Best AI Tax Planning Tools for CPAs [2026 Comparison Guide]

![Best AI Tax Planning Tools for CPAs [2026 Comparison Guide]](https://www.cpapilot.com/blog/wp-content/uploads/2026/01/AI-Tax-Planning-Tools-Comparison.png)

[Last Updated on 1 month ago]

The best AI tax planning tools for CPAs are platforms built specifically for U.S. tax professionals that support defensible tax research, structured planning, and real CPA workflows. While many CPAs experiment with generic AI tools, those tools lack tax guardrails, audit readiness, and workflow consistency.

This guide compares best AI tools built for CPAs with general AI tools commonly used for tax work, so you can clearly see where each fits — and where professional risk begins.

Why Are CPAs Actively Searching for AI Tax Tools?

Most CPAs aren’t looking for “AI” for its own sake. They are trying to solve practical, recurring problems:

- Too much time spent on repetitive tax research

- Planning quality varies by staff experience

- Missed deductions due to time pressure

- Review overhead increases as firms grow

- Burnout during peak tax season

Traditional tax software focuses on compliance and documentation, not planning speed or advisory efficiency. That gap is why firms increasingly compare AI tax planning software with traditional approaches.

What “AI Tax Planning” Means for CPA Firms?

AI tax planning is not the same as asking a chatbot a tax question.

For CPA firms, it typically refers to tools that can:

- Assist with U.S. tax research using professional tax logic

- Help surface tax deductions, credits, and planning strategies

- Produce explanations that can be reviewed and shared with clients

- Fit into workflows like 1040 prep, tax projections, and responses to IRS notices for clients

This distinction becomes important when comparing tax-native AI platforms with generic AI tools that were never designed for professional tax use.

Quick Comparison: Best AI Tax Planning Tools for CPAs (2026)

AI Tax Planning & Research Tools Built for CPAs

| Tool | Primary Use Case | Best For | Key Limitation |

|---|---|---|---|

| CPA Pilot | End-to-end AI tax planning & advisory workflows | CPA firms doing recurring planning & advisory | U.S. tax focused |

| TaxPlanIQ | Scenario modeling & projections | High-income client planning | Limited workflow automation |

| Blue J Tax | Predictive tax research & case law | Complex tax interpretation | Research-heavy, not planning-first |

| Thomson ReutersCheckpoint | Comprehensive tax research database | Large firms & enterprises | Steep learning curve, high cost |

| CCH AnswerConnect | Practical tax explanations | Compliance-focused firms | Limited AI-driven planning |

| Bloomberg Tax | Federal & international tax research | Advanced research teams | Not built for daily CPA workflows |

| CoCounsel | AI-assisted tax & legal research | Tax + legal crossover work | Dependent on underlying databases |

| Hive Tax | Lightweight advisory planning | Boutique CPA firms | Narrow planning depth |

| Keeper Tax | Expense tracking & deductions | Freelancers / SMBs | Not CPA-workflow oriented |

| Black Ore | AI-driven tax research summaries | Early AI adopters | Limited maturity |

| TaxGPT | Conversational tax Q&A | Quick explanations | Chat-only, no planning workflows |

Generic AI Tools Commonly Used for Tax Work (Not Built for CPAs)

| Tool | How CPAs Use It | Useful For | Major Risk |

|---|---|---|---|

| ChatGPT | Drafting, explanations, brainstorming | Plain-language summaries | No tax guardrails or audit defensibility |

| Claude | Long-document review & reasoning | Summarizing IRS guidance | Not tax-constrained |

| Gemini | Fast summaries & search-adjacent queries | High-level clarification | Not designed for CPA workflows |

Table of Contents

How We Evaluated AI Tax Planning Tools for CPAs ?

Tools were assessed based on whether they:

- Are built for CPAs, not merely adapted for tax questions

- Support planning decisions, not just explanations

- Produce reviewable and defensible outputs

- Fit into real tax-season workflows

- Scale without increasing review burden

- Respect client data sensitivity and professional risk

Top AI Tax Planning & Research Tools Built for CPAs

These tools are tax-native or tax-marketed platforms designed for U.S. tax professionals. They focus on tax research, planning, or advisory workflows inside CPA firms — not consumer filing or generic AI chat.

1. CPA Pilot

What it is: An AI tax planning assistant built exclusively for CPAs, Enrolled Agents, and U.S. tax firms.

What it’s best at:

- End-to-end tax planning workflows (research → strategy → client-ready output)

- Reducing repetitive research, analysis, and drafting during peak tax season

Where CPAs hit limitations: Not designed to replace deep enterprise research libraries for niche international tax matters

Best fit for: Solo CPAs and firms seeking planning, research, and workflow support in one system

Why it’s better than others:

- CPA Pilot unifies tax research, planning logic, and workflow execution in one platform, while most alternatives focus on only one area (research-only, scenario-only, or chat-only).

2. TaxPlanIQ

What it is: A tax planning and scenario modeling platform designed for advisory-focused CPAs.

What it’s best at:

- Comparing structured tax planning scenarios

- Supporting advisory conversations with clients

Where CPAs hit limitations: Limited automation outside predefined planning models

Best fit for: Firms that focus primarily on advisory and scenario-based planning

How it compares to CPA Pilot:

- CPA Pilot extends beyond scenario modeling into day-to-day tax planning workflows. Learn more at Best TaxPlanIQ alternative post.

3. Blue J Tax

What it is: An AI-powered tax research platform focused on predictive analysis of tax law.

What it’s best at: Case-law interpretation and probability-based research

Where CPAs hit limitations: Research-centric, with limited planning execution or workflow automation

Best fit for: Firms handling complex or research-heavy tax positions

How it compares to CPA Pilot:

- CPA Pilot emphasizes planning execution, while Blue J Tax emphasizes research depth. Learn more at Best Blue J Tax alternative post.

4. Thomson Reuters Checkpoint

What it is: An enterprise-grade tax research platform widely used by large CPA firms.

What it’s best at: Comprehensive statutory and regulatory coverage

Where CPAs hit limitations: Complex interface and limited proactive planning automation

Best fit for: Large firms with dedicated tax research teams

How it compares to CPA Pilot:

- CPA Pilot prioritizes planning workflows over deep research repositories. Learn more at Thomson Reuters Checkpoint alternative post.

5. CCH AnswerConnect

What it is: A tax research platform integrated into the Wolters Kluwer ecosystem.

What it’s best at: Familiar research workflows for legacy CPA firms

Where CPAs hit limitations: Limited flexibility for AI-driven planning and automation

Best fit for: Firms already invested in the CCH product stack

How it compares to CPA Pilot:

- CPA Pilot is built for modern AI-driven planning rather than legacy research navigation. Learn more at CCH AnswerConnect alternative post.

6. Bloomberg Tax

What it is: A professional tax research and regulatory analysis platform.

What it’s best at: Deep tax law, regulatory, and international research

Where CPAs hit limitations: Not designed for day-to-day tax planning workflows

Best fit for: Firms handling complex regulatory or cross-border matters

How it compares to CPA Pilot:

- CPA Pilot focuses on planning execution, while Bloomberg Tax focuses on research breadth. Learn more at Bloomberg Tax alternative post.

7. CoCounsel

What it is: An AI assistant layered on professional tax and legal research platforms.

What it’s best at: Summarizing and analyzing research content

Where CPAs hit limitations:

- Dependent on underlying databases

- Limited standalone planning workflows

Best fit for: Firms seeking AI assistance on top of existing research tools

How it compares to CPA Pilot:

- CPA Pilot operates as a primary planning system, not just a research assistant. Learn more: at CoCounsel Tax alternative post.

8. Hive Tax

What it is: An AI tax assistance platform aimed at smaller practices.

What it’s best at: Lightweight tax assistance and guidance

Where CPAs hit limitations: Limited depth for complex planning scenarios

Best fit for: Small firms or solo CPAs with simple tax needs

How it compares to CPA Pilot:

- CPA Pilot supports more advanced planning and workflow automation. Learn more at Hive Tax alternative post.

9. Keeper Tax

What it is: A tax platform primarily built for freelancers and SMBs.

What it’s best at: Simplified tax guidance for non-CPA users

Where CPAs hit limitations: Not designed for CPA firm workflows or advisory planning

Best fit for: Not typically suited for CPA firm use

How it compares to CPA Pilot:

- CPA Pilot is designed for professional tax planning, not consumer tax assistance. Learn more at Keeper Tax alternative post.

10. Black Ore

What it is: An emerging AI tax platform with experimental positioning.

What it’s best at: Early-stage AI-driven tax experimentation

Where CPAs hit limitations: Limited adoption and workflow maturity

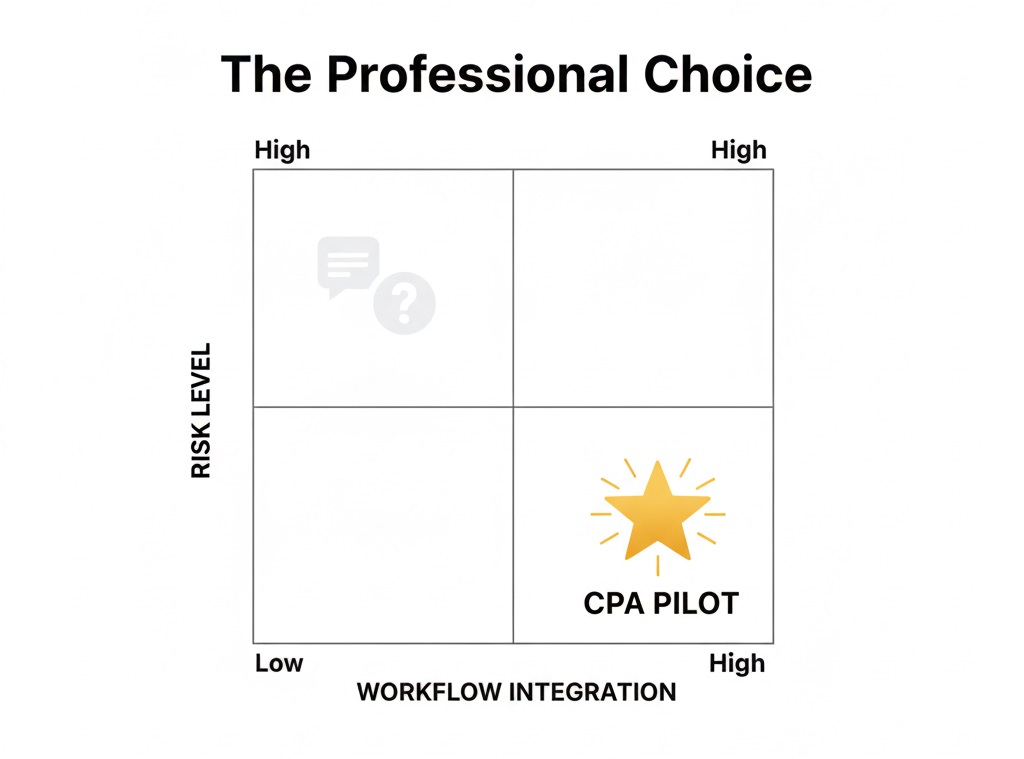

Best fit for: Firms exploring new AI tools with low dependency requirements

How it compares to CPA Pilot:

- CPA Pilot is a production-ready planning platform, not experimental tooling. Learn more at Black Ore alternative post.

11. TaxGPT

What it is: A tax-focused AI chatbot marketed to tax professionals.

What it’s best at: Contextual tax Q&A compared to generic AI tools

Where CPAs hit limitations:

- Limited explainability and audit defensibility

- Chat-first experience without planning workflows

Best fit for: Early experimentation with AI-assisted tax questions

How it compares to CPA Pilot:

- CPA Pilot goes beyond Q&A into structured planning, workflows, and client delivery. Learn more at CPA Pilot vs TaxGPT vs ChatGPT post.

Generic AI Tools Used for Tax Work (And Their Limitations)

These tools are general-purpose AI platforms, not tax software. While some CPAs use them for explanations, drafting, or document summaries, they are not designed for IRS-aligned tax planning, audit defensibility, or CPA firm workflows.

They can assist thinking — but should not drive tax decisions.

1. ChatGPT – General AI for Drafting and Tax Explanations

What it is: A general-purpose AI chatbot used across industries for writing, explanations, and ideation.

What it’s best at:

- Explaining tax concepts in plain language

- Drafting emails, summaries, or rough outlines

Where CPAs hit limitations:

- No tax-specific guardrails or citations

- Outputs are not audit-ready or defensible

Best fit for: Non-authoritative explanations or internal drafting only

How it compares to CPA Pilot:

- CPA Pilot is built specifically for professional tax planning, not generic Q&A. Learn more at CPA Pilot vs TaxGPT vs ChatGPT post.

2. Claude – Long-Context AI for Document Review

What it is: A large-language-model AI known for long-context reasoning and document analysis.

What it’s best at:

- Summarizing long tax documents

- Conceptual reasoning across complex text

Where CPAs hit limitations:

- Not trained or constrained for U.S. tax compliance

- No built-in tax logic or planning workflows

Best fit for: Document review and conceptual understanding

How it compares to CPA Pilot:

- CPA Pilot is designed for tax planning workflows, not general reasoning tasks. Learn more at CPA Pilot vs Claude for Tax Research post.

3. Gemini – Search-Driven AI for High-Level Tax Queries

What it is: Google’s general AI assistant used for search-adjacent tasks and summarization.

What it’s best at: Fast summarization and language-based queries

Where CPAs hit limitations:

- Not designed for professional tax research or planning

- No CPA-grade explainability or workflow support

Best fit for: High-level exploration or clarification

How it compares to CPA Pilot:

- CPA Pilot is purpose-built for CPA tax planning, not general AI assistance. Learn more at CPA Pilot vs Gemini for Tax Research post.

Important Context for CPAs

Many CPA firms test these tools early — then pull back once they realize:

- Review time increases instead of decreasing

- Outputs lack citations or defensible reasoning

- Risk shifts from research time to liability exposure

This is why most firms eventually separate:

- Thinking tools (generic AI)

- Decision tools (tax-native platforms)

Final Takeaway: How CPAs Should Choose the Right AI Tax Tool

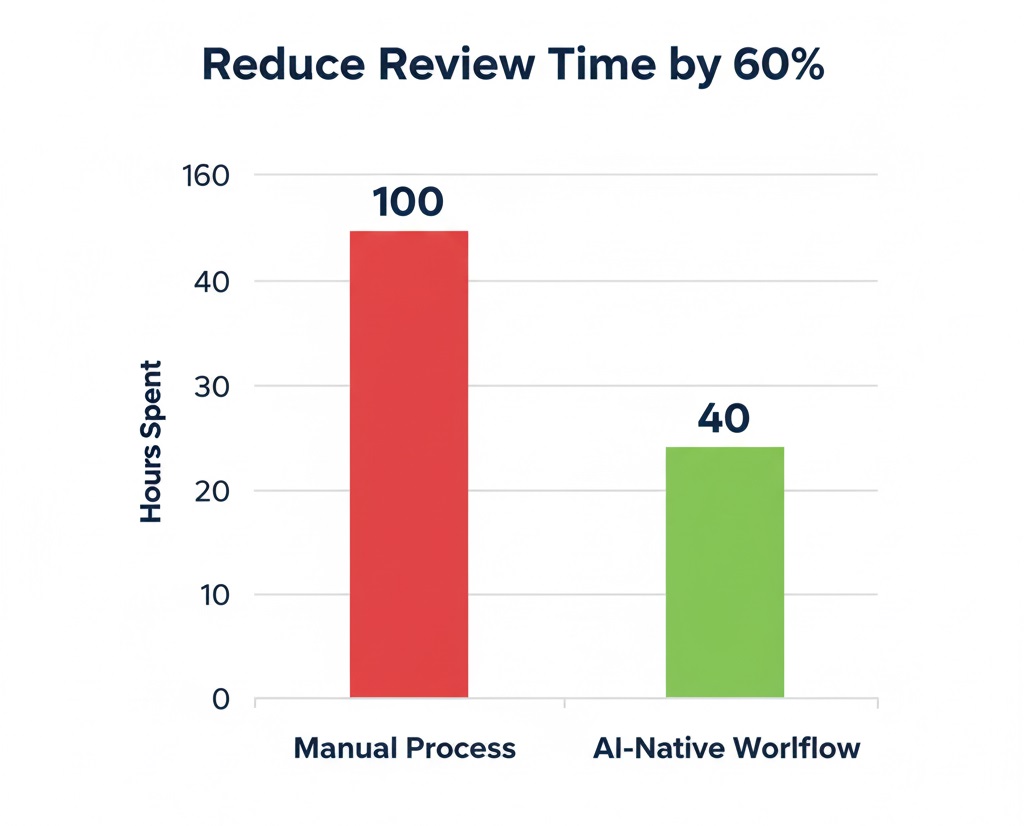

If your goal is to reduce review time, standardize planning quality, and scale advisory work without increasing risk, tax-native planning platforms outperform generic AI tools.

How CPAs Usually Decide (Fast)

- Need fewer hours on research + drafting?You need a tool that turns research into planning actions, not just explanations.

- Seeing more review work as your firm grows?You need consistent planning logic, not chat-based answers.

- Using multiple tools to get one outcome?You likely need a workflow layer, not another standalone product.

This is the point where many firms evaluate CPA Pilot.

Why Many CPA Firms Ultimately Choose CPA Pilot?

Most tools help with one step:

- Research databases explain the law

- Scenario tools compare numbers

- Chatbots answer questions

CPA Pilot brings these together by supporting:

- Research → planning → client-ready output

- Consistent planning quality across staff

- Faster client responses with less review overhead

For firms already experimenting with AI, CPA Pilot often becomes the tool that replaces multiple workflows, not just adds another one.

Best Fit Check (Quick Self-Qualifier)

CPA Pilot is a strong fit if you:

- Do recurring tax planning or advisory work

- Want AI outputs you can review and stand behind

- Are outgrowing chat-based AI tools

- Want to reduce workload without hiring more staff

If that sounds like your firm, the next step isn’t reading more comparisons—it’s seeing how the workflow fits.

Next Step

Compare CPA Pilot directly against tools like TaxGPT, ChatGPT, Claude, and Gemini, or evaluate how a planning-first workflow would work inside your firm. The firms that see the most value from AI are the ones that move from answers to decisions. CPA Pilot is built for that shift.

![Florida Tax Planning – Residency, IRS & Multi-State Risk [2026 Guide]](https://www.cpapilot.com/blog/wp-content/uploads/2026/02/Florida-Tax-Planning.png)

![CPA Pilot vs TaxGPT vs ChatGPT: Best AI Assistant For Tax Planning [2026]](https://www.cpapilot.com/blog/wp-content/uploads/2025/09/ChatGPT-vs-TaxGPT-vs-CPA-Pilot-Comparison.png)