Texas Franchise Tax Guide 2026 – Margin, Nexus & Filing Rules

[Last Updated on 14 hours ago]

Why do Texas franchise tax questions keep showing up in CPA workflows, even when clients assume “Texas has no state income tax”?

Because headlines don’t drive Texas business tax compliance — statutory structure does. Entity classification, annualized revenue thresholds, sourcing rules, and required filings determine exposure under Texas law.

TL;DR: Texas Franchise Tax (2025–2026)

- Texas imposes a franchise tax on most taxable entities with nexus under Tax Code Chapter 171.

- The tax applies at the entity level, including LLCs, S corporations, partnerships, and out-of-state businesses operating in Texas.

- The no-tax-due threshold is $2.47 million in annualized total revenue.

- Entities above the threshold must calculate taxable margin using the lowest of four statutory methods.

- The standard tax rate is 0.75%, and qualifying retail or wholesale entities apply 0.375%.

- Texas uses single-factor gross receipts apportionment under §171.106.

- Franchise tax reports are due annually on May 15.

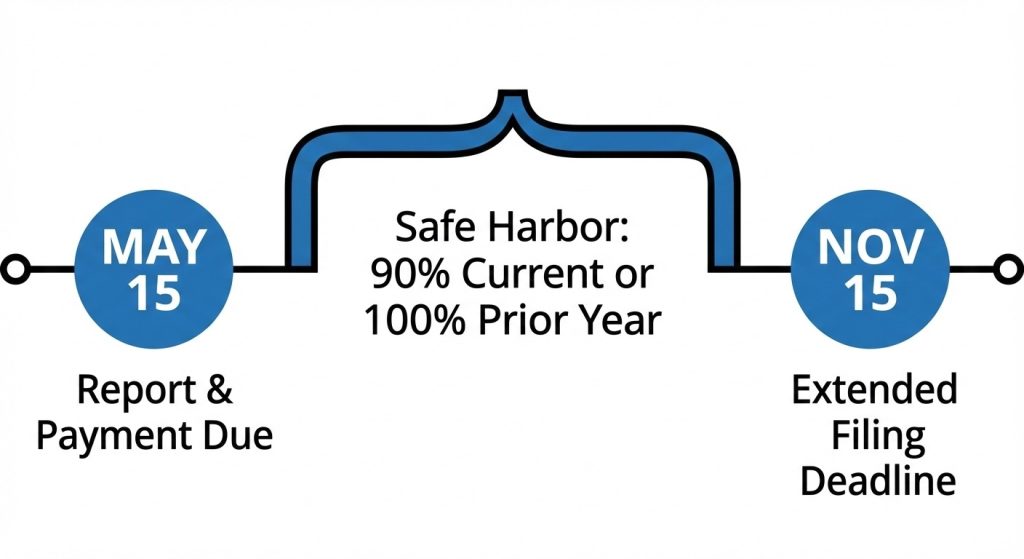

- Extensions require payment of at least 90% of current-year tax or 100% of prior-year tax.

- Filing may still be required even when no tax is owed.

- CPAs reduce compliance risk by standardizing workflows and using AI-driven tax research tools to validate margin calculations, nexus determinations, apportionment sourcing, and filing accuracy.

The Texas Comptroller of Public Accounts administers the franchise tax program and provides annual reporting requirements and forms for businesses operating in the state. [Source]

For 2025 franchise tax reports, the Comptroller confirms a key filing rule: entities with annualized total revenue less than or equal to $2.47 million do not owe franchise tax, though reporting obligations may still apply depending on statutory classification. [Source]

That’s where confusion often arises, not in the definition of the Texas franchise tax, but in applying the rules correctly across different entity types and multistate structures.

This issue is part of a broader framework discussed in our guide on state and multistate tax planning for CPAs, where entity classification and cross-state exposure create layered compliance challenges.

For CPA firms managing Texas clients, having a structured research workflow becomes essential. AI-assisted tax research platforms like CPA Pilot help streamline the interpretation of Texas franchise tax statutes, thresholds, and filing requirements by centralizing state tax guidance and reducing repetitive manual statute lookup.

So, without any further ado, let’s start!!!

Table of Contents

- What is the Texas Franchise Tax?

- Who Must File the Texas Franchise Tax?

- How Texas Franchise Tax is Calculated (Step-by-Step)

- Apply the Texas No-Tax-Due Revenue Threshold for 2025 and 2026

- Meet Texas Franchise Tax Filing Requirements and Deadlines (For 2025 and 2026)

- Apply Texas Franchise Tax Rules to LLCs, S Corporations, and Out-of-State Entities

- Apportion Multistate Revenue Under Texas Franchise Tax Rules

- How to Avoid Common Texas Franchise Tax Compliance Errors?

- Simplify Texas Franchise Tax with Structured Intelligence

- FAQs About the Texas Franchise Tax Compliance

What is the Texas Franchise Tax?

The Texas franchise tax is a state-level tax imposed under Texas Tax Code Chapter 171 on taxable entities for the privilege of conducting business in Texas. It is administered by the Texas Comptroller of Public Accounts and is calculated using a business’s taxable margin rather than its federal taxable income.

The Texas franchise tax operates independently from federal tax concepts. That means:

- Federal deductions do not automatically apply

- Net income for IRS purposes does not determine Texas liability

- Multistate revenue sourcing affects margin apportionment

The legal framework is designed around:

- Total revenue reporting

- Statutory deduction methods

- Apportionment rules for multistate businesses

- Defined tax rates based on business classification

Knowing how Texas structures the franchise tax under Chapter 171 is useful, but it doesn’t answer the question most firms need to resolve first in real life: Does this client actually have a Texas filing obligation this year?

That determination hinges on factors like entity status, Texas nexus, and whether the business falls into a category with special reporting treatment.

So before we get into formulas and margin computations, the next step is to clarify the filing trigger: Who must file the Texas franchise tax, and which entities have different reporting requirements under Texas rules?

Who Must File the Texas Franchise Tax?

An entity must file the Texas franchise tax if it has established nexus with Texas and falls within a reportable business classification under Texas Tax Code Chapter 171.

The filing requirement is based on operational presence and statutory status, not on whether the business earned a profit

That high-level rule breaks down into three practical determinations. In real compliance workflows, firms evaluate filing status in the following order:

–> Does the business have a nexus with Texas?

Nexus generally exists when a business:

- Maintains a physical location in Texas

- Has employees or representatives operating in Texas

- Owns or leases property in Texas

- Earns Texas-sourced revenue

Nexus is the primary compliance trigger. Once nexus is established, the entity must review its annual franchise tax reporting obligations, regardless of whether tax will ultimately be due.

–> Does the entity fall into a special statutory classification?

Even when a nexus exists, not all entities follow identical reporting pathways.

Texas law provides modified treatment for certain classifications, including:

- Passive entities under §171.0003

- Qualified REITs under §171.0002(c)(4)

- Entities with zero Texas gross receipts

- Pre-qualified new veteran-owned businesses under §171.0005 [Source]

These classifications affect which report must be filed and whether additional information reports (PIR or OIR) are required. The compliance impact depends on statutory qualification, not business size alone.

–> Is the entity formed outside Texas but conducting taxable activities within the state?

Formation outside Texas does not remove filing exposure.

If an out-of-state entity conducts business activities that create a Texas nexus, it must evaluate franchise tax reporting obligations under Texas law.

Texas evaluates economic and operational connections to the state, not just the place of incorporation. Once that connection is established, filing analysis becomes mandatory.

Each of these factors independently affects reporting obligations.

Establishing who must file resolves the threshold question of reporting exposure. The next compliance step is measurement.

How Texas Franchise Tax is Calculated (Step-by-Step)

The Texas franchise tax is calculated by

- Determining a business’s taxable margin,

- Applying the appropriate tax rate, and then

- Sourcing revenue to Texas under the state’s apportionment rules.

This distinction between federal income concepts and state-level margin calculations highlights why CPAs must clearly differentiate between federal and state tax frameworks.

Let’s explore these steps in detail:

Step 1: Determine Total Revenue Under §171.1011

Texas defines total revenue under §171.1011. It begins with federal gross revenue figures but requires specific inclusions and exclusions under state law. Source

Texas does not simply import federal taxable income. Instead, it uses a revenue-based starting point and then applies state-specific adjustments before the margin is computed.

Step 2: Select the Lowest Taxable Margin Deduction Method

Under §171.101, taxable margin is generally the lesser of:

- 70% of total revenue

- Total revenue minus cost of goods sold (COGS)

- Total revenue minus compensation

- Total revenue minus $1 million (if applicable under statutory election)

The business evaluates each permitted method and selects the calculation that results in the lowest taxable margin. This statutory structure creates planning and compliance implications depending on the entity’s expense profile.

Step 3: Apply the Correct Franchise Tax Rate

For most entities, the franchise tax rate is:

- 0.75% of taxable margin

- 0.375% for entities primarily engaged in retail or wholesale trade

For eligible small entities electing the EZ Computation method, a separate rate applies.

Rate determination depends on business classification. Retail and wholesale entities receive a reduced statutory rate, while other entities apply the standard rate.

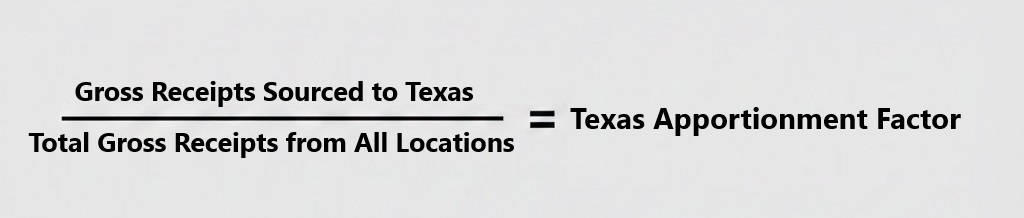

Step 4: Apportion Gross Receipts to Texas

Under §171.106, Texas applies a single-factor apportionment formula based on gross receipts sourced to Texas.

Only the portion of revenue attributable to Texas is subject to the franchise tax. Businesses operating in multiple states must calculate the Texas receipts ratio before

Each step builds on the previous one, and errors often occur when businesses skip statutory review or misapply deduction methods.

Now that we’ve walked through how Texas determines taxable margin and applies statutory rates, the next compliance checkpoint is the No-Tax-Due Threshold.

Apply the Texas No-Tax-Due Revenue Threshold for 2025 and 2026

For franchise tax reports due on or after January 1, 2024, entities with annualized total revenue of $2.47 million or less do not owe franchise tax. [Source]

Determine When Filing Is Still Required

The threshold applies to annualized total revenue, not to taxable margin and not to net income. This means:

- Revenue must be annualized when a reporting period is shorter than 12 months

- The comparison is made before any deduction elections

- The determination is made at the entity level

The threshold functions strictly as a liability determination mechanism within the Texas franchise tax framework.

Practical Compliance Significance

The $2.47 million figure acts as a statutory boundary.

Below it → no franchise tax liability.

Above it → full margin computation and rate application required.

The technical complexity lies not in the number itself, but in properly determining annualized total revenue under Texas law.

With the liability threshold clarified, the remaining compliance focus shifts to procedural execution.

Even when liability is zero, Texas imposes defined reporting structures and statutory due dates.

That brings us to the next operational layer: What franchise tax reports must be filed each year, and what deadlines apply for 2025 and 2026?

Meet Texas Franchise Tax Filing Requirements and Deadlines (For 2025 and 2026)

Texas franchise tax reports are due annually on May 15. If May 15 falls on a weekend or holiday, the deadline moves to the next business day. [Source]

File the Correct Franchise Tax Report Type

Depending on eligibility and statutory classification, entities must file one of the following:

- Franchise Tax Long Form

- EZ Computation Report

- Public Information Report (PIR)

- Ownership Information Report (OIR)

[Click here to download all of the above forms]

Each report serves a specific compliance function:

| Report | Purpose |

|---|---|

| Long Form | Full margin computation and tax calculation |

| EZ Computation | Simplified calculation for eligible entities |

| PIR | Disclosure of officers, directors, and registered agent information |

| OIR | Ownership disclosure for certain non-corporate entities |

Form selection depends on statutory eligibility and entity type.

Request Extensions and Meet Payment Safe Harbors

An extension is available if the entity:

- File the extension request by May 15, and

- Pays at least 90% of the current year’s tax due, or

- Pays 100% of the prior year’s tax due by May 15.

If these conditions are satisfied, the filing deadline extends to November 15. [Source]

An extension applies to the time to file, not the time to pay.

If the required payment threshold is not met by May 15, penalties and interest may apply even if an extension request was submitted.

Calculate Penalties and Interest Accurately

Texas imposes statutory penalties if the franchise tax is not paid by the due date:

- 5% penalty if the tax is unpaid after the due date

- An additional 5% penalty (total 10%) if unpaid for more than 30 days after the due date

- Interest begins accruing 61 days after the due date

These penalties apply to unpaid tax amounts. Administrative actions may occur separately if required reports are not filed.

Implement an Annual Compliance Workflow

Each reporting year, firms should confirm:

- Correct report type selection

- May 15 deadline tracking

- Extension eligibility and safe harbor payment compliance

- Timely electronic submission via Webfile

- Confirmation of report acceptance

The annual workflow clarifies how franchise tax reports are submitted and managed each year.

But compliance doesn’t begin with forms—it begins with structure.

The entity’s legal classification and operational footprint determine how Texas franchise tax rules apply in the first place. That structural layer is especially important for LLCs, S corporations, and businesses formed outside Texas.

So before turning to risk management, it’s important to examine: How does the Texas franchise tax apply differently to LLCs, S-corps, and out-of-state businesses?

Apply Texas Franchise Tax Rules to LLCs, S Corporations, and Out-of-State Entities

Texas franchise tax applies at the entity level, meaning LLCs, S-corporations, C-corporations, partnerships, and other taxable entities are evaluated independently under Texas Tax Code Chapter 171.

Texas does not treat S corporations or LLCs as exempt simply because they are pass-through entities for federal income tax purposes.

Apply Entity-Level Taxation Principles

Texas franchise tax is imposed on the legal entity itself, not on the individual owners or shareholders.

This means:

- An LLC is evaluated separately from its members

- An S-corporation is evaluated separately from its shareholders

- Each registered entity in a group structure may have its own reporting obligation

Federal tax status does not eliminate Texas franchise tax exposure.

Evaluate LLC and S Corporation Reporting Obligations

For LLCs and S-corps, the compliance focus is not pass-through taxation—it is:

- Revenue attribution

- Entity-level reporting

- Ownership disclosure requirements

- Multientity structuring decisions

Texas does not follow federal “pass-through equals no entity tax” logic.

This becomes especially relevant when comparing how other high-complexity states, such as California and New York Tax Planning frameworks, approach entity taxation and multilevel compliance structures.

Determine Filing Duties for Out-of-State Businesses

Possibly. Formation outside Texas does not automatically eliminate franchise tax exposure. If the business is conducting activities that fall within Texas statutory reach, the entity must evaluate franchise tax obligations under Texas law.

Practical Compliance Reality

Out-of-state exposure most often arises when businesses:

- Expand sales operations into Texas

- Establish physical presence

- Maintain property or employees in the state

- Participate in revenue-generating activities connected to Texas

Texas evaluates business activity—not incorporation location.

Identify Structural Risk Areas in Multientity Groups

| Entity Structure | Why It Matters for Texas Franchise Tax |

|---|---|

| Multi-entity LLC groups | Each entity may require separate analysis |

| S-corp conversions | Structural changes can affect reporting treatment |

| Holding company + operating subsidiary | Texas exposure may differ by entity |

| Out-of-state expansion | Texas compliance may begin before internal systems adjust |

Understanding how Texas applies franchise tax at the entity level is only part of the picture. For businesses operating in more than one state, the next technical question becomes allocation: How does Texas determine what portion of multistate revenue is attributable to Texas for franchise tax purposes?

Apportion Multistate Revenue Under Texas Franchise Tax Rules

Texas applies a single-factor receipts apportionment formula under Texas Tax Code §171.106. Only gross receipts sourced to Texas are included in the Texas franchise tax base.

Core Rule: Receipts-Based Allocation

Texas does not consider property or payroll in its apportionment formula. Instead, the focus is exclusively on gross receipts attributable to Texas.

The statutory framework distinguishes sourcing based on the type of revenue generated.

Revenue Sourcing Categories Under §171.106

| Revenue Type | Sourcing Standard |

|---|---|

| Tangible personal property | Sourced in Texas if delivered or shipped to a Texas location |

| Services | Sourced to Texas if the service is performed in Texas |

| Use of property | Sourced based on the location of use |

| Other business receipts | Allocated according to statutory classification rules |

Each category must be analyzed under the statutory definition of where the activity occurs, not where the customer is headquartered.

Document Multistate Apportionment Assumptions

Apportionment depends on:

- The nature of the transaction

- Where the income-producing activity occurs

- The statutory sourcing rule applicable to that revenue category

The statute governs sourcing methodology—not internal accounting treatment.

For entities operating across state lines, the Texas apportionment factor directly affects the portion of business activity attributed to Texas under §171.106.

Accurate sourcing requires consistent categorization and statutory interpretation.

With entity applicability, calculation structure, liability threshold, filing procedures, and apportionment rules now clarified, the remaining exposure lies in execution.

Compliance breakdowns typically occur when one of these structural components is misapplied. Let’s now identify:

How to Avoid Common Texas Franchise Tax Compliance Errors?

- Misclassifying the business as retail or wholesale without meeting the Comptroller’s primary activity criteria.

- Applying the wrong deduction method without evaluating which statutory option produces the lowest taxable margin under Texas Tax Code §171.101.

- Failing to annualize total revenue correctly when the reporting period is shorter than 12 months.

- Treating the $2.47 million no-tax-due threshold as a complete filing exemption instead of a liability determination.

- Submitting the wrong report type (Long Form vs EZ Computation) due to a misunderstanding of eligibility requirements.

- Filing an extension without meeting the required 90% current-year or 100% prior-year payment threshold.

- Misapplying receipts sourcing rules under §171.106, especially for service revenue performed partially inside and outside Texas.

- Inconsistently allocating revenue across related entities in a multi-entity structure.

- Overlooking franchise tax exposure when restructuring entity form (LLC to corporation or vice versa).

- Assuming out-of-state formation eliminates Texas reporting responsibility.

- Failing to review ownership disclosure accuracy in PIR or OIR filings.

- Ignoring short-period reporting adjustments after mergers, acquisitions, or dissolutions.

- Relying solely on federal tax treatment when analyzing Texas franchise tax obligations.

Understanding these recurring errors is critical because Texas franchise tax compliance is formula-driven and statute-based. Even small classification or sourcing mistakes can affect reporting accuracy.

Simplify Texas Franchise Tax with Structured Intelligence

Texas franchise tax compliance is not complex because the law is unclear — it becomes complex when entity structure, revenue sourcing, and multistate exposure intersect under real filing deadlines.

For CPA firms, the difference between risk and confidence is structured execution. CPA Pilot helps firms centralize state tax research, streamline statutory interpretation, and reduce repetitive manual review across Texas franchise tax workflows.

If Texas compliance is consuming valuable review time in your firm, it’s time to systematize it.

👉 Schedule your CPA Pilot demo and see how AI-assisted tax research can support your Texas franchise tax strategy.

FAQs About the Texas Franchise Tax Compliance

Does the Texas franchise tax apply to single-member LLCs?

A single-member LLC is subject to the Texas franchise tax if it is a legally formed entity and conducts business in Texas. Texas imposes franchise tax at the entity level, regardless of federal disregarded entity status.

Is the Texas franchise tax deductible for federal income tax purposes?

Texas franchise tax is generally deductible as a state tax expense for federal income tax purposes if it qualifies as an ordinary and necessary business expense under IRC §162.

Does a dissolved entity still owe Texas franchise tax?

A dissolved entity must file a final Texas franchise tax report covering the period up to termination. The entity remains responsible for compliance until officially closed with the Texas Comptroller.

Are nonprofits required to file Texas franchise tax reports?

A nonprofit organization must obtain tax-exempt status from the Texas Comptroller to be exempt from franchise tax. Without formal exemption recognition, filing requirements may still apply.

How does the Texas franchise tax apply to combined reporting groups?

Texas requires affiliated entities engaged in a unitary business to file a combined franchise tax report. The combined group calculates taxable margin collectively under Texas Tax Code §171.1014.

Is Florida more tax-efficient than Texas for business owners relocating?

Both states avoid personal income tax, but Texas applies a franchise tax on business margin. In contrast, Florida tax planning strategies focus on corporate and sales tax exposure without a margin-based franchise system. Entity type determines comparative benefit.

![Florida Tax Planning – Residency, IRS & Multi-State Risk [2026 Guide]](https://www.cpapilot.com/blog/wp-content/uploads/2026/02/Florida-Tax-Planning.png)