Turbocharge Your Tax Practice

with AI-Powered Automation

CPA Pilot helps tax professionals save time, automate tasks, and grow their practice effortlessly. Join 1,000+ accountants transforming their workflow with AI-powered precision.

Julie, UT

I’m using CPA Pilot to ensure payroll and 1099 compliance.

Mike, NY

I’ve tested CPA Pilot with 15-20 questions and it’s been spot on.

Claire, MI

This is great! It’s much more accurate than the other chat tools.

Randall, NY

Thanks for building this! It’s been much needed

Forrest, NY

Client Helper will reduce client requests by 50%

Anil, CA

CPA Pilot is amazing!

Steve, NJ

I will talk to anybody to vouch for the quality of CPA Pilot

Eduard, IL

At this price this is a no brainer

Larry, WA

I’m going to be a customer for life…

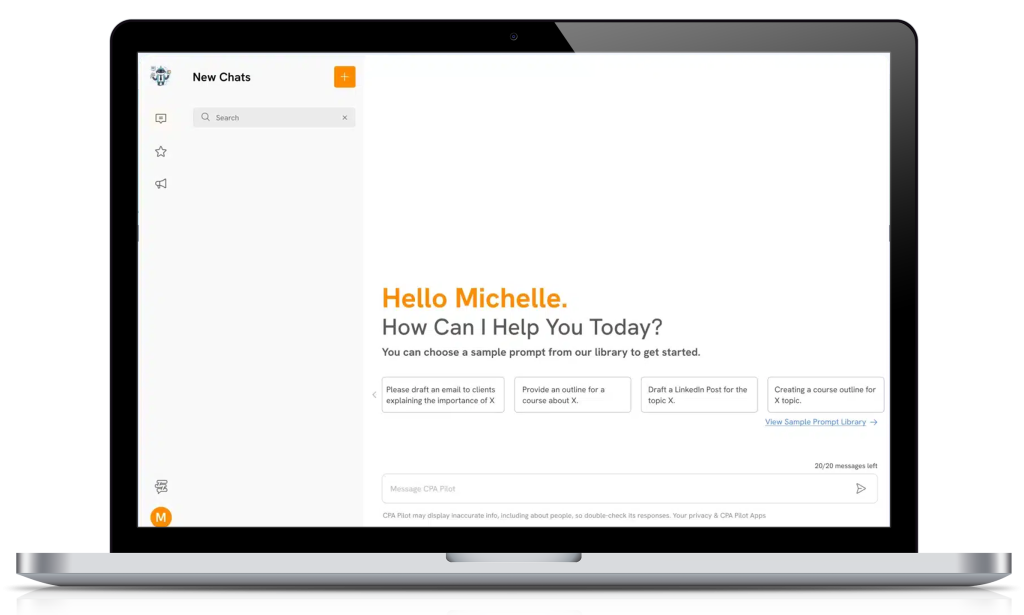

What is CPA Pilot?

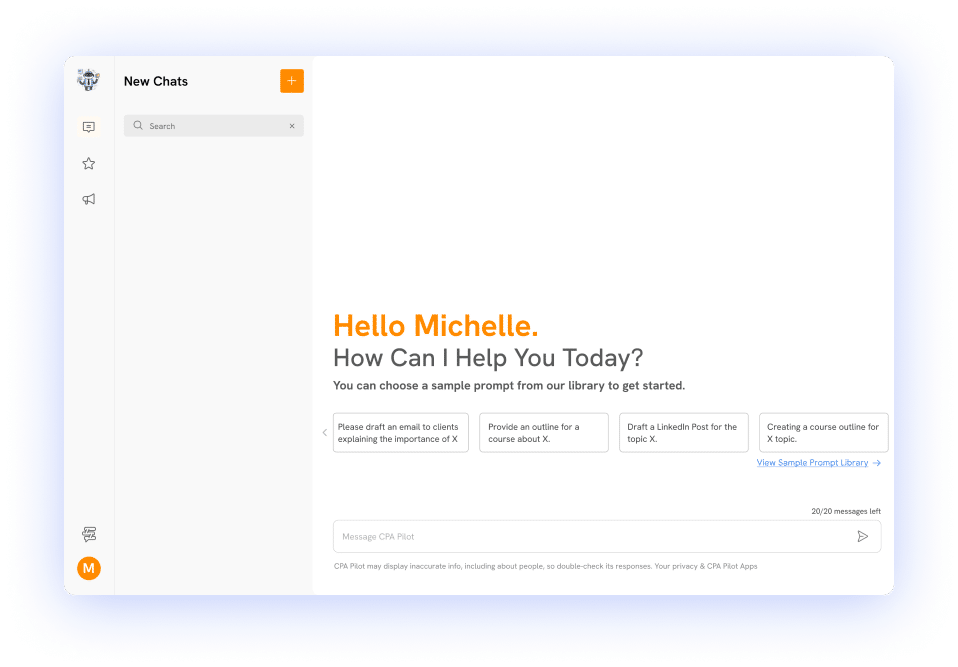

CPA Pilot is an AI-powered assistant built specifically for tax professionals. It streamlines complex tax research, automates client communication, creates marketing content, and supports staff training—helping you save time, reduce stress, and grow your practice effortlessly. Whether you’re responding to clients, managing your workload, or attracting new business, CPA Pilot makes it easy to work smarter, not harder.

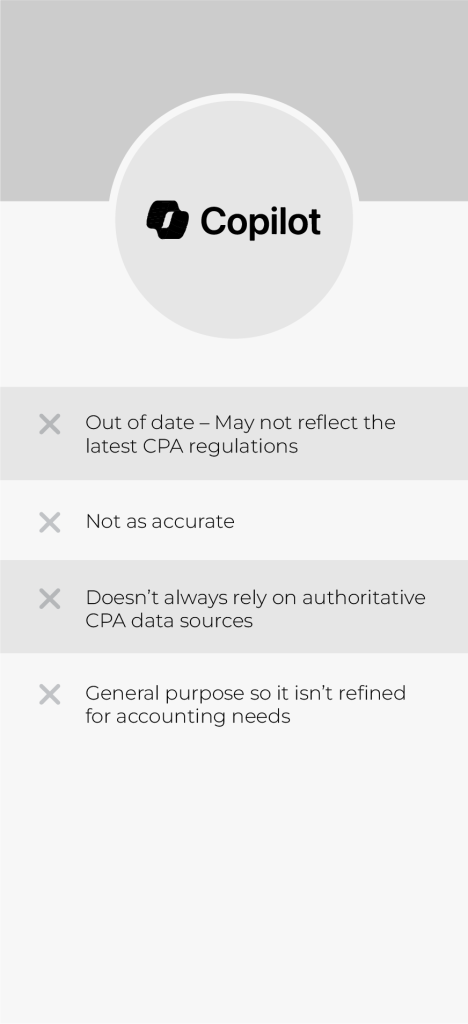

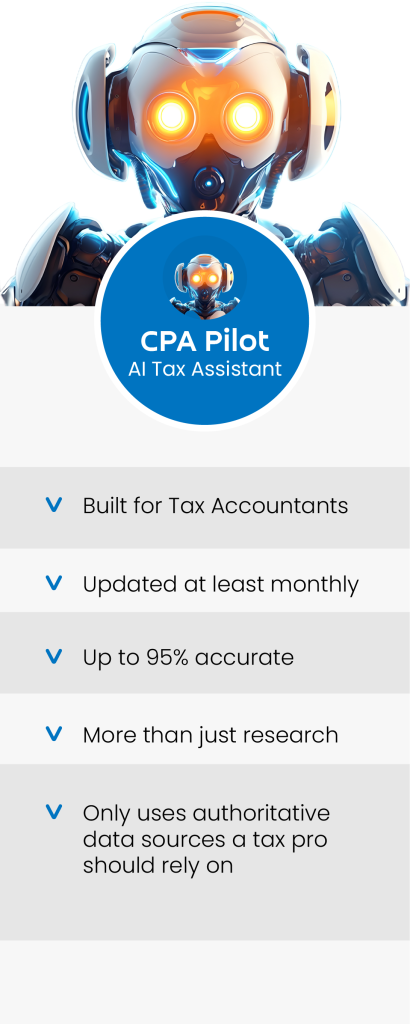

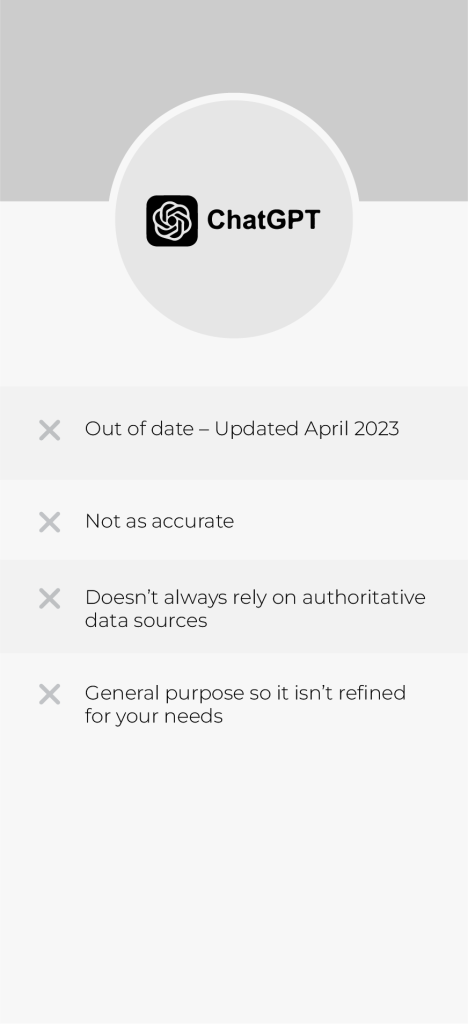

US VS Them

CPA Pilot is better than ChatGPT for tax accountants and provides answers “as good as a tax attorney”.

~

“I didn’t like the format of the answers TaxGPT provides. It requires a full year subscription and expensive for my whole team to use.”

~

“BlueJ Tax only provides tax research and requires you to keep digging to get the answer. Meant for someone who enjoys doing tax research not for a quick answer.”

~

CPA Pilot provides answers quickly, nicely formatted responses without much prompt engineering. It also has chatbots that specialize in your tax software. This allows you to get step by step instructions and automate work by asking CPA Pilot to create import files.

With our usage based plans, you can onboard your entire team for the cost of 1 license of any competitor.

Feature/Aspect

CPA Pilot

ChatGPT (General)

FlyFin

TaxGPT

ZeroTax AI

Taxly.ai

TruePrep

Blue J Tax

6000+

Tax Professionals

200,000+

Questions Answered

Partnerships with Industry Leading Organizations

EAs, CPAs and Tax Attorneys love us as much as we love them. See why:

5 Experts in 1 Chatbot

- Tax Research & Strategy

- Client Communications (emails)

- Marketing (in any language)

- Staff Training

- Tax Software Support and Automation

- Secure Tax Document Upload and Analysis Coming 6/15/25!

People trust us

Trusted by majority of Accountants to be their AI Tax Assistant

Bill Opaska

Jan 24, 2024

AI for the small practitioner CPA & EA Firm

CPA Pilot has made our small CPA – EA better by providing information vital to our clients at our finger tips. We are able to draft instructional letters and emails just by asking questions. The time we are saving is enormous. This is definitely what the small practitioner needs.

Daniel Skipworth

Jan 25, 2024

CPA Pilot is invaluable!! 💣⚡🚀

CPA pilot has been an invaluable tool in helping jumpstart various projects and a quick reference tool available on the fly during a call.

TJ

Jan 24, 2024

We have saved some much time

We have saved some much time. We are so thankful for CPA Pilot!! Thank you.

Sheila

Jan 24, 2024

Best program ever!!

Best program ever!!! I don’t know how I ever lived without it.

Features

Why choose CPA Pilot?

Time Efficiency

Automate repetitive tasks like client emails, tax research, and marketing, saving hours every week to focus on high-value work.

AI-Powered Accuracy

Leverage cutting-edge AI with up to 95% accuracy, ensuring reliable tax insights and professional communication.

Staff Training Made Easy

Provide instant training on tax topics and software, helping your team stay informed and productive without external resources.

Marketing Automation

Effortlessly create niche-targeted marketing content to attract and retain the right clients for your practice.

Designed for the Seasonal Tax Business

Plans start at just $20/month/user with rollover messages and annual plan perks to keep your costs low year-round. For just $499/year, you are given 720 messages with CPA Pilot 60 to use them whenever you’d like and share with your entire team. All message based plans also accrue unused messages month to month and never expire as long as you have an active subscription.

CPA Pilot 20

Dip your toe into the water and see how much better your firm is with CPA Pilot

$19/Per Month

- 20 messages/month

- 7-Day Free Trial with 20 messages

- Unlimited Devices

- Rollover Messages

- Annual Plan: 240 Messages Upfront

CPA Pilot 60

Most popluar plan. Scratching the surface of what CPA Pilot can do.

You want to use CPA Pilot to for more than research. From email replies to automating data entry for tax returns.

$49/Per Month

- 60 messages/month

- 7-Day Free Trial with 20 messages

- Unlimited Devices

- Rollover Messages

- Annual Plan: 720 Messages Upfront

CPA Pilot 150

For power users and small teams sharing an account. Yes we are okay with that!

$119/Per Month

- 150 messages/month

- 7-Day Free Trial with 20 messages

- Unlimited Devices

- Rollover Messages

- Annual Plan: 1800 Messages Upfront

CPA Pilot Unlimited

Because you don't like restrictions. Meant for 1 user.

$199/Per Month

- Unlimited messages For Power Users

- 7-Day Free Trial with 20 messages

- Limited to 1 user and 3 Devices (No account sharing)

CPA Pilot 20

Great for a solo tax practice if you are only using it for tax research.

Get 240 messages upfront so you can use them when you want.

$200$240

/Per Year

- 20 messages/month

- 7-Day Free Trial with 20 messages

- Unlimited Devices

- Rollover Messages

- Annual Plan: 240 Messages Upfront

CPA Pilot 60

Get 720 messages upfront and use CPA Pilot to automate daily tasks from email replies to tax return data entry

$499$588

/Per Year

- 60 messages/month

- 7-Day Free Trial with 20 messages

- Unlimited Devices

- Rollover Messages

- Annual Plan: 720 Messages Upfront

CPA Pilot 150

Great for Super Users and teams who want to share an account.

Get 1800 conversations upfront.

$1199$1428

/Per Year

- 150 messages/month

- 7-Day Free Trial with 20 messages

- Unlimited Devices

- Rollover Messages

- Annual Plan: 1800 Messages Upfront

CPA Pilot Unlimited

You want to leave CPA Pilot open all day and use it as your right hand and maybe be your nerdy tax best friend that you've been looking for all your life.

$1999$2388

/Per Year

- Unlimited Messages for Power Users

- 7-Day Free Trial with 20 messages

- Limited to 1 user and 3 Devices (No account sharing)

Frequently Asked Questions

Benefits and features

Here’s why you need it:

Do work in seconds that used to take hours

Navigate tax complexities with instant access to IRS and State forms, publications, articles, and tax code. We cite the sources used in each answer so you can have greater confidence in the answer and verify it more easily.Instant Technical Support

Get immediate help with your tax software from CPA Pilot instead of calling customer support or spending hours looking for the answer online.Powered by GPT-4o

Leverages the smartest AI, for the most insightful tax guidance beyond basic offerings.Outperform ChatGPT for Tax Professionals

When tested by users CPA Pilot got 99% and ChatGPT got 55% answer correct.Tailored for Tax Experts

Tackle complex scenarios, conduct nuanced research, and generate custom tax strategies. Save Time and BoostClient Satisfaction

Automate time-consuming tasks like tax research, client communication, and content creation.Streamline Client Communication

Craft detailed emails and explanations in moments, enhancing client satisfaction.Boost Your Marketing

Easily create engaging newsletters and social media content for your tax practice.Available 24/7

Get instant answers and assistance whenever you need it.

What sources does CPA Pilot use?

- IRS Website

- Federal Tax Code

- State Tax Code for all 50 states

- IRS Form Instructions and Publications

- Forms, Instructions and Publications for all 50 states

- Support Documentation for:

- Drake

- Lacerte

- UltraTax

- ProSeries

- ProConnect

- QuickBooks Online

For instant access to technical support so you don’t have to search online or call customer support.

Is CPA Pilot ever wrong?

All current AI tools using Large Language Models, like ChatGPT hallucinate meaning they will get answers wrong sometimes. Even the best AI have a high error rate. We go above and beyond to minimize these errors.

A user of CPA Pilot tested CPA Pilot and ChatGPT on questions from a CPE course. ChatGPT got 55% correct and CPA Pilot got 98%.

We tell our AI to only rely on authoritative information to provide you the best possible answer.

On rare occasion, CPA Pilot may give you a wrong answer, because:

- We may not have a source that provides guidance on the situation you are researching. If this is the case, please email us at [email protected] so we can add the appropriate source.

- CPA Pilot misunderstood your questions or request. In this case you can clarify your question or tell it the answer is wrong.

- CPA Pilot may pull some information from the incorrect year. You will see the source documents are from a different year. You can tell it to pull information from the year related to the situation you are investigating.

- CPA Pilot sometimes has trouble pulling numbers from documents. We are working to make this better. It is much better at helping you interpret rules than it is for looking deduction amount limits.

What state tax codes are included in CPA Pilot?

CPA Pilot has access to the tax code for all 50 states and most of the webpages, documents, forms, instructions and publications for all 50 states and updated on a regular basis.

What if I run out of questions before ?

You can purchase additional questions if you run out of them before your subscription renews. All messages never expire when your subscription renews as long as you have an active subscription.