California Tax Planning for CPAs – Managing Compliance & Risk

[Last Updated on 1 week ago]

California tax planning for CPAs requires a separate analytical and operational approach because California does not fully conform to federal tax law and enforces state rules independently through the California Franchise Tax Board (FTB).

TL;DR — California Tax Planning for CPAs

- California tax planning is uniquely complex because the state does not fully conform to federal tax law and enforces rules independently through the California Franchise Tax Board (FTB).

- Federal-first tax strategies often fail in California, especially for depreciation, net operating losses, pass-through income, residency, and sourcing.

- Entity-level taxes create exposure regardless of profitability, affecting LLCs, S corporations, and multistate businesses.

- Residency and income sourcing drive the highest audit risk, particularly for high-income individuals, executives, remote workers, and business owners.

- California PTE tax elections are conditional, not automatic benefits, and depend on timing, ownership, and multistate impact.

- Most California tax failures are workflow failures, caused by late identification, inconsistent interpretation, and weak documentation.

- AI supports California tax planning best when used for research, consistency, and early risk detection, not for final judgment or audit decisions.

- Effective California tax planning requires early reconciliation, parallel federal–state analysis, and defensible documentation.

Unlike most states, California introduces planning risk through:

- Selective and delayed conformity to federal changes

- Entity-level taxes that apply regardless of profitability

- Aggressive enforcement of residency, sourcing, and nexus

- Planning positions that remain exposed even when federally sound

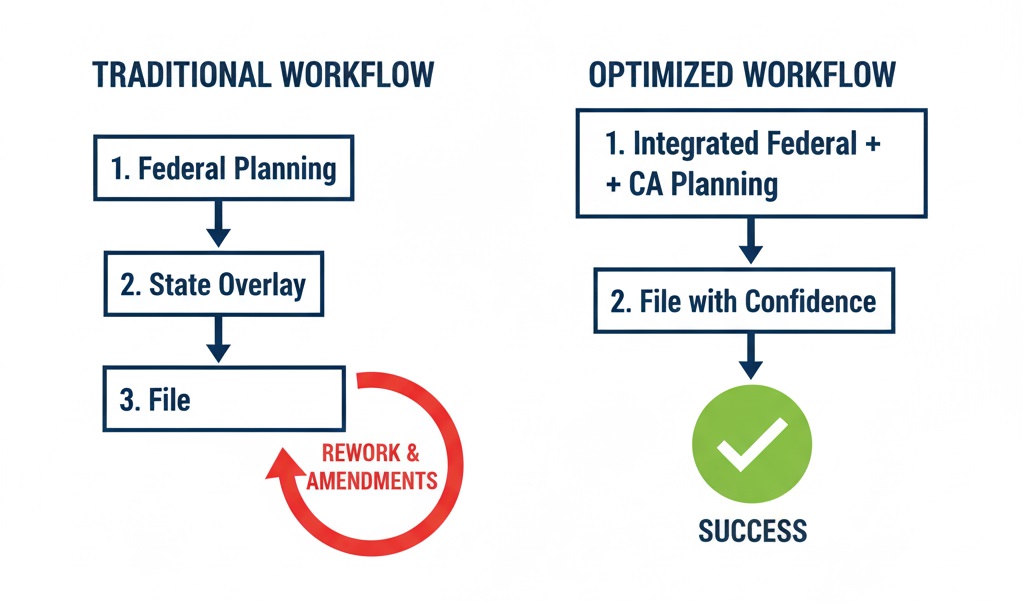

For CPAs advising individuals or businesses with California exposure, tax planning is not a federal-first exercise with minor state adjustments. California tax planning requires parallel evaluation, separate documentation, and early workflow integration to avoid rework, compliance failures, and client disputes.

This becomes especially critical for:

- High-income individuals and executives

- Closely held and pass-through entities

- Multistate businesses with California customers or employees

- Clients relying on federal planning assumptions without state reconciliation

California’s divergence from federal rules affects core planning areas such as depreciation, net operating losses, pass-through taxation, residency, and income sourcing. As a result, positions that appear complete under IRS guidance can still create exposure when reviewed through an FTB lens.

CPAs who treat California as a routine state overlay often encounter:

- Late-stage adjustments

- Amended filings

- Missed elections

- Inconsistent outcomes across similar clients

This is why effective California tax planning depends on early identification of state-specific issues, not post-federal cleanup.

So, without any further ado, let’s start!!!

Table of Contents

- Why California Tax Planning Is Uniquely Challenging for CPA Firms?

- Federal vs. California Tax Rules Require Active Reconciliation by CPAs

- California Personal Income Tax Planning: High-Risk Areas for CPAs

- California Business and Entity-Level Tax Planning Considerations

- California PTE Tax Election: When It Creates Value and When It Creates Risk

- Multistate Clients With California Nexus Require Early Planning Review

- Where California Tax Planning Breaks Down in Traditional CPA Workflows?

- How CPA Firms Use AI to Support California Tax Planning

- Turn California Tax Complexity Into a Repeatable Planning Process

- FAQs About California Tax Planning

Why California Tax Planning Is Uniquely Challenging for CPA Firms?

The challenge for CPAs is not simply that California applies different tax rules; it’s that those differences surface mid-workflow, often after federal positions appear settled.

Planning decisions that seem complete at the federal level frequently need to be revisited once California-specific adjustments are applied, disrupting timelines and review sequencing.

- California Non-Conformity Disrupts Federal-First Planning Workflows:

One of the most persistent friction points is non-conformity timing. California selectively adopts federal provisions and often does so on a delayed or modified basis.

This creates planning scenarios where depreciation schedules, loss utilization, or credit eligibility must be tracked separately for federal and California purposes.

For CPA firms handling volume work, this split treatment introduces parallel calculations that increase the likelihood of inconsistency across engagements, especially within broader state and multistate tax planning workflows.

2. Entity-Level Rules Increase Late-Stage Planning Risk:

Entity-level divergence adds further pressure. Minimum franchise taxes, gross-receipts-based LLC fees, and California-specific limitations can materially affect structures that appear tax-efficient under federal analysis.

These issues often emerge late in the planning process, particularly for entities operating across multiple states or ownership tiers, increasing review complexity and documentation burden.

3. Staff Interpretation Variance Increases Compliance Exposure:

Operationally, California also amplifies staff interpretation risk. Junior preparers may apply federal guidance correctly while overlooking California-specific thresholds or exceptions. Senior reviewers then inherit reconciliations that are harder to validate under time pressure.

Over time, this pattern mirrors many of the common tax research mistakes seen in complex jurisdictions, where state-level nuances are identified too late to be addressed cleanly.

These challenges explain why California tax planning requires more than awareness of the rules.

It demands:

- Intentional workflow design,

- Consistent internal interpretation, and

- Early identification of state-level adjustments, before federal positions are finalized.

To see where these adjustments originate, the next section focuses on the specific federal and California tax rule differences that most often force CPAs to revisit planning decisions.

Federal vs. California Tax Rules Require Active Reconciliation by CPAs

CPAs must actively reconcile federal and California tax rules because California does not automatically adopt federal changes and applies independent conformity, timing, and enforcement standards.

Federal conclusions cannot be treated as final when California exposure exists.

Where reconciliation is most critical

California divergence concentrates in planning areas that directly affect projections, estimates, and elections:

1. Depreciation

- Federal law allows accelerated and bonus depreciation.

- California does not fully conform and applies state-specific limitations.

- Result: Separate asset schedules are required to avoid projection and filing mismatches.

2. Net Operating Losses (NOLs)

- Federal rules allow broad carryforward usage.

- California imposes suspension periods and percentage caps.

- Result: Income smoothing and estimated payment planning must be modeled separately.

3. Pass-Through Income

- Federal deductions and income generally flow through to owners.

- California modifies outcomes through entity-level taxes and non-conforming treatment.

- Result: Owner-level assumptions based on federal results may not hold.

4. SALT Deduction Interaction

- Federal SALT deductions are capped.

- California’s entity-level taxes and elections interact differently with the cap.

- Result: Federal-only SALT analysis can materially misstate net benefit.

5. Conformity Timing

- Federal changes often apply immediately.

- California selectively adopts changes, sometimes years later.

- Result: CPAs must track federal and California rules in parallel rather than sequentially.

6. Enforcement Authority

- Federal tax law is administered by the IRS.

- California tax law is enforced independently by the California Franchise Tax Board.

- Result: IRS guidance does not guarantee FTB acceptance.

Why reconciliation must happen early

If California reconciliation occurs after federal positions are finalized, CPA firms often face:

- Revised depreciation and NOL schedules

- Recalculated estimated payments

- Late identification of non-conforming elections

- Increased review and documentation burden

Effective California tax planning treats federal and state analysis as concurrent, not sequential.

Federal vs. California Tax Rule Differences — CPA Planning Reference

| Planning Area | Federal Treatment | California Treatment | Planning Impact |

|---|---|---|---|

| Depreciation | Bonus and accelerated depreciation allowed | No full bonus conformity | Separate asset schedules required |

| NOLs | Broad carryforward usage | Suspensions and percentage caps | Alters income smoothing |

| Pass-through income | Flows directly to owners | Modified by entity-level rules | Owner outcomes change |

| SALT deductions | Subject to federal cap | Interacts with entity taxes | Federal benefit may differ |

| Conformity timing | Immediate adoption | Selective and delayed | Parallel tracking required |

| Enforcement | IRS-administered | FTB-administered | Federal guidance not controlling |

This reconciliation burden is not theoretical. It directly shapes individual client risk—especially when residency, sourcing, and compensation structures are involved.

The next section focuses on California personal income tax planning and the high-risk areas that most often create exposure for CPA firms.

California Personal Income Tax Planning: High-Risk Areas for CPAs

California personal income tax planning creates outsized risk because multiple fact-based determinations—residency, sourcing, and compensation—interact simultaneously. Errors rarely stem from a single rule; they arise when assumptions overlap without coordinated analysis.

California Residency Relies on Facts and Circumstances

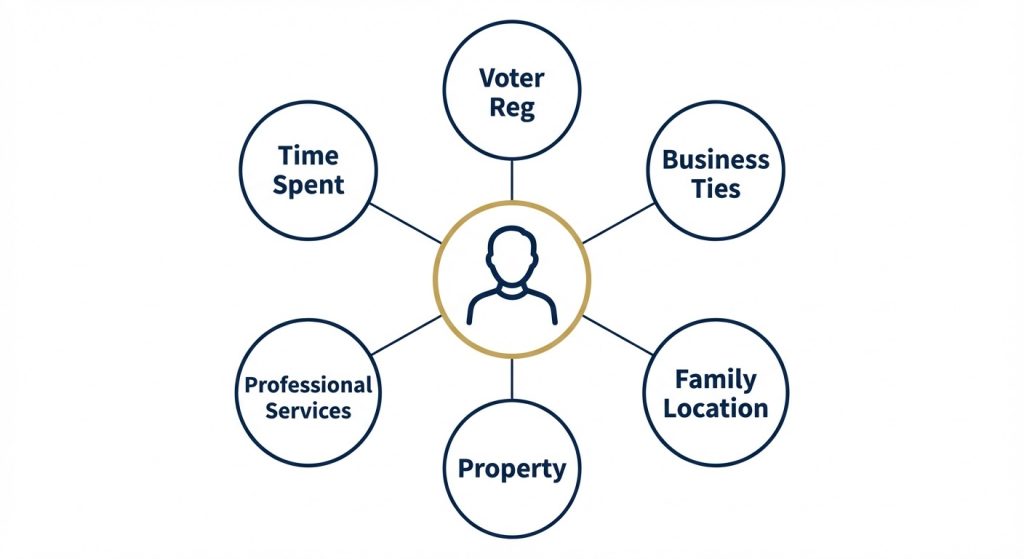

California does not use a mechanical day-count test. Residency is determined by the totality of facts, including:

- Domicile intent

- Location of family and personal ties

- Business activity and economic connections

- Duration and purpose of time spent in and out of California

Taxpayers who believe they have exited California often retain audit exposure when ties are reduced informally rather than clearly severed. Residency positions must be documented contemporaneously to withstand FTB scrutiny. (See related guidance on [California residency tax rules].)

Income Sourcing Drives Executive and Founder Exposure

California applies state-specific sourcing rules to:

- Wages and bonuses

- Deferred compensation

- Performance-based pay

For executives and founders, sourcing assumptions often determine whether large portions of income remain taxable after relocation.

Equity Compensation Requires California-Specific Analysis

Stock options and restricted stock units introduce heightened risk because California sourcing depends on:

- Grant date

- Vesting period

- Services performed during vesting

Federal equity compensation treatment does not resolve California sourcing. Misaligned assumptions frequently surface during audit, not filing.

Remote Work Continues to Trigger California Taxability

California scrutinizes individuals who live outside the state but earn income connected to California-based employers or businesses. Compensation tied to California services may remain taxable even when work is performed remotely.

This issue often intersects with broader remote work tax exposure and multistate planning.

Documentation Determines Audit Outcomes

California personal income tax audits emphasize:

- Written residency narratives

- Sourcing methodology

- Consistency across years

When residency or sourcing positions are challenged, assessments often span multiple tax years and include penalties and interest. Early documentation is critical to risk control.

Operationally, these issues tend to surface late—after federal returns are substantially complete—forcing revisions under deadline pressure.

The next section shifts from individual risk to business structures, where California entity-level taxes introduce a different class of planning exposure for CPA firms.

California Business and Entity-Level Tax Planning Considerations

California business tax planning introduces risk at the entity level, often independent of profitability. Unlike federal planning, California exposure is driven by structure, sourcing, and filing position, making early entity analysis essential.

C-Corporations Face Market-Based Sourcing and Apportionment Risk

California applies market-based sourcing for many categories of income. Revenue may be sourced to California based on customer location, not physical presence.

This creates exposure when:

- Customers are located in California

- Intellectual property is monetized nationwide

- Operations span multiple states

As a result, California can represent a disproportionate share of total tax liability even when in-state operations appear limited. These outcomes often differ from federal allocation assumptions and must be evaluated early in multistate planning.

S-Corporations Trigger Entity-Level Taxes and Compensation Scrutiny

While S-corporations simplify federal pass-through analysis, California imposes:

- An entity-level franchise tax

- Heightened scrutiny of shareholder-employee compensation

Planning decisions around wages, payroll taxes, and distributions often require recalibration once California rules are applied. These adjustments affect both entity-level liability and individual income tax exposure.

California LLC Gross Receipts Fees Apply Regardless of Profitability

California imposes an annual franchise tax and an additional LLC fee based on California-source gross receipts, not net income.

This structure means:

- Early-stage or loss-generating LLCs may still owe significant tax

- Revenue growth can materially change state exposure

Entity choice decisions driven by federal flexibility frequently understate California cost unless LLC tax treatment is modeled upfront.

Entity Choice Requires California-Specific Cost Modeling

Federal tax efficiency does not guarantee California efficiency. Entity selection and restructuring decisions must incorporate:

- Franchise taxes and minimums

- Gross receipts fees

- Sourcing and apportionment outcomes

- Owner-level spillover effects

Failure to model California implications early often leads to late-stage restructuring or suboptimal outcomes.

Workflow and Sequencing Risk

Entity-level issues commonly surface after personal income planning is complete, increasing rework and review strain. When entity analysis is delayed, CPA firms face:

- Revised projections

- Missed elections

- Inconsistent documentation

Integrating entity-level review early reduces friction and improves engagement consistency.

The next section examines California’s pass-through entity (PTE) tax election, focusing on when it adds value and where it introduces risk.

California PTE Tax Election: When It Creates Value and When It Creates Risk

California’s pass-through entity (PTE) tax election can restore part of the federal SALT deduction benefit, but only when timing, ownership, and multistate effects are evaluated correctly. The election is conditional, not default.

How the California PTE Election Works

- The entity pays California income tax at the entity level

- The payment generates a federal deduction at the entity level

- Owners receive a California tax credit on their individual returns

This structure may improve federal outcomes, but it also introduces California-specific compliance and modeling requirements.

When the PTE Election Creates Value

The election is more likely to be beneficial when:

- Owners are subject to the federal SALT deduction cap

- Income is consistently positive and predictable

- Ownership is primarily individuals or qualifying trusts

- California is a significant portion of total state tax exposure

In these cases, entity-level deductions can produce a measurable federal benefit.

Where Risk Commonly Arises

Timing and Payment Errors

- California requires specific election and payment deadlines

- Missed or misapplied payments can eliminate the intended benefit

- Federal projections often need recalculation after California rules are applied

Late modeling is one of the most common failure points.

Ownership Structure Limitations

The PTE election does not benefit all owners equally. Risk increases when ownership includes:

- Tax-exempt entities

- Nonresident partners

- Certain trusts

Uneven benefits can create internal disputes and disclosure obligations.

Multistate Reporting Complexity

For entities operating in multiple states, the California PTE election can:

- Create mismatches between federal deductions and state allocations

- Increase K-2 and K-3 reporting complexity

- Complicate owner-level disclosures

These issues often surface after elections are assumed rather than evaluated.

Planning Takeaway

The California PTE election should be assessed as part of an integrated planning workflow that aligns:

- Federal SALT assumptions

- California conformity and deadlines

- Owner-level outcomes

When applied strategically, the election adds value. When applied mechanically, it introduces avoidable risk.

The next section focuses on multistate clients with California nexus, where sourcing, workforce, and revenue thresholds intersect most sharply for CPA firms.

Multistate Clients With California Nexus Require Early Planning Review

California nexus issues create risk when they are identified late. By the time California exposure is confirmed, federal and primary-state filings are often already in progress, forcing CPAs to revisit planning decisions under deadline pressure.

Employee Presence Creates California Payroll and Income Tax Nexus

California nexus can be triggered when employees:

- Perform services in California, even temporarily

- Support California-based customers or operations

- Work remotely for California-connected employers

These scenarios often surface during review rather than planning, particularly as remote work arrangements evolve informally. Late identification forces reconciliation with already-modeled federal positions.

Revenue-Based Nexus Applies Under California Economic Thresholds

California applies economic nexus standards based on customer location and revenue, not physical presence. Nexus may arise solely from:

- California-based customers

- Market-based sourcing of receipts

- Digital or service-based revenue streams

Once nexus is established, CPAs must adjust:

- Apportionment factors

- Estimated payments

- Filing positions—sometimes retroactively

This creates execution risk when revenue modeling occurs before California exposure is evaluated.

Pass-Through Entities Face Layered Compliance Obligations

For pass-through entities with California nexus:

- Entity-level filing obligations increase

- Owner-level reporting must reflect California activity

- State-by-state disclosures must remain consistent

These requirements often intersect with PTE elections and K-2/K-3 reporting, compounding complexity when addressed reactively.

Late Nexus Identification Drives Rework

When nexus review is delayed, firms frequently encounter:

- Additional state filings

- Revised projections

- Amended estimates

These outcomes strain review cycles and increase error risk. Over time, this mirrors the same execution failures seen in other complex state engagements.

Planning Takeaway

Effective nexus management depends on embedding California review into early planning workflows rather than treating nexus as a post-filing determination. Early evaluation preserves control over structure, sourcing, and timing.

The next section examines where California tax planning most often breaks down inside traditional CPA workflows—and why these failures are process-driven, not rule-driven.

Where California Tax Planning Breaks Down in Traditional CPA Workflows?

Most California tax planning failures are not technical errors. They are process failures caused by late identification, fragmented analysis, and inconsistent documentation.

California Research Happens After Federal Positions Are Finalized

Many workflows treat California as a follow-up step. Federal analysis is completed first, and California adjustments are layered on later.

This sequencing leads to:

- Reworked projections

- Revised estimated payments

- Missed or misapplied elections

By the time California issues surface, planning flexibility is already constrained.

Interpretation Varies Across Staff Levels

Junior preparers may correctly apply federal guidance while overlooking California-specific:

- Thresholds

- Timing rules

- Non-conformity exceptions

Senior reviewers then inherit reconciliations that are harder to validate under time pressure. Similar client profiles can receive different outcomes, increasing firm-level risk.

Documentation Is Fragmented and Inconsistent

California planning assumptions are often scattered across:

- Emails

- Spreadsheets

- Informal notes

When residency, sourcing, or elections are challenged, the rationale is difficult to reconstruct. Year-over-year consistency becomes harder to maintain or defend during FTB review.

Personal, Entity, and Multistate Planning Are Disconnected

California exposure frequently spans:

- Individual income tax

- Entity-level taxes

- Multistate nexus

When these areas are handled separately, changes in one area are not reflected across the engagement. This leads to duplicated effort and missed planning opportunities.

Reactive Execution Increases Error Risk

Late discovery of California issues forces firms into defensive execution:

- Additional filings

- Amended estimates

- Compressed review timelines

These conditions increase error rates and client-facing risk during peak periods.

Process Takeaway

Firms that manage California effectively surface state-specific issues before federal positions are finalized. Early integration preserves control over planning decisions and reduces rework.

The next section explains how CPA firms use AI—selectively and responsibly—to support California tax planning without replacing professional judgment.

How CPA Firms Use AI to Support California Tax Planning

CPA firms use AI to reduce friction in California tax planning by improving early issue detection, consistency, and research discipline—not by replacing professional judgment.

AI Surfaces California-Specific Issues Earlier

AI-assisted research helps CPAs identify:

- California non-conformity alongside federal guidance

- FTB publications, notices, and conformity updates

- State-specific limitations affecting depreciation, NOLs, and elections

By surfacing California rules earlier, firms avoid discovering state adjustments after federal positions are already finalized.

AI Improves Consistency Across California Engagements

California planning often breaks down when similar fact patterns are interpreted differently by different team members.

AI-supported systems help by:

- Anchoring research to consistent authority sources

- Applying uniform analytical logic across engagements

- Reducing interpretation variance between preparers and reviewers

This consistency lowers review risk and improves defensibility across similar clients.

AI Supports Early Scenario Validation

California outcomes can change materially based on:

- Residency assumptions

- Sourcing methodology

- Entity-level taxes and elections

AI-supported modeling allows CPAs to test these inputs earlier in the planning cycle, before projections, estimates, or elections are finalized. This supports more controlled decision-making in non-conforming states.

Human Judgment Remains Central

AI functions as an augmentation layer:

- CPAs retain responsibility for conclusions

- Planning positions remain reviewable and explainable

- Documentation remains human-authored and defensible

Used correctly, AI strengthens California tax planning workflows by improving execution discipline without bypassing professional standards.

The final section explains how CPA firms can turn California’s complexity into a repeatable, defensible planning process.

Turn California Tax Complexity Into a Repeatable Planning Process

California tax planning becomes manageable when CPA firms shift from reactive adjustments to early, structured execution. The goal is not to eliminate complexity, but to control when and how it enters the workflow.

What a Repeatable California Planning Process Requires

- Early California exposure identification

- Residency, sourcing, entity structure, and nexus reviewed during onboarding

- California implications evaluated before federal positions are finalized

- Parallel federal and California analysis

- Conformity differences tracked concurrently, not retroactively

- Separate schedules maintained where California diverges

- Consistent interpretation standards

- Similar fact patterns analyzed using the same logic

- Reduced variance across preparers and reviewers

- Defensible documentation

- Residency narratives, sourcing methodology, and election rationale documented contemporaneously

- Year-over-year consistency preserved for audit readiness

- Integrated workflow sequencing

- Personal income, entity-level, and multistate planning evaluated together

- Changes in one area reflected across the full engagement

Why This Matters for CPA Firms

Firms that operationalize California planning see:

- Fewer late-stage revisions

- Lower error and rework rates

- More predictable review cycles

- Stronger client confidence in planning outcomes

California tax risk is rarely caused by lack of technical knowledge. It is caused by late recognition and fragmented execution. Firms that surface California-specific issues early retain control over structure, timing, and strategy.

How CPA Pilot Supports California Tax Planning Workflows?

CPA Pilot helps firms support California tax planning by centralizing federal and California research, validating planning assumptions early, and maintaining consistency across staff, clients, and tax years.

CPA firms use CPA Pilot to:

- Research California non-conformity alongside federal rules

- Validate residency, sourcing, and entity-level assumptions early

- Standardize planning logic across teams

- Reduce rework caused by late California adjustments

- Maintain documentation that supports FTB review and audit readiness

Instead of reacting to California issues late in the filing cycle, firms use CPA Pilot to surface risk before projections, estimates, or elections are finalized.

See How CPA Pilot Fits Into Your Planning Workflow?

If your firm manages California clients, or multistate clients with California exposure, see how CPA Pilot supports tax planning without disrupting your existing process. 👉 Request a 30-minute Demo

FAQs About California Tax Planning

How often does California decouple from federal tax law?

California periodically decouples from federal tax law by selectively adopting or rejecting provisions passed by the Internal Revenue Service. CPAs must monitor conformity updates issued by the California Franchise Tax Board to identify timing gaps that affect depreciation, losses, and credits.

Does California require separate tax planning documentation from federal files?

Yes. California tax planning requires state-specific documentation that explains residency positions, sourcing assumptions, and conformity adjustments. Federal workpapers alone are often insufficient during a California review or audit.

Can California tax planning positions be reused year over year?

Only conditionally. California tax planning positions remain valid when the underlying facts stay consistent. Changes in residency, remote work, ownership, or conformity rules require reassessment before reuse.

How early should California tax planning start in the engagement lifecycle?

California tax planning should begin during initial fact gathering. Early evaluation allows CPAs to align federal assumptions with California rules before projections, estimates, or elections are finalized.

Are California tax audits more documentation-driven than federal audits?

Yes. California audits place heavy emphasis on factual documentation, especially for residency, sourcing, and nexus. Positions lacking written rationale or contemporaneous support carry higher adjustment risk.

Do California planning risks increase for part-year residents?

Yes. Part-year residency introduces allocation and sourcing complexity. CPAs must clearly document entry and exit dates, income attribution, and continued California ties to reduce exposure.