Florida Tax Planning – Residency, IRS & Multi-State Risk [2026 Guide]

![Florida Tax Planning – Residency, IRS & Multi-State Risk [2026 Guide]](https://www.cpapilot.com/blog/wp-content/uploads/2026/02/Florida-Tax-Planning.png)

[Last Updated on 4 days ago]

Florida tax planning is the process of coordinating federal tax liability, residency documentation, business structure, and multi-state filing obligations for individuals and businesses relocating to or operating in Florida.

Florida’s “no income tax” headline continues to pull high‑earning households and business owners out of higher‑tax states, making it one of nine U.S. states without a broad individual income tax.

TL;DR – Florida Tax Planning Guide

- Florida has no personal income tax, estate tax, or inheritance tax — but federal tax liability still applies.

- Florida residents remain subject to IRS income tax and federal reporting obligations.

- Corporate income tax, sales tax, and tangible property filings still apply to many businesses.

- Residency must be documented carefully to avoid prior-state tax claims.

- Multi-state exposure depends on where employees work, customers are located, and income is sourced.

- Most Florida tax risk arises from coordination gaps rather than tax rates.

Structured tax research — including AI-assisted tools such as CPA Pilot — helps identify multi-state and residency risks before filing.

As of early 2026, Florida still imposes

- No personal income tax,

- No estate tax, and

- No inheritance tax,

Yet new residents are often surprised to learn that federal income tax and out-of-state filing obligations typically remain the largest drivers of total tax exposure.

Corporations and LLCs taxed as C corporations are subject to Florida’s 5.5% corporate income/franchise tax on taxable income, and most businesses must navigate sales and use tax, employment taxes, and multi-state nexus rules as operations and remote teams expand.

In practice, moving to Florida does not eliminate tax risk — it restructures it. Exposure shifts away from a state wage return and toward federal planning, entity design, transaction-based compliance, and residency documentation that can withstand scrutiny from higher-tax states left behind.

Let’s examine how this tax structure works.

Table of Contents

- Why is Florida Tax Planning Commonly Misunderstood?

- Federal Tax Exposure for Florida Residents

- Florida Residency and Domicile Rules That Trigger Audits

- Florida Business Taxes That Still Create Compliance Risk

- Multi-State Tax Exposure for Florida-Based Individuals and Businesses

- Common Florida Tax Planning Mistakes to Catch Early

- How Structured Tax Research and AI Tax Research Tools Surface Risk Earlier

- Florida Tax Planning FAQs

Why is Florida Tax Planning Commonly Misunderstood?

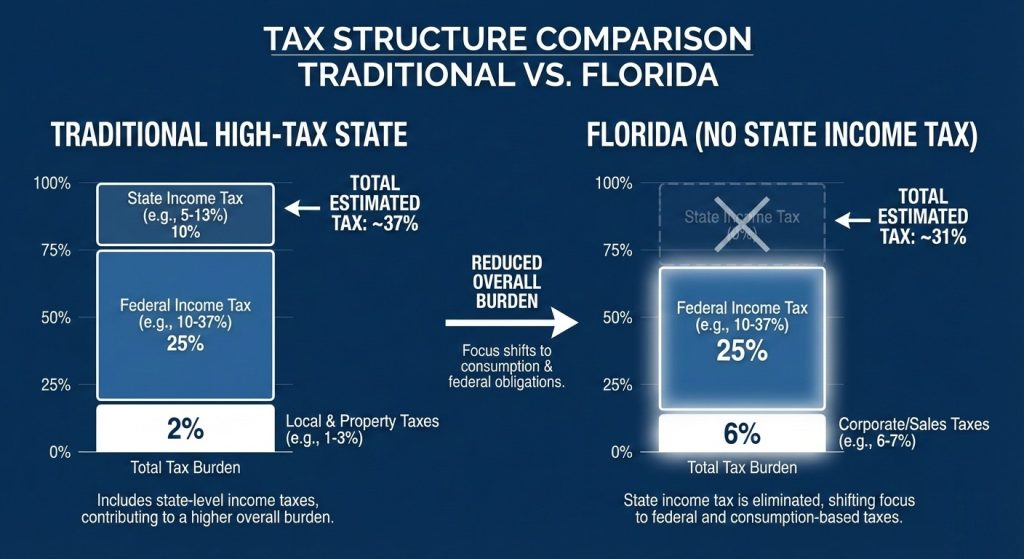

Florida tax planning is misunderstood because people equate “no state income tax” with “low overall tax risk.”

Florida does not impose a personal income tax. That headline drives migration and shapes expectations. But tax exposure is defined by structure, not by one missing tax category.

Most tax strategies in the United States assume interaction between federal and state income taxes. When one layer is removed, planning does not disappear — it reconfigures. Florida’s model changes the way exposure is distributed.

The misunderstanding begins with perception, not law.

Why “No State Income Tax” Changes the Structure of Tax Exposure?

Florida replaces personal income-based taxation with a mix of corporate income tax and transaction-based taxes, such as sales and use tax.

Key structural characteristics include:

- Continued federal income taxation administered by the Internal Revenue Service

- Corporate income tax for certain Florida businesses

- Sales and use tax is administered by the Florida Department of Revenue

- Multi-state nexus exposure triggered by economic activity

Example: A Florida resident may owe no state wage tax but still generate corporate tax, sales tax, or out-of-state filing obligations depending on how income is earned.

The risk profile changes from “rate management” to “exposure identification.”

Why Florida Tax Issues Often Appear After Filing?

Florida-related tax problems rarely arise from miscalculating a rate. They arise from incomplete fact analysis.

Common post-filing triggers include:

- Residency status challenged by a prior state

- Inconsistent domicile documentation

- Sales thresholds exceeded without registration

- Income sourced incorrectly across state lines

These errors surface during audits or notices because the underlying assumption — that Florida simplifies tax — reduces scrutiny during planning.

Federal Tax Exposure for Florida Residents

Florida does not impose a personal income tax. However, Florida residents still owe federal income tax in one way or another and are administered by the Internal Revenue Service. Because there is no state income tax layer, federal outcomes dominate planning decisions.

Florida residents generally do not file a state individual income tax return, so all income‑tax planning flows through the federal return plus any required nonresident state returns.

What Florida Residents Still Owe Under Federal Law?

Florida residency does not eliminate federal tax liability. Residents remain subject to:

- Federal income tax on earned and investment income

- Self-employment tax

- Payroll and employment taxes

- Estimated tax requirements

- Federal reporting and compliance obligations

If you’re mapping these obligations return‑by‑return, our checklist of IRS tax forms for U.S. accounting firms can help structure client workflows

The removal of state income tax does not reduce these federal responsibilities. It isolates them.

How does No State Income Tax Change Deductions and Credits?

In states with income tax, deductions and credits influence both federal and state liabilities. In Florida, they influence federal liability only.

There is no secondary state-level calculation to coordinate with or offset.

As a result, planning decisions involving:

- Business expense treatment

- Depreciation elections

- Retirement contributions

- Qualified business income deductions

- Capital gain timing has a direct and concentrated federal impact.

The SALT deduction is also structurally different. Florida residents do not generate state income tax payments, which changes how federal itemization strategies operate.

How Federal Tax Planning Differs for Individuals and Business Owners

For individuals, income characterization becomes more significant. The distinction between ordinary income and capital gain, active and passive income, and the timing of recognition directly determines federal exposure.

For business owners, entity structure decisions carry federal-first consequences.

S corporation distributions, partnership allocations, C corporation earnings, and estimated tax payments are evaluated primarily through federal tax efficiency..

When revenue, payroll, or property extends beyond Florida, multi-state sourcing and filing rules become relevant. For a broader framework on how cross-border exposure is structured nationwide, see our guide to state and multi-state tax planning.

There is no parallel state income tax system to align with. Both individuals and businesses rely on federal alignment as the primary planning anchor.

Why IRS Outcomes Drive Florida Tax Planning?

Because the Internal Revenue Service is the primary income-tax authority for Florida residents, federal outcomes determine overall tax efficiency.

Planning, therefore, centers on:

- Income classification

- Deduction optimization

- Timing strategies

- Entity structuring

- Federal compliance positioning

Florida removes one tax layer. It does not reduce strategic complexity. It concentrates it under federal jurisdiction.

Florida Residency and Domicile Rules That Trigger Audits

Florida does not impose a personal income tax, but residency status still matters. Residency and domicile determine whether another state can continue taxing an individual after relocation.

Audit risk arises when residency facts are incomplete, inconsistent, or poorly documented.

Florida Domicile vs Statutory Residency

| Category | Domicile | Statutory Residency (Other States) |

|---|---|---|

| Core Definition | Permanent home where an individual intends to remain indefinitely. | Residency is determined by physical presence under statutory thresholds. |

| Primary Legal Standard | Intent + abandonment of prior domicile. | Day-count threshold (often 183 days) plus maintenance of a dwelling. |

| Audit Presumption | A prior domicile is presumed to continue until it is clearly abandoned. | Presence exceeding the statutory threshold creates a presumption of residency. |

| Burden of Proof | The taxpayer must prove a clear intent to establish Florida domicile and abandon the former state. | The taxpayer must disprove statutory residency if the day-count threshold is met. |

| Can It Be Dual? | Only one domicile at a time. | Yes. A taxpayer may be deemed resident in more than one state. |

| Key Evidence Considered | Homestead filing, driver’s license, voter registration, banking, primary residence location, and family relocation. | Physical presence logs, travel records, property access, business activity, and electronic records. |

| Abandonment Requirement | Must demonstrate severance of meaningful ties to prior state. | Not required — statutory threshold alone may trigger liability. |

| Common Audit Trigger | Retained primary residence in prior high-tax state. | Spending more than 183 days in another state while maintaining access to the dwelling. |

| Primary Risk Exposure | Continued taxation by the former state asserting ongoing domicile. | Dual-state taxation due to statutory residency classification. |

| Litigation Risk Level | Fact-intensive and intent-driven disputes. | Mechanical threshold disputes are supported by objective day-count evidence. |

In domicile disputes, states generally apply a presumption that an established domicile continues until the taxpayer proves otherwise.

This means:

- Moving to Florida is not enough.

- Purchasing a home in Florida is not enough.

- Filing a declaration of domicile is not enough.

The taxpayer must demonstrate both:

- Clear intent to establish Florida as a permanent home

- Abandonment of the former domicile

Without both elements, prior-state taxation may continue.

For clients leaving other high‑tax jurisdictions, see our detailed guides to

New York tax planning and California tax planning, which explain how those states approach residency disputes.

Audit Presumptions and Burden of Proof in Residency Disputes

The burden of proof typically rests on the taxpayer.

In domicile audits:

- The taxpayer must provide objective evidence of relocation.

- Courts evaluate conduct, not declarations.

In statutory residency audits:

- If a taxpayer exceeds the day threshold, residency may be presumed.

- The taxpayer must disprove the day-count or dwelling criteria.

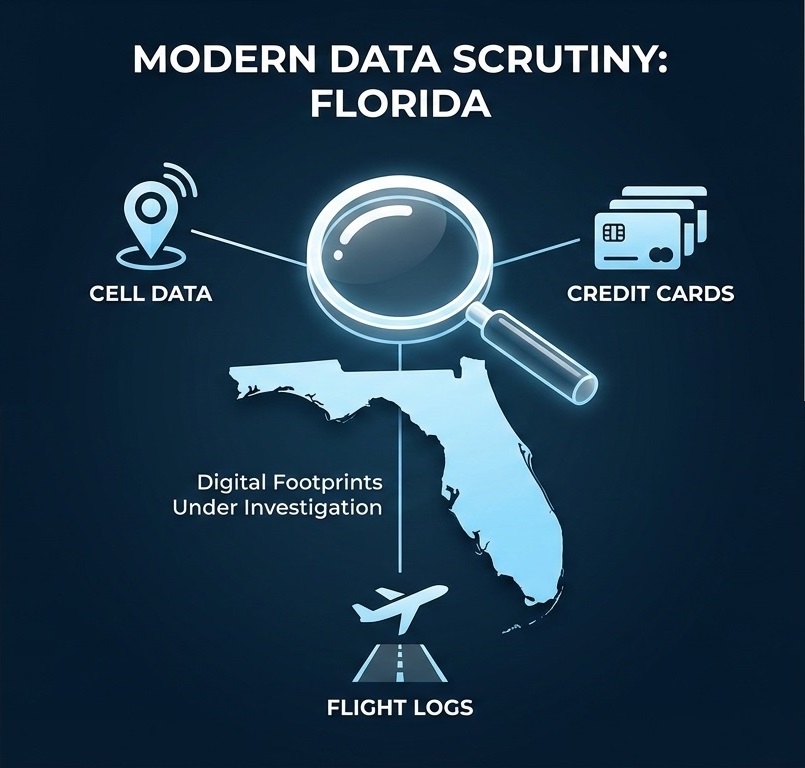

Documentation becomes critical. States increasingly rely on:

- Cell phone location data

- Credit card records

- Flight logs

- EZPass and toll records

- Social media timestamps

Residency disputes are evidence-driven.

Why This Creates Audit Risk for Florida Relocations

Florida does not tax personal income. However, high-tax states aggressively examine outbound taxpayers.

Audit risk increases when:

- Time is split between states

- Business operations remain active elsewhere

- Family members remain in the prior state

- Primary residence is not clearly defined

The financial exposure is not a Florida tax assessment. It is retroactive taxation by the prior state.

Common Behavioral and Documentation Triggers in Residency Audits

Residency audits often focus on behavioral and documentary inconsistencies rather than tax calculations.

Common triggers include:

- Maintaining a primary residence in a prior state

- Spending more than 183 days outside Florida

- Retaining voter registration in another state

- Holding a driver’s license issued by another state

- Continuing business operations or board participation outside Florida

- Maintaining family ties or dependent residency in another jurisdiction

States with high income tax rates frequently examine outbound taxpayers for incomplete domicile changes.

Documents and Behavioral Signals That Support Florida Domicile

Florida domicile must be supported by objective documentation and consistent conduct. Declarations alone do not control tax outcomes. Auditors evaluate whether actions align with the claimed intent.

Common supporting documentation includes:

- Florida homestead exemption filing

- Florida driver’s license and vehicle registration

- Voter registration in Florida

- Declaration of domicile filed with a Florida county

- Relocation of primary banking and professional relationships

- Updated estate planning documents reflecting Florida residency

However, documentation is only one layer of proof. Behavioral consistency is equally important.

Behavioral Signals Checklist

Auditors often analyze daily life patterns to determine true domicile. The following behavioral signals frequently influence residency determinations:

- The majority of overnight stays occur in Florida

- Spouse and minor children reside primarily in Florida

- Children attend school in Florida

- Primary physicians and healthcare providers are located in Florida

- Active participation in Florida community, religious, or social organizations

- Florida address used for primary mail, financial accounts, and government records

- Personal items of sentimental or significant value were relocated to Florida

- Holiday and major life events are primarily spent in Florida

Behavior answers a central audit question:

Does Florida function as the individual’s true “center of life”?

If conduct suggests life remains anchored in another state, documentation alone may not overcome audit presumption.

Residency determines which state may tax you. Business activity determines how you are taxed.

Even when personal income is not taxed at the state level, business operations can still trigger state-level obligations. Florida’s tax structure does not eliminate business exposure. It changes where it appears.

That distinction becomes critical for owners, operators, and investors with Florida-based entities.

Florida Business Taxes That Still Create Compliance Risk

Business exposure in Florida is driven by entity structure, transactional activity, and operational footprint. Compliance risk is shaped by how income is earned, allocated, and reported.

Florida Corporate Income Tax for C Corporations

Florida imposes corporate income tax on C corporations and certain entities conducting business in the state.

- Net taxable income calculations: Corporate income is computed after federal adjustments and state-specific modifications. Planning must account for how income is defined and allocated.

- Apportionment across state lines: Multi-state businesses must divide income using prescribed formulas. Revenue sourcing rules directly influence the portion subject to Florida taxation.

- Estimated tax requirements: Corporations meeting threshold income levels must remit payments throughout the year. Underpayment can trigger penalties even if the annual liability is accurate.

- Filing thresholds: Nexus or active operations within the state may create filing obligations regardless of physical headquarters location.

Florida Sales and Use Tax Compliance Risks

Sales and use tax is administered by the Florida Department of Revenue and represents an active compliance area.

- Failure to register: Businesses meeting taxable activity standards must register before collecting revenue. Late registration often leads to retroactive assessment.

- Misclassification of taxable goods or services: Determining whether a product or service is taxable requires careful interpretation of statutory definitions and exemptions.

- Incorrect sourcing of revenue: Sales tax is imposed based on where transactions are deemed to occur. Improper sourcing can shift liability unexpectedly.

- Marketplace and remote seller obligations: Third-party platforms and digital operations may create collection duties even without a traditional storefront presence.

Because sales tax is transaction-based, exposure grows with volume rather than annual income.

Florida Tangible Personal Property Tax Filing Requirements

Florida counties assess tangible personal property tax on certain business assets.

- Equipment and machinery: Physical business assets used in operations may be subject to annual reporting and assessment.

- Furniture and leasehold improvements: Even non-revenue-producing assets can trigger filing obligations.

Businesses must file annual returns even if no tax is ultimately owed. Failure to file can result in automatic penalties.

Multi-State Apportionment for Florida-Based Businesses

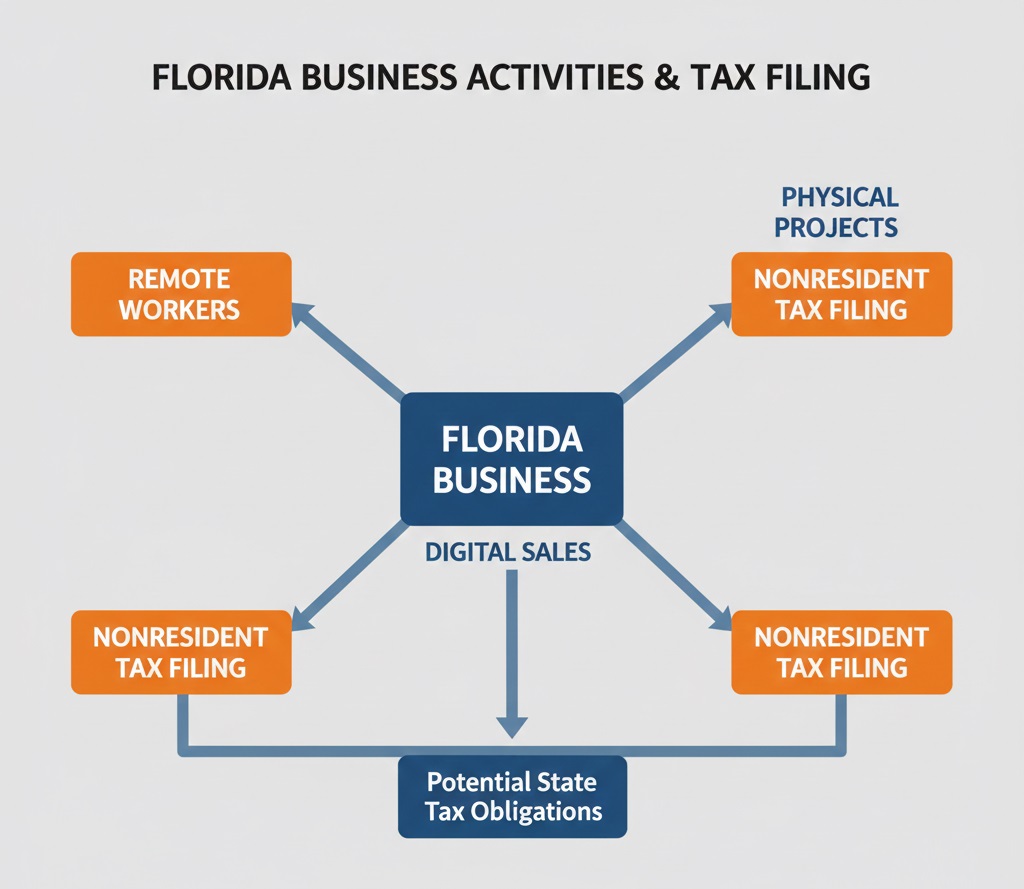

When business activity crosses state lines, income must be allocated according to jurisdictional formulas.

- Revenue sourcing: States may apply market-based sourcing rules that assign income based on customer location.

- Payroll and property placement: Employee location and physical assets influence allocation percentages.

- Market-based allocation rules: Digital services and remote delivery models require analysis of where value is deemed delivered.

Operational footprint determines exposure more than mailing address.

All-in-all, entity structure determines in-state compliance, and the operational reach determines cross-state exposure.

As soon as revenue, payroll, or property touch another jurisdiction, multi-state sourcing and filing rules become relevant.

Multi-State Tax Exposure for Florida-Based Individuals and Businesses

Florida residency does not limit where tax obligations arise. Jurisdiction follows activity, not mailing address.

When income is generated, services are performed, or customers are located outside Florida, additional states may assert filing and payment authority.

How Remote Work Triggers Cross-State Filing Obligations

Distributed operations can trigger obligations in states where work is physically performed.

Exposure may arise when:

- Employees perform work physically in another state: A single employee regularly working from another state may create employer registration, payroll withholding, and business qualification requirements in that jurisdiction.

- Independent contractors operate across state lines: Repeated service delivery in a state may create a nexus depending on that state’s standards, especially if activity is continuous rather than occasional.

- Executives regularly travel for operational decisions: Frequent in-person meetings, contract negotiations, or oversight activities can strengthen a state’s jurisdictional claim.

- Payroll is processed for workers located elsewhere: Employer obligations often attach based on employee location, not corporate headquarters.

Physical presence remains one of the most durable jurisdictional anchors in state taxation.

How Customer Location Drives Revenue Sourcing

Many states assign income based on where the customer receives the service benefit.

This creates exposure when:

- Consulting services are delivered to out-of-state clients: Even if services are performed in Florida, revenue may be sourced to the client’s location under market-based rules.

- Digital products are accessed by users in other states: Software, subscriptions, and online platforms may create allocation obligations based on user geography.

- Subscription or recurring revenue originates nationally: Ongoing customer relationships across multiple states can create multi-jurisdiction reporting requirements.

Revenue allocation increasingly follows economic footprint rather than physical office location.

How Pass-Through Income Creates Nonresident Filing Requirements?

Owners of partnerships and S corporations may receive income allocated across multiple states based on where the entity operates.

Exposure increases when:

- Business partnerships operate in multiple jurisdictions: Each state where the partnership conducts business may require nonresident filings by owners.

- Board or executive activity occurs outside of Florida: Decision-making presence may strengthen nexus analysis depending on state standards.

- Revenue is tied to projects performed elsewhere: Income associated with in-state projects may be sourced to that state regardless of owner residency.

Individual domicile does not override income sourcing tied to operational activity.

How Multi-State Credits and Allocations Prevent Double Taxation

When more than one state asserts tax authority, structured coordination becomes necessary.

This may involve:

- Filing nonresident returns in other states: Even limited activity can require informational or income filings, depending on that state’s nexus standard.

- Allocating income under state-specific formulas: Each state may apply different sourcing or apportionment standards.

- Applying credits for taxes paid to other jurisdictions: Credit calculations must align with both states’ rules to prevent double taxation.

Allocation errors often surface during an audit because states compare filings across jurisdictions.

Example: A Florida-based advisory firm serves clients in North Carolina and Colorado, employs one remote analyst in Illinois, and travels quarterly for on-site engagement.

Even if ownership resides entirely in Florida:

- North Carolina may source revenue based on the client’s benefit location

- Illinois may impose employer registration requirements

- Colorado may assert allocation exposure tied to in-state project work

Operational footprint, not residency, determines exposure.

Florida residency does not shield taxpayers from multi-state tax obligations. Filing requirements depend on where income is earned, services are performed, employees are located, and customers receive benefits.

Common Multi-State Triggers

- Remote employees in other states

- Revenue assigned to out-of-state customers

- Repeated travel for operational purposes

- Ownership in multi-jurisdiction entities

- Digital or marketplace-based sales

Multi-state exposure arises from activity, not address. Understanding where tax obligations arise is only the first step. The greater risk often comes from how those obligations are handled — or overlooked.

In Florida tax planning, errors rarely stem from complex statutes alone. They arise from assumptions, incomplete coordination, and timing misjudgments.

Those mistakes are preventable when identified early.

Common Florida Tax Planning Mistakes to Catch Early

Florida’s structure simplifies certain aspects of taxation. It also creates blind spots. Below are recurring planning errors that surface during audit or post-filing review.

- The absence of personal income tax does not remove business taxation, sales tax compliance, asset reporting, or multi-state sourcing obligations. Planning shifts — it does not disappear.

- Relocating to Florida while maintaining a substantial presence or business operations elsewhere can create dual-state exposure. Residency posture and operational footprint must align.

- Transaction-based taxes often go unmonitored until revenue scales. By the time compliance is reviewed, multiple reporting periods may be exposed.

- Annual asset filings may be required even when no tax is owed. Failure to file can trigger automatic penalties unrelated to income calculations.

- Business income may be allocated to states where activity occurs, regardless of owner residency. Nonresident filing obligations may still apply.

- Credits for taxes paid to other states must align precisely with allocation rules. Misapplied credits can result in underpayment or lost relief.

- Entity classification, compensation structure, and income timing choices affect ongoing exposure. Late-stage adjustments are often more costly than early planning.

Even when common mistakes are understood, execution remains the challenge.

Florida tax planning often requires coordination across residency posture, entity structure, sales compliance, and multi-state sourcing. Managing those moving parts manually increases the likelihood of timing gaps, overlooked filings, or misaligned assumptions.

That is where structured tax research, particularly AI-assisted tax research, becomes valuable.

How Structured Tax Research and AI Tax Research Tools Surface Risk Earlier

Florida tax planning exposure rarely appears in isolation. It emerges from the interaction between facts, jurisdiction, and timing.

Structured research systems help identify those interactions before filing.

- Early residency risk identification: Structured review frameworks can prompt evaluation of domicile abandonment, behavioral signals, and statutory presence thresholds before another state raises the issue.

- Entity and sourcing interaction review: Coordinated research allows planners to evaluate how income allocation, apportionment, and operational footprint affect both Florida and out-of-state filings simultaneously.

- Sales and transaction exposure monitoring: Ongoing tracking helps detect threshold triggers and sourcing shifts before compliance gaps accumulate.

- Multi-state coordination modeling: Structured tools assist in mapping where income is assigned, where returns are required, and how credits must be applied to avoid double taxation.

This is where AI Tax Platforms, such as CPA Pilot, become relevant. Rather than replacing professional judgment, these platforms help:

- Surface jurisdictional interactions earlier

- Organize multi-state research efficiently

- Reduce missed compliance triggers

- Standardize analysis across engagements

- Support documentation discipline in audit-prone areas

Florida tax planning is often less about complexity and more about coordination. Structured research reduces fragmentation and helps surface risks before they mature into assessments.

So, don’t waste your time finding the latest tax rules, etc. Just select the dedicated task to do so and get every important piece of information in just a few seconds.

Try now and see the difference!!! Book a 30-minute demo today!!!

Florida Tax Planning FAQs

When should Florida tax planning begin — before or after relocation?

Florida tax planning should begin before relocation. Pre-move analysis allows income timing, asset restructuring, and residency documentation to align before another state’s tax year closes.

What documents should be updated immediately after moving to Florida?

A relocating taxpayer should update estate planning documents, business registrations, financial accounts, insurance records, and mailing addresses to reflect Florida domicile consistently.

How should estimated tax payments be adjusted after moving to Florida?

Estimated tax payments should be recalculated based on federal liability and any remaining multi-state exposure to prevent overpayment or underpayment after residency change.

Does changing business entity structure make sense after relocating to Florida?

A business owner should reassess entity structure after relocation because corporate income, pass-through allocation, and compensation strategy may produce different results under Florida’s framework.

How should audit documentation be maintained after establishing Florida residency?

A taxpayer should maintain organized records of travel logs, property usage, residency documents, and income sourcing to support domicile and multi-state reporting positions.