Healthcare Tax Planning for CPAs – Execution & Compliance

[Last Updated on 2 months ago]

What makes healthcare tax planning uniquely challenging for CPAs, and how should seasoned tax practitioners approach execution, compliance, and the underlying industry complexity?

Healthcare tax planning is one of the most technically demanding niches in professional tax work because it sits at the intersection of regulated healthcare delivery models, multi-layered compliance requirements, reimbursement timing dynamics, and evolving federal tax rules governing healthcare practices.

TL:DR – Healthcare Tax Planning for CPAs

- Healthcare tax planning focuses on execution, compliance, and documentation, not one-time strategies.

- Medical practices create tax complexity through reimbursement timing, compensation models, and regulatory oversight.

- Entity structure affects payroll taxes, income allocation, reporting, and audit exposure.

- Healthcare-specific deductions and capital assets require enhanced substantiation and review discipline.

- State and Local Tax (SALT) rules, including add-backs, PTE elections, and apportionment, impact real tax outcomes.

- QBI eligibility for healthcare SSTBs depends on income thresholds and consistency across filings.

- Retirement and income deferral must align with volatile healthcare cash flow and ownership changes.

- Multi-state activity from telehealth and locum tenens work increases nexus and filing obligations.

- Effective healthcare tax work depends on repeatable workflows, assumption tracking, and year-over-year consistency.

In 2024, the U.S. healthcare sector’s national health expenditures reached $5.3 trillion, accounting for 18% of the nation’s gross domestic product, underscoring the scale of economic activity and tax exposure that CPAs must navigate in this vertical. (Source)

At the same time, the number of licensed physicians in the U.S. has expanded substantially — surpassing 1,080,000 and up 27% since 2010, which translates into tens of thousands of individual practices and group entities requiring nuanced tax governance and execution oversight. (Source)

For tax professionals, this means executing highly structured tax planning workflows, documenting method choices, and continuously managing compliance risks across entity structures, revenue cycle timing, accounting method decisions, and federal/state regulatory interplay.

In this article, we will examine how CPAs approach industry-specific tax execution and compliance review processes in the healthcare sector, including the interpretation and application of complex tax rules to optimize client outcomes while maintaining accuracy and defensibility.

So, without any further ado, let’s start!!!

Table of Contents

- What Makes Healthcare Tax Execution So Complex for CPAs?

- How Should CPAs Structure Medical Practices for Tax Execution?

- How Do CPAs Execute Healthcare-Specific Deductions Correctly?

- How Does QBI Actually Work for Healthcare Practices?

- How Should CPAs Execute Retirement and Income Deferral for Healthcare Providers?

- How Do CPAs Manage Multi-State Tax Exposure in Healthcare?

- How Do CPAs Build a Repeatable Healthcare Tax Execution Framework?

- Execution is the Differentiator in Healthcare Tax Work

- Healthcare Tax Planning FAQs

What Makes Healthcare Tax Execution So Complex for CPAs?

Once a healthcare client relationship is established, the CPA’s work quickly shifts from high-level planning considerations to day-to-day tax execution decisions that must hold up under regulatory scrutiny.

Medical practices introduce a combination of nonlinear revenue streams, layered compliance obligations, and entity-driven tax consequences that require deliberate review processes and documentation standards.

This section focuses on the execution realities CPAs encounter when translating healthcare operations into defensible tax positions.

1. Revenue Timing and Insurance Reimbursement Risk

Medical practices do not control the timing of a significant portion of their revenue.

Payments are often subject to

- Payer adjudication,

- Contractual adjustments,

- Clawbacks and post-service corrections make it more challenging to accurately track and project taxable income.

CPAs reconcile operational production data with cash receipts, evaluate historical reimbursement lag patterns, analyze denial rates by payer, and document assumptions used in estimated tax calculations.

These timing considerations must be assessed within the broader context of the U.S. tax system and how income recognition rules apply across industries, particularly where healthcare deviates from standard service models.

2. Accounting Method Choices in Healthcare

Revenue timing issues directly inform one of the most consequential execution decisions in healthcare tax planning: the choice of accounting method.

While cash-basis reporting may simplify administration for smaller practices, it can obscure economic performance where reimbursement delays are material.

Accrual accounting may better reflect earned income, but it introduces additional compliance requirements and ongoing reconciliation work.

For CPAs, executing an accounting method decision involves evaluating whether the method accurately reflects income while remaining consistent with IRS requirements.

Method changes require formal filings, calculated adjustments, and documentation that withstand examination, particularly where federal and state conformity rules diverge.

4. Provider Compensation and Payroll Tax Exposure

Compensation structure is one of the most scrutinized areas in healthcare tax compliance. Whether advising solo practitioners or multi-provider groups, CPAs must balance operational realities with payroll tax exposure and audit risk.

In pass-through structures, owner compensation affects payroll taxes and how income flows through the entity, and is reported at the individual level.

Execution in this area requires

- Periodic Compensation Reviews,

- Benchmarking Against Specialty Norms, and

- Documenting The Rationale Behind Salary and Distribution Allocations.

These decisions are closely tied to how income is taxed within pass-through entities, making compensation planning inseparable from entity-level compliance and reporting obligations.

5. Federal Healthcare Compliance With Tax Impact

Healthcare tax execution cannot be isolated from federal healthcare compliance frameworks. Employer obligations, benefit eligibility, and reporting requirements influence tax treatment in ways that extend beyond traditional income and payroll considerations.

CPAs must integrate healthcare-specific regulatory interpretation into their tax workflows to ensure consistent treatment across returns, information filings, and client records.

For multi-entity or multi-owner healthcare groups, these compliance considerations often extend into partner-level reporting obligations, including Schedules K-2 and K-3, where improper disclosures can create downstream compliance exposure.

Maintaining alignment between healthcare compliance data and tax reporting documentation is a critical execution responsibility, not a one-time planning exercise.

With these execution challenges mapped — revenue timing, accounting methods, compensation exposure, and compliance integration — the next step in healthcare tax planning is structural.

Entity selection and ownership modeling determine how these challenges compound or resolve over time, making entity decisions one of the most consequential planning levers CPAs manage for medical practices.

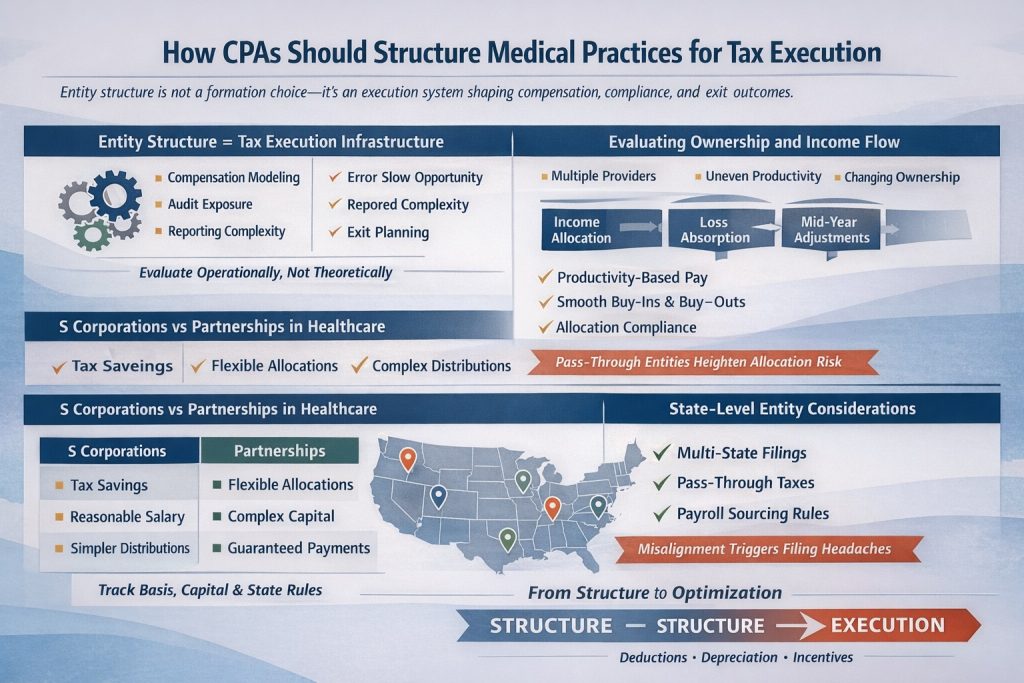

How Should CPAs Structure Medical Practices for Tax Execution?

After execution challenges are identified, entity structure becomes the mechanism through which those risks are either contained or amplified.

For healthcare clients, entity selection is not a one-time formation exercise—it is an ongoing tax execution framework that affects compensation modeling, audit exposure, reporting complexity, and long-term exit planning.

CPAs advising medical practices must evaluate entity structure through an operational lens, not a theoretical one.

1. Evaluating Ownership and Income Flow in Healthcare Entities

Medical practices often operate with multiple providers, uneven production, and evolving ownership interests, making income allocation far more sensitive than in other professional services.

Entity selection determines how income flows, how losses are absorbed, and how adjustments are documented when provider activity changes mid-year.

From an execution standpoint, CPAs must assess whether the entity structure supports:

- Variable compensation tied to productivity

- Buy-ins and buy-outs without triggering unintended tax consequences

- Ongoing compliance with ownership and allocation rules

These considerations are especially pronounced in pass-through entities, where distributive share mechanics directly affect each provider’s tax outcome and reporting responsibilities.

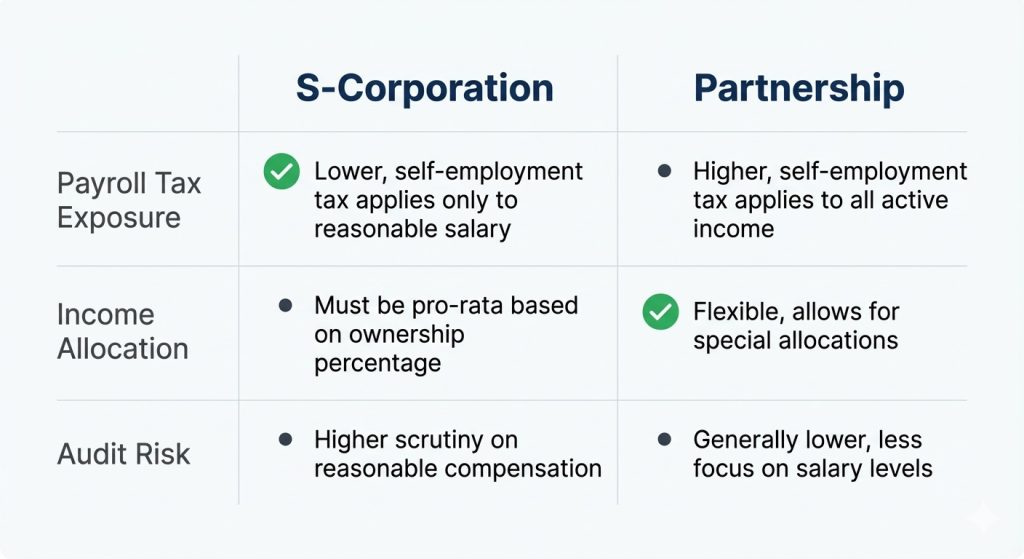

2. S Corporations vs Partnerships in Healthcare

No single entity structure fits all healthcare practices. S corporations may reduce certain employment taxes but they also introduce a reasonable compensation enforcement risk. Partnerships offer flexibility in allocations but increase complexity in capital accounts, guaranteed payments, and partner reporting.

Execution challenges arise when CPAs must:

- Support salary determinations with contemporaneous documentation

- Track basis and capital account adjustments accurately

- Align entity elections with state conformity rules

Comparing S corporations, C corporations, and LLCs is not about identifying the “best” option—it is about selecting the structure that aligns with the practice’s cash flow behavior, compensation design, and compliance capacity.

3. Entity Structure and Retirement Planning Constraints

Entity selection also constrains or expands retirement planning options. Defined benefit plans, cash balance plans, and profit-sharing arrangements interact differently depending on how wages and profits are characterized at the entity level.

For healthcare practices with high earnings volatility, CPAs must ensure:

- Retirement contributions are supported by entity-level income treatment

- Compensation structures do not unintentionally limit plan design

- Plan funding decisions align with long-term ownership strategy

These considerations must be integrated into entity selection early, as retrofitting retirement strategies onto an ill-suited structure often creates avoidable compliance risk.

4. State-Level Entity Considerations for Healthcare Groups

Healthcare entities frequently operate across state lines through satellite clinics, telehealth services, or locum tenens arrangements. Entity selection influences how state filing obligations are triggered and how income is apportioned.

CPAs must evaluate whether the entity structure:

- Simplifies or complicates multi-state filings

- Supports pass-through entity tax elections where available

- Aligns with varying state treatment of entity income and payroll

Failure to align entity structure with state-level requirements can result in duplicative filings, inconsistent reporting, and exposure during examinations.

Once the entity framework is established, the CPA’s focus shifts from structure to optimization within that structure. The next layer of healthcare tax execution involves managing deductions, depreciation, and industry-specific incentives without compromising compliance or documentation standards.

How Do CPAs Execute Healthcare-Specific Deductions Correctly?

In healthcare, tax deductions often involve mixed-use assets, regulatory overlays, and timing decisions that require documentation well beyond standard expense categorization.

CPAs advising medical practices must approach deductions as positions to be supported, not assumptions to be claimed.

1. Medical Equipment and Capital Expenditures

Healthcare practices routinely invest in high-cost equipment such as diagnostic machines, surgical tools, and specialized technology.

From a tax execution perspective, the question is not whether these assets are deductible, but how and when the deduction is taken and whether the treatment aligns with both federal rules and state conformity.

CPAs must evaluate:

- Whether immediate expensing or depreciation aligns with the practice’s income profile

- How asset classification affects recovery periods

- Whether state rules diverge from federal treatment

These decisions are often revisited during examinations, making contemporaneous documentation of asset use, placement-in-service dates, and capitalization policies essential. Where accelerated depreciation methods are considered, execution must account for how bonus depreciation is treated across jurisdictions.

2. Facility Improvements and Cost Segregation Considerations

For practices that own or substantially improve their facilities, capital planning extends beyond equipment. Leasehold improvements, build-outs, and structural modifications raise questions about capitalization, depreciation lives, and potential reclassification.

CPAs must determine whether costs should be:

- Capitalized and depreciated over standard recovery periods

- Segregated into shorter-life components where supported

- Allocated between personal property and structural elements

These determinations are heavily fact-dependent and often reviewed years after the original filing. Execution requires retaining engineering reports, contractor invoices, and allocation schedules that clearly support the chosen treatment, particularly when accelerated recovery is involved.

3. Practice-Specific Operating Deductions

Healthcare practices incur operating costs that are uncommon or heavily regulated in other industries. Items such as malpractice insurance, licensing fees, credentialing costs, and continuing education expenses are generally deductible, but only when properly substantiated and correctly classified.

Execution issues arise when:

- Expenses benefit both the individual provider and the entity

- Costs span multiple tax periods

- Reimbursements or allowances are inconsistently documented

CPAs must ensure that deduction treatment aligns with entity policy, payroll reporting, and benefit structures.

Misalignment across these areas increases the likelihood of adjustments during review or examination.

4. SALT and State-Level Deduction Limitations

State and Local Taxes (SALT) refer to income, franchise, and similar taxes imposed by states and municipalities that directly affect how deductions and pass-through income are ultimately taxed.

Healthcare deduction planning must account for SALT constraints, not just federal treatment. State non-conformity, add-back rules, and pass-through tax regimes can materially reduce—or negate—the benefit of otherwise valid deductions.

From an execution standpoint, CPAs must evaluate:

- State add-backs or disallowances for depreciation and large expenses

- Interaction with pass-through entity (PTE) tax elections, which vary by state

- Apportionment impact for multi-state healthcare practices

Ignoring SALT mechanics can undermine federal planning and create downstream state exposure, particularly for capital expenditures and high-income pass-through owners.

5. Documentation and Review Standards

Across all healthcare-specific deductions, the defining execution requirement is documentation quality. CPAs must maintain records that demonstrate:

- Business purpose

- Proper classification

- Consistent treatment across years

- Alignment with entity policies and state rules

This documentation is not ancillary; it is central to sustaining tax positions.

In healthcare, where asset values are high and regulatory oversight is common, weak documentation is often the primary cause of unfavorable outcomes during audits.

With deductions and capital assets addressed, the next layer of healthcare tax execution focuses on income-based limitations and eligibility thresholds.

Qualified Business Income planning introduces constraints that intersect with compensation, retirement contributions, and deduction timing, requiring a coordinated execution approach.

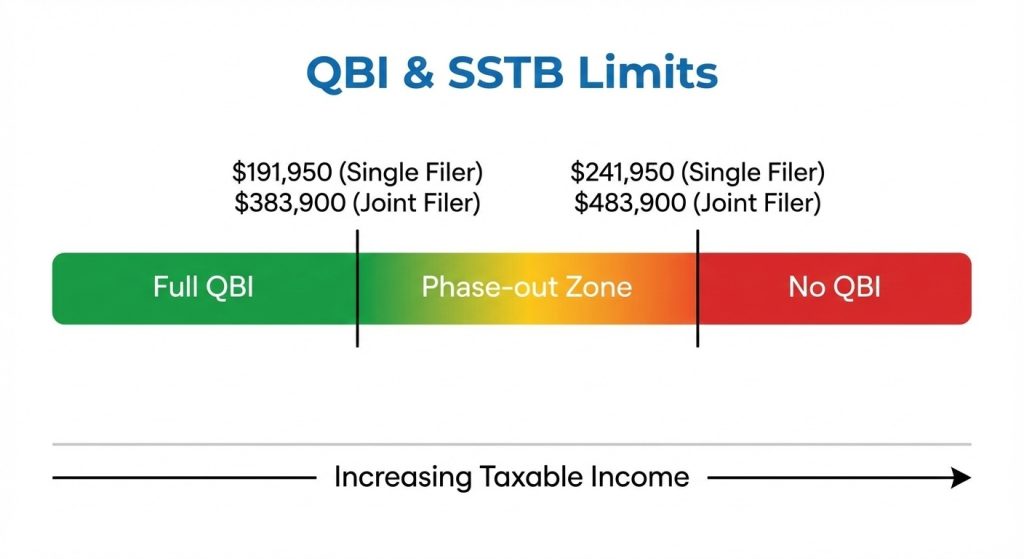

How Does QBI Actually Work for Healthcare Practices?

Qualified Business Income (QBI) is one of the most restrictive layers of tax execution for medical practices because healthcare activities are classified as Specified Service Trades or Businesses (SSTBs), placing eligibility squarely behind income thresholds and compliance precision.

For CPAs, QBI in healthcare is less about optimization and more about eligibility management and documentation discipline.

Qualified Business Income (QBI) Execution Framework for Healthcare SSTBs

| Execution Area | What CPAs Must Evaluate | Primary Risk If Mishandled | Documentation Required |

|---|---|---|---|

| SSTB Classification | Whether income is directly tied to licensed healthcare services or an ancillary activity | Improper QBI claim or full disallowance | Activity descriptions, entity agreements, revenue breakdowns |

| Income Threshold Monitoring | Projected taxable income at the individual level (not entity level) | Unexpected phase-out due to late adjustments | Income forecasts, estimate workpapers |

| Entity-Level Consistency | Alignment of entity reporting with individual return treatment | Mismatch triggering review or adjustment | K-1s, allocation schedules, reconciliation memos |

| Timing of Deductions | Whether deductions affecting taxable income are supported and timely | Loss of QBI eligibility due to unsupported timing | Invoices, accrual schedules, and capitalization policies |

| Multi-Entity Structures | How related entities interact for SSTB purposes | Aggregation errors or artificial separation | Organizational charts, intercompany agreements |

| Review & Sign-Off | Whether QBI assumptions are reviewed before filing | Post-filing correction not possible | Review checklists, partner sign-off notes |

With QBI eligibility evaluated and documented, the remaining execution challenge shifts to longer-term income management and compliance coordination, particularly where retirement contributions and deferred compensation intersect with healthcare-specific income patterns.

How Should CPAs Execute Retirement and Income Deferral for Healthcare Providers?

In healthcare, this work is execution-heavy. Income volatility, ownership changes, and regulatory limits mean retirement strategies must be actively managed, not set once and revisited years later.

For CPAs, retirement planning in medical practices is less about plan selection and more about operational alignment and ongoing compliance execution.

Retirement and Income Deferral Execution for Healthcare Providers

| Execution Area | CPA Execution Focus | Common Risks in Healthcare Practices | Documentation & Review Requirements |

|---|---|---|---|

| Income Volatility Alignment | Match contribution formulas to realistic reimbursement-driven cash flow | Overfunding based on projected income that does not materialize | Cash flow analysis, year-to-date income reviews, contribution rationale memos |

| Contribution Timing | Coordinate retirement funding with actual collection patterns | Late or corrective contributions triggering penalties | Deposit schedules, payroll records, and funding confirmations |

| Plan Design for Owners vs Staff | Ensure plan structure reflects differing compensation and ownership roles | Discrimination issues in multi-provider practices | Plan documents, eligibility testing results, and annual compliance testing |

| Multi-Provider Practice Coordination | Reassess plan terms when ownership or staffing changes occur | Outdated plan terms following partner admissions or departures | Amendment records, ownership change documentation |

| Independent Contractor & Locum Income | Base contributions only on properly characterized income | Inconsistent treatment across filings or entities | Engagement agreements, income classification support, and contribution calculations |

| Cross-Jurisdiction Income | Coordinate deferrals where income spans multiple states | Misalignment between state filings and retirement calculations | State allocation schedules, income sourcing workpapers |

| Annual Limit Compliance | Monitor contribution caps and eligibility thresholds | Excess contributions requiring correction | Annual limit tracking, compliance checklists |

| Review & Sign-Off Process | Integrate retirement decisions into annual tax review | Retirement planning is handled in isolation from tax filings | Reviewer sign-off notes, integrated tax review documentation |

With retirement and income deferral execution structured, the next compliance layer involves coordinating these decisions across jurisdictions, particularly where healthcare services are delivered across state lines.

How Do CPAs Manage Multi-State Tax Exposure in Healthcare?

As healthcare delivery expands beyond fixed locations, multi-state tax exposure has become a routine execution challenge rather than an edge case. Telehealth services, rotating clinic schedules, and locum tenens arrangements regularly trigger state filing, withholding, and reporting obligations that are easy to overlook without deliberate monitoring.

For CPAs, multi-state tax work in healthcare is not about identifying theoretical nexus—it is about maintaining filing accuracy, documentation consistency, and defensible sourcing positions across jurisdictions.

Multi-State Tax Execution for Telehealth and Mobile Healthcare Providers

| Execution Area | CPA Execution Focus | Common Multi-State Risk | Documentation & Compliance Controls |

|---|---|---|---|

| Nexus Identification | Determine where services are considered performed for tax purposes | Unrecognized filing obligations triggered by telehealth or short-term travel | Service location logs, telehealth platform records, engagement schedules |

| Income Sourcing | Allocate income based on state-specific sourcing rules | Over- or under-reporting income in high-tax states | State allocation workpapers, sourcing methodology memos |

| Payroll & Withholding | Assess withholding requirements for providers working across state lines | Failure to withhold in non-resident states | Payroll registers, state withholding registrations |

| Independent Contractor Exposure | Evaluate whether locum tenens activity creates a business presence | Misclassification leading to penalties or back taxes | Contracts, classification analysis, state guidance references |

| Pass-Through Entity (PTE) Elections | Determine where PTE elections mitigate SALT limitations | Missed elections or inconsistent application across states | Election filings, state confirmations, partner communication records |

| Composite & Nonresident Filings | Coordinate entity-level and individual nonresident returns | Duplicate filings or missed composite obligations | Filing calendars, jurisdictional checklists |

| Apportionment Changes | Reassess apportionment factors as service delivery evolves | Outdated formulas not reflecting telehealth growth | Annual apportionment reviews, comparative year analyses |

| Estimated Tax Coordination | Align multi-state estimates with income projections | Underpayment penalties due to fragmented estimates | State estimate schedules, payment confirmations |

| Regulatory Consistency | Ensure tax positions align with healthcare licensure and compliance data | Conflicting representations across agencies | Licensure records, compliance filings, cross-check reviews |

| Review & Audit Readiness | Validate that multi-state assumptions are reviewed before filing | Exposure was discovered only during examination | Reviewer sign-offs, multi-state tax summary memos |

With entity structure, deductions, QBI constraints, retirement execution, and multi-state exposure addressed, the final step is consolidating these layers into a cohesive, repeatable tax execution framework that supports accurate review, defensibility, and year-over-year consistency for healthcare clients.

How Do CPAs Build a Repeatable Healthcare Tax Execution Framework?

By the time entity structure, deductions, QBI eligibility, retirement coordination, and multi-state exposure have been addressed, the remaining challenge for CPAs is not technical knowledge—it is execution discipline over time.

Healthcare tax planning fails most often not because individual strategies are wrong, but because they are applied inconsistently, reviewed out of sequence, or insufficiently documented across filing periods.

For healthcare clients, tax execution must operate as a coordinated framework, not a collection of independent decisions.

- Maintaining Consistency Across Tax Positions

Healthcare practices evolve continuously. Ownership changes, reimbursement models shift, service lines expand, and geographic footprints grow. Each of these changes can affect multiple tax positions simultaneously.

CPAs must ensure that adjustments made in one area do not silently undermine positions taken elsewhere.

This requires deliberate year-over-year comparison and reconciliation. Changes in treatment should be intentional and documented, not the byproduct of staff turnover, system changes, or rushed filing cycles.

Consistency, when properly managed, becomes a defensibility asset rather than a rigidity constraint.

- Tracking Assumptions and Planning Rationale

Many healthcare tax decisions rely on assumptions about income behavior, operational structure, or regulatory interpretation.

These assumptions may be reasonable at the time they are made, but they must be revisited as facts change.

When assumptions are undocumented, CPAs lose the ability to explain why a position was taken—particularly problematic during examinations that occur years later.

Effective execution requires maintaining a clear record of:

- What assumptions informed key tax positions

- When those assumptions were last reviewed

- Whether they remain valid under current operations

This practice supports both internal review and external defense.

- Sequencing Review and Sign-Off Processes

Healthcare tax planning involves interdependent layers. Reviewing these layers out of order increases the likelihood that conflicts are discovered too late to correct. CPAs must apply a structured review sequence, ensuring that upstream decisions are validated before downstream filings are finalized.

This sequencing is critical where multiple returns, owners, or jurisdictions are involved. A disciplined review process reduces last-minute adjustments and strengthens overall accuracy.

- Preserving Institutional Knowledge

Healthcare clients often maintain long-term relationships with their advisors, but the personnel executing the work may change over time.

Without clear documentation of prior planning rationale, successor teams are forced to infer intent, which increases the risk of inconsistency or error.

Preserving institutional knowledge through concise planning summaries and retained workpapers ensures continuity even as teams evolve.

This is particularly important for regulated industries, where historical consistency is frequently scrutinized.

Healthcare tax planning is not a single engagement or annual exercise. It is an ongoing execution responsibility that requires coordination, documentation, and review discipline across years. CPAs who approach healthcare clients with this mindset are better positioned to deliver accurate and defensible outcomes—regardless of regulatory or operational changes.

Execution is the Differentiator in Healthcare Tax Work

In healthcare, tax outcomes are determined less by strategy selection and more by how consistently tax positions are researched, interpreted, documented, and carried forward across years. As healthcare entities grow more complex, CPAs face increasing pressure to manage execution quality while maintaining review discipline and regulatory alignment.

CPA Pilot supports this execution layer by helping CPAs organize healthcare-specific tax research, standardize documentation, and maintain continuity across complex engagements—so planning decisions remain consistent, defensible, and reviewable as facts and regulations evolve.

If your firm is focused on strengthening how healthcare tax work is executed—not just planned—CPA Pilot provides the structure and clarity needed to operate at that level.

Book a 30 min free demo today and feel the difference!!!

Healthcare Tax Planning FAQs

How do healthcare ownership changes affect tax planning?

Healthcare ownership changes affect tax planning by altering income allocation, basis calculations, and reporting obligations. CPAs must reassess entity agreements, compensation logic, and continuity of tax positions when partners enter or exit.

How do healthcare audits differ from other IRS examinations?

Healthcare audits differ because the IRS scrutinizes compensation, expense substantiation, and entity consistency more closely. Medical practices face higher review risk due to regulated income sources and complex provider compensation structures.

Do healthcare practices require specialized tax documentation standards?

Healthcare practices require specialized tax documentation because regulatory compliance, reimbursement data, and provider agreements must align with tax filings to support deductions, income treatment, and audit defense.

How does healthcare licensure impact tax compliance?

Healthcare licensure impacts tax compliance by determining where services are legally performed. CPAs must align licensure records with income sourcing, nexus determinations, and state filing positions.

Why is continuity important in healthcare tax planning year over year?

Continuity is important in healthcare tax planning because inconsistent treatment across years increases audit risk. CPAs must preserve prior-year logic, assumptions, and documentation to maintain defensible tax positions.

![Florida Tax Planning – Residency, IRS & Multi-State Risk [2026 Guide]](https://www.cpapilot.com/blog/wp-content/uploads/2026/02/Florida-Tax-Planning.png)

![Last-Minute Mid-Year & Year-End Tax Planning Using AI – [2026 GUIDE]](https://www.cpapilot.com/blog/wp-content/uploads/2025/09/Last-Minute-Mid-Year-Year-End-Tax-Planning-Using-AI.png)