning logic across engagements, allowing CPAs to focus on judgment and strategy rather than fragmented rule-checking.

Table of Contents

- What is State and Multistate Tax Planning?

- Why has Multistate Tax Planning become a Core CPA Challenge for CPAs?

- State vs Multistate Tax Planning – Key Differences CPAs Must Manage

- When Do Multistate Tax Obligations Begin? Understanding Nexus

- Where Multistate Tax Risk Accumulates Across CPA Client Portfolios?

- Tax Planning vs Tax Compliance – Where CPAs Add Strategic Value

- How Multistate Tax Planning Differs by Entity Type

- Which States Create the Most Multistate Tax Complexity for CPAs?

- Why These States Matter in Multistate Planning?

- How Multistate Tax Complexity Scales Across CPA Client Bases?

- How CPAs Can Build a Repeatable Multistate Tax Planning Framework?

- Bringing Structure to State and Multistate Tax Planning for CPAs

- State and Multistate Tax Planning FAQs for CPAs

What is State and Multistate Tax Planning?

State and multistate tax planning is the process CPAs use to evaluate and manage tax obligations across one or more U.S. states by accounting for differences in how states impose and calculate taxes. Unlike compliance, which focuses on reporting after the fact, tax planning evaluates exposure before liabilities are finalized, allowing CPAs to anticipate how state rules affect overall tax outcomes.

At the state level, tax planning generally applies to a single jurisdiction. CPAs Assess

- How income is taxed under that state’s corporate income tax system,

- How income is sourced, and

- How payroll or sales activity factors into the tax base.

According to the Tax Foundation, state corporate income taxes are imposed on net business income, but the structure, rates, and calculation methods vary widely by state (Source).

Multistate tax planning expands this analysis across jurisdictions. Instead of evaluating a single state in isolation, CPAs must consider how different state tax systems interact.

States apply different corporate income tax rates, thresholds, and calculation rules, which can produce materially different outcomes depending on where income is earned and how business activity is distributed.

The Tax Foundation’s state data shows that corporate income tax rates range from 0% in states without a corporate income tax to more than 9% in others, underscoring the lack of uniformity across the U.S. (Source).

Because these rules differ by jurisdiction, multistate tax planning is not additive or linear. Each additional state introduces new variables, such as

- Differing Tax Bases,

- Filing Thresholds, and

- Apportionment Mechanics

All these must be coordinated to avoid inconsistent positions.

Addressing states individually without a unifying framework increases the likelihood of duplicated effort, misalignment, and audit exposure.

In practice, state and multistate tax planning establishes the analytical foundation that informs later decisions around nexus evaluation, entity structure, compliance sequencing, and documentation.

Understanding how state tax systems differ is essential before examining why multistate complexity escalates so quickly for CPAs who are managing growing and geographically dispersed client portfolios.

Why has Multistate Tax Planning become a Core CPA Challenge for CPAs?

So why does multistate tax planning consistently create challenges for CPAs, even when the rules themselves are well-documented?

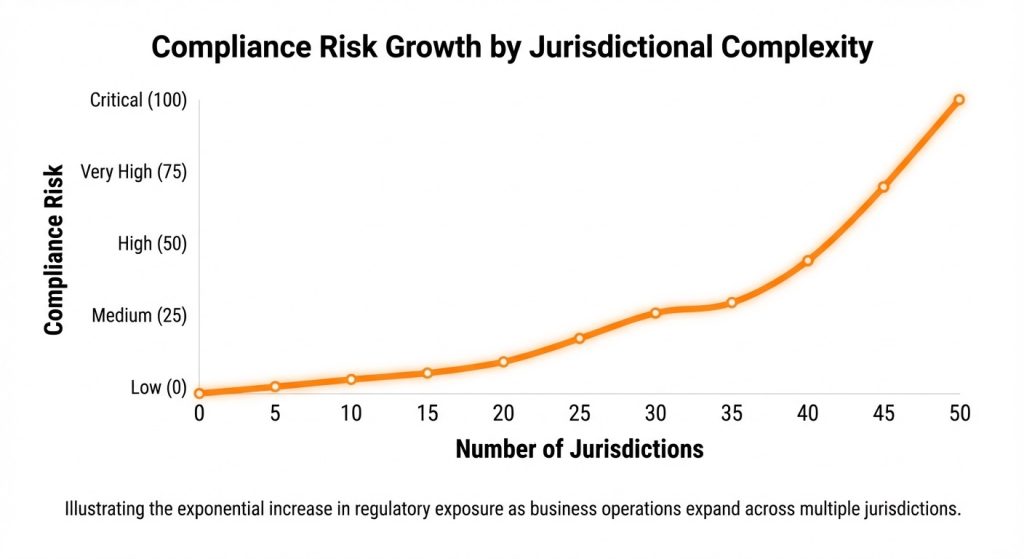

The answer is that multistate complexity does not grow evenly. It accelerates as client activity changes.

A new remote hire, an out-of-state sale, or an expansion into a new market can quietly introduce additional filing obligations, registration requirements, and reporting positions, often without triggering an immediate red flag.

- For CPAs, the difficulty lies in timing and visibility. Multistate issues rarely appear all at once. They develop incrementally across payroll, sales activity, entity structures, and operational decisions, often made outside the tax function.

By the time the tax impact becomes visible, exposure may already exist across multiple jurisdictions.

- Another challenge is that multistate tax planning requires CPAs to manage interdependent decisions, not isolated ones. A change in how income is sourced, how employees are classified, or how revenue is allocated can affect multiple states simultaneously.

This makes it difficult to rely on state-by-state analysis without introducing inconsistencies or duplicated effort. - Client scale compounds the problem. Managing one multistate client may be manageable. Managing dozens of each with different footprints, growth patterns, and risk tolerance creates a coordination problem.

Without standardized evaluation criteria and documentation, CPAs are forced into reactive research and cleanup work rather than proactive planning.

As a result, multistate tax planning has evolved from a technical knowledge issue into a systems and process challenge.

CPAs are no longer just interpreting rules; they are responsible for monitoring change, identifying exposure early, and applying consistent planning logic across an entire client base.

This shift explains why understanding how multistate complexity develops is essential before comparing state versus multistate planning decisions or evaluating nexus triggers in detail.

State vs Multistate Tax Planning – Key Differences CPAs Must Manage

When CPAs ask, “What’s the real difference between state tax planning and multistate tax planning?”, the answer comes down to scope, interaction, and risk management.

While both involve understanding state tax rules, the planning approach changes significantly once more than one jurisdiction is involved.

The table below highlights the practical differences CPAs manage in real engagements, not theoretical distinctions.

| Area of Focus | State Tax Planning | Multistate Tax Planning |

|---|---|---|

| Planning Scope | One jurisdiction analyzed in isolation | Multiple jurisdictions evaluated together |

| Primary Objective | Optimize tax position within a single state | Manage exposure and consistency across states |

| Rule Interaction | Minimal interaction with other states | Rules interact and can conflict |

| Income Treatment | Sourcing based on one state’s rules | Coordinated sourcing and apportionment across states |

| Filing Considerations | Known filing requirements | Expanding and evolving filing obligations |

| Risk Profile | Contained and predictable | Cumulative and compounding |

| CPA Workload | Linear and repeatable | Exponential as states are added |

| Error Impact | Limited to one jurisdiction | Can cascade across multiple states |

| Planning Approach | Tactical, state-specific | Strategic, system-based |

| Documentation Needs | State-focused support | Cross-state consistency and defensibility |

From a CPA standpoint, the key distinction is that state tax planning remains largely self-contained, while multistate tax planning is interconnected. A position taken in one state can directly affect outcomes in another, which means decisions must be evaluated holistically rather than sequentially.

This comparison explains why treating multistate planning as “more of the same” often leads to inconsistencies, duplicated work, and elevated audit risk.

Once businesses operate across state lines, CPAs must shift from state-by-state optimization to cross-jurisdiction coordination.

Understanding this difference sets the stage for examining how and when multistate obligations begin, which requires a deeper look at nexus triggers and jurisdictional thresholds.

While this comparison focuses on differences between state and multistate tax planning, many of these challenges build on foundational differences between federal and state tax systems, including how income is defined, sourced, and reported.

Once those baseline distinctions are clear, the next critical question becomes more practical: “When does a business become subject to multistate tax?”

The answer is: when a state determines that a sufficient connection, known as a nexus, exists.

When Do Multistate Tax Obligations Begin? Understanding Nexus

Nexus is the legal threshold that allows a state to impose tax filing, reporting, or payment obligations on an out-of-state business.

In practice, nexus does not begin with a single, obvious event. It develops through business activities that states view as meaningful participation in their economy, often before clients realize tax exposure exists.

What Activities Create Multistate Tax Nexus?

Traditional nexus has long been associated with physical presence, such as maintaining an office, warehouse, or employees working within a state. While these triggers remain relevant, modern nexus standards extend well beyond physical footprints.

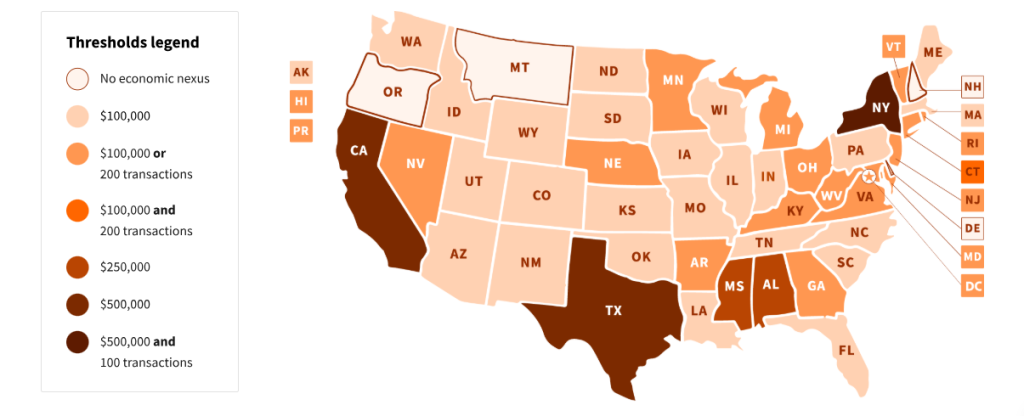

States also impose nexus based on economic activity, meaning a business can create tax obligations solely by exceeding sales or revenue thresholds, even without property or employees in the state. These thresholds vary by jurisdiction and are frequently updated.

Payroll and remote employees are now among the most common nexus triggers CPAs encounter. Hiring an employee who works remotely from another state can immediately create income tax, withholding, or payroll filing obligations, regardless of the business’s headquarters.

Similarly, sales and revenue thresholds play a significant role in establishing nexus. Regularly delivering goods or services into a state, particularly through digital or interstate commerce channels, can trigger filing obligations once state-specific thresholds are met.

Why Nexus Rules Differ by State and Tax Type?

There is no universal standard for determining nexus. Each state defines its own thresholds, tax bases, and enforcement priorities, which means nexus can arise differently depending on the jurisdiction and the type of tax involved.

- A common CPA assumption that fails in practice is that limited activity or lack of intent prevents nexus.

- In reality, many states impose obligations based solely on measurable activity such as employee presence or sales volume, regardless of whether the business intended to establish a taxable presence.

- Another reason nexus is frequently identified too late is that it often develops incrementally. A new hire, a change in sales patterns, or a short-term project can create obligations months before the tax impact becomes visible.

- When nexus is discovered after activity has already occurred, CPAs must evaluate retroactive exposure, registration timing, and potential penalties.

Because nexus standards vary by state and by tax type, CPAs cannot rely on static rules or one-time assessments. Effective multistate tax planning requires ongoing monitoring of client activity, consistent evaluation criteria, and documentation that supports when and why nexus determinations were made.

For a deeper breakdown of how employee location and remote work create nexus exposure, CPAs can review our detailed guide on multistate tax nexus for remote clients.

Once nexus has been established, the question for CPAs is no longer if multistate obligations exist, but where risk begins to accumulate across clients and jurisdictions.

Identifying the nexus explains why obligations arise; understanding risk explains where firms are most likely to see problems surface as client activity expands.

That shift, from determining obligation to managing exposure, brings the focus squarely onto the practical risks CPAs encounter when multistate activity is not monitored consistently.

Where Multistate Tax Risk Accumulates Across CPA Client Portfolios?

Most multistate tax risk develops through small gaps that compound across jurisdictions, clients, and filing periods.

- One of the most common risks is missed or inconsistent filings. As clients expand into additional states, registration and filing obligations often grow faster than internal tracking systems.

A return filed in one state but overlooked in another can create penalties, interest, and audit exposure—even when overall tax liability is minimal. - Another frequent risk involves withholding and payroll mismatches. Multistate operations often lead to situations where payroll is processed correctly in one state but not aligned with withholding or reporting requirements elsewhere.

These discrepancies tend to surface during audits rather than at the time payroll decisions are made. - CPAs also encounter risk through inconsistent income reporting and sourcing positions. When similar activity is treated differently across states—whether intentionally or due to oversight—those inconsistencies can weaken defensibility and invite scrutiny.

Over time, mismatched positions increase both compliance workload and audit complexity. - Perhaps the most challenging risk is cumulative exposure across multiple clients. A single multistate issue may be manageable, but when similar gaps appear across dozens of engagements, firms are forced into reactive cleanup work during tax season.

At that point, risk is no longer isolated to one client; it becomes an operational problem for the firm.

Because these risks emerge gradually, they are often identified only after notices arrive or audits begin. That reality makes proactive monitoring, standardized review criteria, and consistent documentation essential for firms managing multistate client portfolios.

Understanding where these risks tend to appear prepares CPAs to evaluate how planning decisions differ from compliance tasks, and why separating the two is critical as multistate complexity grows.

Tax Planning vs Tax Compliance – Where CPAs Add Strategic Value

When CPAs ask, “What’s the difference between tax planning and tax compliance?”, the simplest answer is that compliance reports what already happened, while planning influences what happens next.

| Dimension | Tax Compliance | Tax Planning |

|---|---|---|

| Primary Purpose | Report and file based on completed activity | Influence future activity to manage exposure |

| Time Orientation | Backward-looking | Forward-looking |

| Trigger | Existing legal obligation | Anticipated business decisions |

| Scope | State-by-state | Cross-jurisdiction and multistate |

| CPA Role | Accurate reporting and deadline management | Risk identification and decision guidance |

| Impact on Exposure | Confirms liability | Reduces or reshapes future liability |

| Workflow Style | Procedural and repeatable | Analytical and scenario-driven |

| Multistate Complexity | Handled per filing | Coordinated across jurisdictions |

| Client Perception | Required service | Value-added advisory |

| Firm Value Creation | Necessary but limited | Differentiates the firm strategically |

How CPAs Apply Planning vs Compliance in Multistate Engagements?

In multistate environments, compliance ensures obligations are met once they exist. Planning determines whether those obligations arise again. CPAs add the most value by recognizing when a client’s activity signals the need to shift from filing to foresight.

Understanding this distinction is especially important when planning decisions intersect with entity structure, sourcing rules, and state-specific tax regimes, which can significantly alter multistate outcomes.

Let’s look at them in detail:

How Multistate Tax Planning Differs by Entity Type

Different entity types interact with state tax systems in materially different ways. The table below summarizes how multistate planning considerations shift based on entity structure, followed by focused explanations that CPAs rely on in practice.

Multistate Planning Considerations by Entity Type

| Entity Type | Primary Multistate Planning Focus | Common Risk Areas | CPA Planning Priority |

|---|---|---|---|

| Partnerships and Multistate Income Allocation | Income allocation and partner-level exposure | Inconsistent sourcing, partner residency issues | Align allocation methods across states |

| S Corporations and State Conformity Gaps | Entity-level vs owner-level treatment | State conformity gaps, composite filings | Coordinate entity and shareholder obligations |

| C Corporations and Multistate Effective Tax Rates | Corporate income and franchise taxes | Rate differences, tax base definitions | Manage the effective tax rate across states |

| Pass-Through Entities and Owner-Level Exposure | Owner-level taxation across jurisdictions | Double taxation risk, SALT limitation impact | Evaluate state-level elections and consistency |

| Franchise-Tax States and Non-Income-Based Liability | Gross receipts or margin-based taxes | Liability without profitability | Identify exposure early and model thresholds |

How Entity Structure Shapes Multistate Planning Decisions

- For partnerships, multistate planning centers on how income is allocated and reported across jurisdictions and at the partner level. CPAs must ensure that allocation methods remain consistent and defensible as states apply different sourcing and reporting rules.

- With S corporations, multistate complexity often arises from differences in state conformity. Some states recognize S status fully, others impose entity-level taxes, and others require composite or withholding filings. Planning focuses on aligning entity treatment with shareholder reporting to avoid mismatches.

- C corporations face multistate planning challenges tied to differing tax bases and rates across states. CPAs evaluate how income is apportioned, how losses are utilized, and how exposure shifts as business activity expands geographically.

- For pass-through entities, multistate planning increasingly involves coordinating owner-level taxation across states while evaluating available state-level elections. Without consistent planning, owners may face overlapping tax obligations or inefficient outcomes across jurisdictions.

Finally, states that impose franchise or gross-receipts-style taxes introduce a unique planning dynamic. Liability may arise even when federal taxable income is minimal, making early identification and modeling essential for managing multistate exposure.

Understanding how entity type influences multistate planning prepares CPAs to evaluate state-specific rules and tax regimes, where these structural differences often have the greatest impact.

Which States Create the Most Multistate Tax Complexity for CPAs?

Not all states contribute equally to multistate tax complexity. Some jurisdictions create outsized planning and compliance risks because their tax regimes diverge significantly from federal norms or from those of other states.

For CPAs managing multistate clients at scale, identifying these states early helps prioritize planning efforts and avoid reactive cleanup work.

Below are four jurisdictions that frequently require elevated attention in multistate planning engagements.

1. California: Nexus Sensitivity and Entity-Level Tax Exposure

California consistently presents multistate challenges due to its expansive nexus interpretation and layered entity-level taxes.

- Aggressive nexus standards that capture limited in-state activity

- Franchise Tax Board audit posture and enforcement consistency

- Minimum franchise tax exposure regardless of profitability

- Market-based sourcing rules that affect service businesses

- Coordination challenges when entity-level elections intersect with owner-level reporting

For detailed information, read our blog “California Tax Planning for CPAs.”

2. New York: Economic Nexus and Elevated Audit Risk

New York’s multistate complexity stems from its sensitivity to economic activity and its focus on enforcement.

- Low tolerance for unregistered multistate activity

- Nexus exposure tied to services, digital activity, and remote work

- Metropolitan-area taxes layered on top of state obligations

- Apportionment complexity for pass-through and closely held entities

Explore “New York Tax Planning for CPAs” for a detailed breakdown

3. Texas: Franchise Tax Exposure Without Net Income

Texas introduces complexity not because of high tax rates, but because of its non-income-based tax structure, which often surprises clients.

- Franchise tax calculated on gross receipts or margin, not net income

- Nexus triggered by economic presence alone

- Filing obligations even when federal taxable income is minimal

- Entity classification and threshold modeling challenges

4. Florida: Corporate and Payroll Exposure Despite No Personal Income Tax

Florida is often underestimated in multistate planning because it lacks a personal income tax, masking real exposure for certain entities.

- Corporate income tax applicability for C corporations

- Payroll and withholding obligations tied to remote employees

- Sales and use tax nexus for out-of-state sellers

- Apportionment issues for businesses operating across the Southeast

Why These States Matter in Multistate Planning?

These jurisdictions tend to:

- Trigger nexus earlier than expected

- Apply nontraditional tax bases or calculations

- Generate audit activity disproportionate to revenue size

- Create cascading effects when combined with other states

For CPAs, recognizing these patterns allows planning efforts to be prioritized where risk is highest, rather than spread evenly across all jurisdictions.

Understanding state-specific complexity also sets the stage for examining how multistate exposure scales across an entire client base, which is often where operational strain becomes most visible.

Not all CPA firms scale the same way. Explore CPA Pilot pricing built around how firms actually manage multistate tax work.

How Multistate Tax Complexity Scales Across CPA Client Bases?

Multistate complexity grows unevenly across a firm’s client base. One client with activity in several states may be manageable through focused attention. But when similar patterns like remote hires, expanding sales footprints, and multi-entity structures appear across many clients, the workload multiplies faster than headcount.

- A major pressure point is inconsistent visibility. Client activity that creates multistate exposure often occurs outside the tax workflow through

- Hiring decisions,

- Operational changes, or

- New revenue channels.

When CPAs rely on manual intake or year-end discovery, exposure can exist across multiple clients before it is formally identified.

- Another scaling challenge is decision consistency. Without shared criteria for evaluating multistate exposure, similar client situations may be handled differently depending on timing or staff involvement. Over time, that inconsistency increases review time, weakens defensibility, and complicates firm-wide oversight.

- Volume also changes the risk profile. A single missed issue may be contained, but repeated small gaps across many clients create systemic risk.

Notices, amended filings, and audit responses begin to consume disproportionate firm resources, shifting work from advisory planning to reactive remediation. - As client bases grow, multistate tax planning becomes less about technical knowledge and more about process design—how firms identify exposure early, apply consistent judgment, and document decisions at scale.

Firms that lack repeatable workflows often find themselves trapped in cycle-based cleanup work rather than forward-looking planning.

Recognizing how complexity scales prepares CPAs to think differently about structure and systems, rather than treating multistate issues as isolated client problems.

How CPAs Can Build a Repeatable Multistate Tax Planning Framework?

As multistate tax work expands across a firm, efficiency becomes less about finding more information and more about applying judgment consistently. CPAs who rely solely on ad-hoc research often discover that complexity grows faster than their manageable ability.

This is where structure, not additional research, becomes the deciding factor in effective multistate tax planning.

1. Early Identification of Multistate Exposure – At the foundation of any effective framework is early identification. This means establishing clear checkpoints for reviewing changes in client activity, such as:

- Hiring,

- Geographic expansion, or

- Revenue growth.

When these checkpoints are standardized, exposure is flagged before it becomes a compliance problem.

2. Consistent Evaluation Across Clients – The next component is consistent evaluation. Firms benefit from applying the same decision logic when assessing similar situations across clients. Consistency reduces internal review friction, improves defensibility, and makes multistate planning easier to scale across staff levels.

3. Defensible Documentation and Decision Tracking – Documentation is equally critical. A strong framework records not just outcomes, but the reasoning behind decisions, including assumptions made, thresholds evaluated, and timing considerations.

This creates continuity across filing periods and supports audit response if questions arise later.

4. Separating Planning Decisions from Compliance Execution – Finally, repeatable frameworks allow CPAs to separate planning from execution. Planning decisions are evaluated centrally and prospectively, while compliance tasks follow established outcomes.

That separation prevents firms from revisiting the same questions each filing cycle and frees time for higher-value advisory work.

AI Tax Tools and platforms can support this approach by centralizing research and standardizing analysis, but the framework itself remains grounded in professional judgment.

The goal is not automation for its own sake; it is consistency, visibility, and control across multistate engagements.

As firms adopt structured planning frameworks, multistate tax work shifts from reactive problem-solving to intentional risk management—positioning CPAs to handle complexity with confidence as client footprints continue to expand.

Bringing Structure to State and Multistate Tax Planning for CPAs

State and multistate tax complexity is no longer an edge case reserved for a handful of growing clients. For CPA firms today, it is a permanent operating reality shaped by remote work, expanding markets, and increasingly fragmented state tax systems.

What determines success is not how many state rules a firm can recall, but how consistently those rules are identified, evaluated, and applied across engagements.

Throughout this guide, one theme remains constant: multistate tax challenges rarely fail because of missing knowledge. They fail because exposure develops faster than ad-hoc processes can keep up. When planning decisions are made in isolation, risk compounds quietly across clients, filing periods, and jurisdictions.

This is why state and multistate tax planning works best when it is treated as a system rather than a series of disconnected tasks.

Firms that adopt structured planning frameworks supported by

- Early identification,

- Consistent evaluation, and

- Defensible documentation is better positioned to reduce exposure while increasing advisory value.

How CPA Pilot Supports Structured Multistate Tax Planning?

Tools can play a supporting role in this shift. AI Tax Assistant like CPA Pilot help firms centralize research, surface state-specific considerations, and apply consistent planning logic across engagements. The value lies not in replacing professional judgment, but in reinforcing it, so CPAs spend less time retracing steps and more time guiding clients through complex multistate decisions with confidence.

As state tax rules continue to evolve, the firms that lead will be those that move beyond reactive compliance and build repeatable planning systems that scale with their client base. In that environment, structure becomes the advantage—and planning becomes a strategic asset rather than a recurring problem.

If your firm is navigating state and multistate tax planning across an expanding client base, the next step is building consistency into how those decisions are evaluated and documented.

CPA Pilot is designed to support that process by helping CPAs centralize state tax research, identify multistate considerations earlier, and apply consistent planning logic across engagements—so complex decisions don’t have to start from scratch each time.

Explore how CPA Pilot supports structured state and multistate tax planning for CPAs, and see how a system-based approach can reduce risk while strengthening advisory work. 👉 Book a 30-minute free demo today!!!

State and Multistate Tax Planning FAQs for CPAs

Does Multistate Tax Planning Differ During Tax Season vs Year-Round?

Yes. During tax season, planning focuses on managing existing exposure. Year-round planning emphasizes early detection of activity changes so CPAs can reduce future filing and audit risk before obligations arise.

How Do Multistate Tax Audits Typically Begin?

Multistate audits often begin after inconsistencies appear across state filings, payroll records, or sales reporting. States frequently identify issues through data matching rather than taxpayer self-disclosure.

Can CPAs Rely on Prior-Year Filings to Assess Multistate Tax Risk?

No. Prior-year filings reflect past activity, not current exposure. Multistate tax obligations can arise mid-year due to staffing or sales changes, making ongoing review essential for accurate planning.

How Does Technology Improve Multistate Tax Planning Accuracy for CPAs?

Technology improves accuracy like CPA Pilot – one of the best AI-assisted tax software to help CPAs by centralizing tax research, standardizing evaluation criteria, and reducing reliance on memory or ad-hoc analysis.

What Documentation Should CPAs Maintain for Multistate Tax Planning Decisions?

CPAs should document activity reviewed, thresholds evaluated, assumptions applied, and timing determinations. This documentation supports defensibility during audits and ensures continuity across filing periods.

How Should CPAs Prioritize States in Multistate Tax Planning?

CPAs prioritize states based on nexus sensitivity, enforcement activity, tax structure complexity, and client exposure levels. High-complexity states often warrant proactive modeling even before filing thresholds are met.

How Does Multistate Tax Planning Strengthen CPA Advisory Services?

Multistate planning strengthens advisory services by shifting conversations from compliance outcomes to future-focused risk management. Clients benefit from understanding how decisions today influence obligations tomorrow.