How to Simplify E-Commerce Tax Planning with AI?

[Last Updated on 2 months ago]

Have you ever wondered why e‑commerce businesses struggle more with tax planning today than ever before?

As online shopping keeps growing fast, global e-commerce sales are expected to rise from $6.42 trillion in 2025 to $7.89 trillion by 2028. With this growth, dealing with different state and product tax rules isn’t just paperwork anymore — it’s a key part of business strategy.

In the United States alone, differences in state sales tax rates — ranging from 0 % in states like Delaware and Oregon to well over 7 % in others like California — and evolving economic nexus thresholds complicate planning and compliance for multi‑state sellers.

TL;DR: AI Makes E-Commerce Tax Planning Smarter

AI transforms tax from a compliance headache into a growth strategy. Here’s what matters:

- Predicts sales tax nexus before you trigger thresholds

- Automates tax rule application by state, product, and sales channel

- Forecasts liabilities across jurisdictions using real-time data

- Improves cash flow planning by estimating remittance early

- Reduces audit risks through accurate classification and alerts

- Empowers tax pros with dashboards, scenario tools, and multi-client views

- CPA Pilot centralizes these features into one AI-driven platform

Traditional manual approaches struggle to keep pace with frequent tax law changes, especially after OBBBA varied taxability rules across product lines, and the risk of costly audits or penalties.

Enter AI Tax Assistants, which uses predictive analytics, automation, and machine learning to help e‑commerce companies forecast liabilities, optimize compliance workflows, and make smarter decisions about growth‑driven tax strategy.

This blog will guide you through how AI transforms e‑commerce tax planning into a proactive, scalable advantage — with insights that matter to both finance teams and growth‑oriented business owners.

Table of Contents

- Why is E-Commerce Tax Planning Getting More Complex?

- From Compliance to Strategy: What Tax Planning Really Means

- How AI Transforms E-Commerce Tax Strategy?

- Step-by-Step Guide to Implementing AI for eCommerce Tax Planning

- Benefits of AI Tax Planning for E-Commerce Brands

- How CPA Pilot Helps Tax Professionals Navigate E‑Commerce Tax Challenges?

- From Tax Burden to Competitive Advantage

- E-Commerce Tax Planning with AI FAQs

Why is E-Commerce Tax Planning Getting More Complex?

For e‑commerce businesses, tax planning is not just about filing forms — it has become a strategic and operational challenge that becomes complicated each year.

In the U.S, 45 states and the District of Columbia impose sales taxes on most goods and services, and each jurisdiction sets its own rates, rules, and exemptions.

Some states even allow local cities and counties to add their own taxes on top of the statewide rate, resulting in a patchwork of rules that can vary drastically from one location to the next. Source

One of the biggest contributors to this complexity is the concept of economic nexus, which was established nationwide after the 2018 South Dakota v. Wayfair Supreme Court decision.

Instead of requiring a physical presence (like a store or warehouse), many states now require an out‑of‑state seller to collect and remit sales tax once the business hits certain thresholds of sales or transaction counts in that state. Source

As of mid-2025, at least 15 states have eliminated the old $200-transaction threshold, meaning businesses may now trigger sales tax obligations based solely on sales value. Economic nexus thresholds continue to vary widely across states. Source

This inconsistency forces online sellers to track detailed activity in every market they serve, and missing a threshold can mean unexpected back taxes, interest, and even audits.

Meanwhile, taxability rules — whether a product or service is taxable at all differ by state and by product category (for example, digital goods vs. tangible goods), adding another layer of nuance that e‑commerce sellers must manage. Source

Combined with local tax jurisdictions and variable filing frequencies, this creates an administrative burden that can easily overwhelm finance teams, particularly as the number of sales channels increases.

With so many moving parts — from shifting nexus laws to inconsistent taxability rules — it’s easy for tax compliance to feel like a never-ending checklist. But the businesses that thrive aren’t just reacting to tax changes; they’re planning around them. That shift — from reactive compliance to proactive, data-driven strategy is where the true opportunity lies for modern e-commerce operations.

From Compliance to Strategy: What Tax Planning Really Means

Most e-commerce businesses treat tax as something to “deal with later” — a task to complete at the end of the month, quarter, or year.

But in today’s online marketplace, proactive tax planning can directly influence where you expand, how you price, and even what products you sell.

Instead of scrambling to stay compliant, strategic tax planning means

- Forecasting your future liabilities,

- Understanding where you’re likely to trigger nexus next, and

- Designing your operations to minimize tax friction.

For example, if a company knows it’s nearing a threshold in a high-tax state, it can assess whether entering that market aligns with profit margins or if delaying expansion makes financial sense.

It also means aligning product development and bundling strategies with tax logic — like structuring kits or subscriptions in a way that’s more favorable under tax law. Tax planning at this level requires real-time access to sales data, jurisdiction rules, and forecasting tools — which is exactly where artificial intelligence comes into play.

How AI Transforms E-Commerce Tax Strategy?

AI is redefining how e-commerce businesses approach tax planning, shifting it from static analysis to a continuous, intelligent process that adapts as you sell.

Unlike traditional tools, AI platforms process thousands of tax variables — from SKU-level product attributes to zip-code-specific rates, and synthesize them into actionable insights.

1. Predictive Nexus Modeling

AI systems analyze your historical sales data, order velocity, and geographic spread to predict when you’re likely to trigger economic nexus in new states — often before you do. This gives finance teams a head start on registration, compliance planning, and even product pricing adjustments to account for tax impact.

2. Tax-Sensitive SKU Forecasting

Modern AI tools use natural language processing (NLP) to scan product catalogs, flag high-risk classifications, and simulate how a product might be taxed in various jurisdictions. This helps avoid misclassification and eliminates guesswork when expanding product lines — a common tax planning blind spot.

3. Scenario-Based Tax Strategy

AI doesn’t just react — it simulates. Need to know how launching a new digital subscription in five states will affect your overall tax liability? AI can simulate that scenario using real-time rate data, current filing schedules, and even anticipated law changes. It gives CFOs the power to compare multiple tax outcomes before making a move.

4. Real-Time Alerts and Strategic Tax Recommendations

Using real-time data feeds, AI systems issue proactive alerts — not just about compliance risks, but about strategic shifts in tax law that could influence margin or market entry. This transforms tax from a cost center into a competitive intelligence engine.

While AI offers powerful tools for tax forecasting and strategy, its value depends entirely on how well it’s implemented.

Turning potential into performance means knowing where to start, how to integrate, and what to measure, especially in a digital environment where tax obligations can shift overnight.

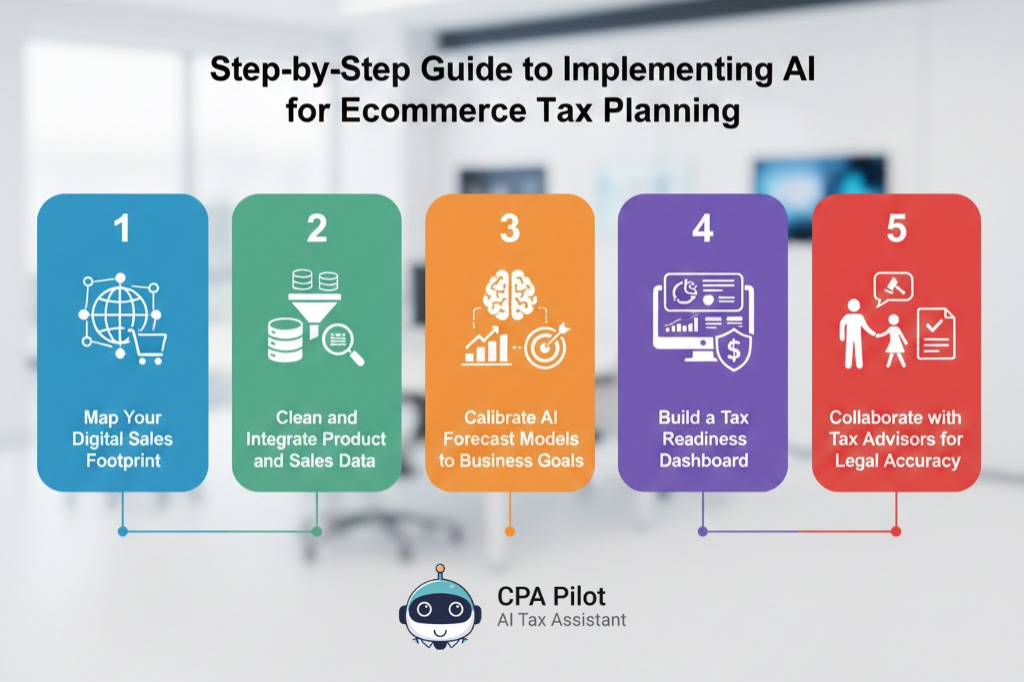

Step-by-Step Guide to Implementing AI for eCommerce Tax Planning

Deploying AI for e-commerce tax planning is not just a tech upgrade — it’s a process transformation.

Businesses need to align their internal data infrastructure, platform integrations, and tax logic with clear execution steps to get the most out of AI-driven planning.

1. Map Your Digital Sales Footprint

Start by identifying where you sell, through which platforms, and what your current tax collection status is in each jurisdiction.

This includes

- Marketplaces,

- Direct sales channels, and

- Subscription platforms.

The accuracy of your AI system relies heavily on a clear sales nexus map.

2. Clean and Integrate Product and Sales Data

AI engines require structured, reliable data. It means standardizing product SKUs, categorizing items with clear tax logic, and linking your Shopify, Amazon, or WooCommerce platforms with your tax system.

Poor data = Poor Planning - No matter how advanced the AI.

3. Calibrate AI Forecast Models to Business Goals

Modern AI tools offer settings to fine-tune risk sensitivity, alert thresholds, and simulation scope. Tailoring these inputs to your business goals — whether it’s margin protection, expansion readiness, or audit avoidance – makes the system more actionable.

4. Build a Tax Readiness Dashboard

Consolidate real-time metrics into a central dashboard that highlights

- Potential nexus triggers,

- Product risks, and

- Upcoming filing deadlines.

This gives tax teams and decision-makers a shared visual layer to monitor tax exposure as they scale.

5. Collaborate with Tax Advisors for Legal Accuracy

AI doesn’t replace human expertise — it amplifies it. Working with tax professionals ensures that the outputs of your AI system are validated, legally sound, and tailored to your specific operating model.

Once AI systems are properly integrated into your tax planning workflow, the benefits start compounding. But beyond the operational gains, AI offers strategic advantages that fundamentally shift how e-commerce businesses grow, plan, and stay ahead of tax risk.

Benefits of AI Tax Planning for E-Commerce Brands

For e-commerce brands operating across multiple jurisdictions, the strategic benefits of AI tax planning go far beyond error reduction or compliance automation; they reshape how the business thinks about expansion, pricing, and profitability.

1. Improved Tax Visibility Across Markets

AI gives business leaders real-time insight into potential tax exposure across current and target markets. This helps CFOs and operations teams evaluate market entry risks, optimize inventory placement, and even time product launches based on jurisdictional tax windows.

2. Smarter Cash Flow Forecasting

By continuously tracking sales activity and tax liabilities by region, AI systems allow businesses to project cash outflows related to tax remittance more accurately. This minimizes surprises and supports smarter reinvestment strategies.

3. Margin Protection Through Tax-Smart Structuring

Understanding how tax impacts pricing at the SKU or category level helps businesses structure offers (bundles, tiered pricing, or service/product combinations) in ways that preserve margins across different states.

4. Early Intelligence on Regulatory Shifts

AI tools can spot regulatory shifts or pattern changes in state-level enforcement that may affect your competitors, giving you a first-mover advantage in compliance strategy or market shifts.

5. Risk-Weighted Expansion Decisions g

AI tax dashboards allow leadership teams to weigh tax consequences alongside revenue potential, helping avoid expansion into high-risk zones without mitigation strategies in place.

- Centralizes Multi-State Tax Intelligence

CPA Pilot answers complex federal and all‑50‑state tax questions in one AI workspace, helping advisors handle multi-state and e‑commerce issues without juggling multiple research tools.

- Enhances Advisory With Projections

Its AI-driven projections and scenario modeling let CPAs test how state moves, income changes, or new markets affect clients’ overall tax position, supporting more proactive, multi-state advisory.

- Automates Tax Analysis Work

The platform reads returns and P&Ls, extracts key data, and structures it for tax software, reducing manual review and freeing capacity to analyze complex multi-jurisdiction situations for online sellers.

- Improves Client-Ready Communication

CPA Pilot drafts clear client emails and summaries that explain multi-state and projection outcomes, so firms can quickly turn technical analysis into e‑commerce–friendly guidance.

- Scales Workflows for Advisory Firms

By combining research, projections, document review, and client communication in one AI assistant, firms can apply the same streamlined process whether supporting a few or hundreds of multi-state e‑commerce clients.

From Tax Burden to Competitive Advantage

Tax shouldn’t be a hurdle to growth — it should be a lever for smarter, faster decisions. With AI, e-commerce businesses can turn

- Reactive compliance into proactive planning, and

- Transforming tax from a backend burden into a strategic advantage.

From forecasting nexus before it strikes to simulating product taxability in new markets, AI gives you clarity, speed, and confidence — at every stage of your business journey.

🚀 Ready to make your tax strategy as agile as your storefront? Book a CPA Pilot demo to explore an AI-powered tax assistant tailored to your eCommerce business model.

E-Commerce Tax Planning with AI FAQs

Is CPA Pilot suitable for accountants managing multiple clients?

Yes. CPA Pilot is built for CPAs, EAs, and tax firms and gives them a centralized AI workspace for tax research, projections, document review, and client communication across engagements, but it is not a full practice‑management or sales‑tax compliance dashboard.

What’s the cost structure of CPA Pilot for small businesses?

CPA Pilot uses a per‑user subscription model with flexible monthly and annual plans starting at $19 per month per user, making it accessible to solo practitioners and scalable for multi‑staff firms.

Can CPA Pilot manage international tax obligations like VAT or GST?

CPA Pilot supports U.S. sales tax compliance but does not currently handle VAT or GST, though future updates may expand international tax capabilities. Users handling global sales should use it alongside cross-border tax tools.

How secure is client data in CPA Pilot’s tax planning system?

CPA Pilot emphasizes enterprise‑grade security with SOC 2–aligned data management, end‑to‑end encryption, role‑based access, and isolated environments per firm, designed to protect sensitive tax data and maintain audit‑ready trails.

Does CPA Pilot support filing or just forecasting and planning?

CPA Pilot focuses on research, projections, return review, and client‑ready outputs rather than direct e‑filing, so firms typically pair it with their existing tax preparation and filing software.

What types of alerts does CPA Pilot send for tax compliance?

CPA Pilot provides predictive compliance insights and projections that help firms reduce penalty notices and missed safe harbors, and it supports multi‑state and SALT tracking in some workflows, but its public materials describe these more as predictive compliance features than as a full dedicated deadline/nexus alerting hub.

![Last-Minute Mid-Year & Year-End Tax Planning Using AI – [2026 GUIDE]](https://www.cpapilot.com/blog/wp-content/uploads/2025/09/Last-Minute-Mid-Year-Year-End-Tax-Planning-Using-AI.png)