Which is the Best CoCounsel Tax Alternative for CPAs? – CPA Pilot

[Last Updated on 2 months ago]

If your bottleneck is finishing work—client emails, IRS/state notice drafts, and modeled choices— CPA Pilot is the best alternative to CoCounsel Tax because it turns research into sendable, cited deliverables with numbers and next steps your whole team can use.

TL;DR — Best CoCounsel Tax Alternative

If you need to finish work—not just find authority—CPA Pilot is the best alternative to CoCounsel Tax (Thomson Reuters).

- Focus: CoCounsel is research-first (authority discovery, memos). CPA Pilot is a practice assistant that turns research into client-ready emails, IRS notice drafts, and numeric scenarios.

- Last-mile outputs: CPA Pilot delivers sendable, cited drafts plus SOPs/checklists so juniors ship partner-level work with one pass.

- Scenarios that matter: Multi-state moves, S-Corp reasonable comp, FTC limits, §1031 vs installment, and equity comp—CPA Pilot adds side-by-side numbers and clear next steps.

- Tax-software follow-through: Built-in guidance for Drake, Lacerte, UltraTax, ProSeries, ProConnect, QBO so the plan actually gets implemented.

- Pricing at a glance: CPA Pilot = public, solo-friendly pricing starting at $19/user/month; CoCounsel = no public pricing (sales-led quote).

- Who should choose what:

- Pick CoCounsel if your bottleneck is finding precedent and writing internal memos.

- Pick CPA Pilot if your bottleneck is finishing deliverables (emails, notices, modeled choices) and scaling output across the team.

Table of Contents

- Why CPAs are searching for a CoCounsel Tax alternative? (Pain Points)

- What is CoCounsel Tax? Focus & Fit

- CPA Pilot vs CoCounsel Tax — Feature-by-Feature Comparison

- Pricing Comparison — CoCounsel Tax vs CPA Pilot

- Real-World Matchups — CoCounsel Tax vs CPA Pilot

- Which One Should You Use – CoCounsel Tax or CPA Pilot?

- FAQs – CoCounsel Tax Alternative

- Conclusion & Next Steps

Why CPAs are searching for a CoCounsel Tax alternative? (Pain Points)

- The “last mile” gap: Research tools help you find authority, but partners still rewrite outputs into client-ready emails, memos, and notice responses.

- Throughput over theory: Clients approve dollars and timelines, not just citations—firms need side-by-side scenarios (e.g., reasonable comp, 1031 vs installment, FTC limits, part-year residency).

- Communication overload: 20+ “quick question” emails a day require defensible, plain-English answers with references.

- Notice season stress: Gathering facts, citing authority, and drafting the reply eats senior time during peak weeks.

- Junior ramp-up: New hires need SOPs, checklists, and worked examples to produce partner-level drafts without shadowing.

- Software hand-off: Even the best plan stalls if staff don’t know where to click in Drake, Lacerte, UltraTax, ProSeries, ProConnect, or QBO.

- Budget clarity: Solo and small firms want transparent, seat-based pricing they can pilot quickly—without enterprise negotiations.

What “best alternative for CoCounsel” really means? (selection criteria)

- Research → deliverable: Outputs you can send—cited, structured, and client-ready.

- Numbers first: Built-in modeling so trade-offs are quantified, not implied.

- Team leverage: SOPs/checklists that let juniors ship drafts in one pass.

- Implementation help: Step-by-step software how-tos to close the loop.

- Accessible pricing: Start small, scale seats, keep spend predictable.

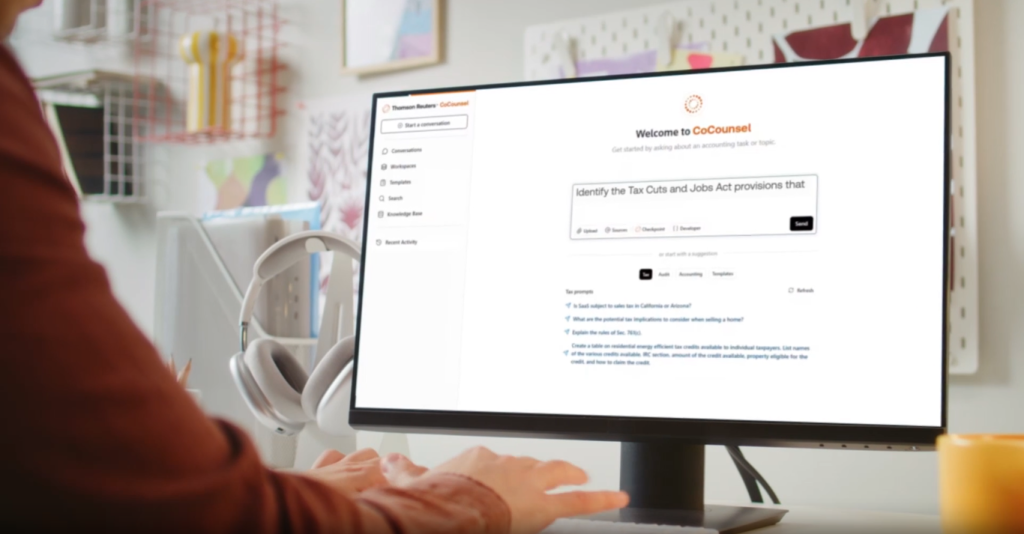

What is CoCounsel Tax? Focus & Fit

CoCounsel Tax, a product of Thomson Reuters, is an AI-powered research assistant for tax/legal analysis—great at finding, organizing, and synthesizing authority and drafting research-oriented summaries.

- Best for: teams spending most hours on research and internal memos.

- Consider an alternative if: you need the research plus client-ready outputs, numeric modeling, notice responses, SOPs, and tax-software how-tos—the “last mile” that ships work.

CPA Pilot vs CoCounsel Tax — Feature-by-Feature Comparison

CoCounsel Tax = research-first. CPA Pilot = full practice AI Tax Assistant (research → deliverables), designed to speed throughput across the entire tax workflow.

| Capability | CoCounsel Tax | CPA Pilot |

|---|---|---|

| Primary focus | Research & memo drafting | Full practice assistant (research → deliverables) |

| IRS & state citations baked into outputs | ✅ | ✅ |

| Client-ready email/letter drafting | ◐ (research summaries) | ✅ (sendable drafts with next steps) |

| IRS/State notice response drafting | ◐ (supporting research) | ✅ (fact prompts + cited response) |

| Numeric scenario modeling (reasonable comp, part-year residency, FTC, 1031 vs installment) | ◐ (narrative analysis) | ✅ (side-by-side figures & trade-offs) |

| Staff onboarding & SOPs (guided Q&A, checklists) | — | ✅ |

| Tax software support (Drake, Lacerte, UltraTax, ProSeries, ProConnect, QBO) | — | ✅ (how-to steps) |

| Knowledge capture/templates for reuse | ◐ | ✅ |

| Pricing accessibility (solo → teams) | Enterprise-leaning | Solo-friendly tiers + team sharing |

| Best for | Research-heavy workflows | End-to-end CPA firm throughput |

If you mainly need authority discovery, a research tool fits. If the grind is deliverables—emails, notices, and modeled choices—CPA Pilot wins on speed, clarity, and consistency.

Pricing Comparison — CoCounsel Tax vs CPA Pilot

- CPA Pilot: Public, transparent pricing starting at $19/user/month with monthly or annual billing and rollover credits; self-serve signup on the pricing page.

- CoCounsel (Thomson Reuters): No public pricing listed; buyers are directed to request a demo/quote (pricing gated behind sales forms/flows and bundled offerings).

Real-World Matchups — CoCounsel Tax vs CPA Pilot

Each card shows: Question → CoCounsel’s Typical Output → CPA Pilot’s Client-Ready Deliverable + Next Steps.

1) Multi-State Move & Part-Year Residency

Question: Client moved CA → TX in June. How do we allocate income, apply credits, and communicate the result?

CoCounsel : Research memo on residency rules, allocation methods, reciprocity/credits, and authority.

CPA Pilot : Sendable memo/email with side-by-side federal + state tax tables (CA part-year vs TX), cited assumptions, and a plain-English recommendation.

Next Steps

- Confirm residency dates & W-2 splits → 2) Apply allocation in software → 3) File memo in workpapers → 4) Send client summary for sign-off.

2) S-Corp “Reasonable Compensation”

Question: What salary vs distribution split balances payroll tax, QBI impact, and audit risk?

CoCounsel : Memo with reasonable-comp factors, case law, IRS guidance; qualitative pros/cons.

CPA Pilot : Two modeled scenarios (Higher-Salary vs Lower-Salary) with payroll tax, income tax, QBI drag, and take-home cash deltas, plus defensibility language.

Next Steps

- Choose target salary band → 2) Update payroll → 3) Save rationale memo → 4) Email client with numbers & risk notes.

3) Foreign Tax Credit (Passive Basket)

Question: Dividends with foreign withholding—how much FTC actually reduces U.S. tax?

CoCounsel : Narrative on §904 limitation, baskets, carrybacks/forwards; citations.

CPA Pilot : Compact FTC worksheet: U.S. tax on foreign-source income, limitation, usable credit now, carryover amount, and a documentation checklist.

Next Steps

- Gather 1099-DIV/1042-S data → 2) Apply limitation in return → 3) Record carryforward → 4) Send 4-bullet client summary.

4) §1031 Exchange vs Installment Sale

Question: Defer with §1031 or use installment sale for cash-flow flexibility—what wins here?

CoCounsel : Comparative research on §1031 eligibility/timelines/boot vs §453 rules, basis/recapture, risks.

CPA Pilot : Year-by-year tax & cash-flow tables for both paths, recapture timing, total after-tax proceeds, and a one-page recommendation.

Next Steps

- Confirm QI or installment terms → 2) Calendar §1031 deadlines or payment schedule → 3) Deliver client one-pager → 4) Prep workpapers.

5) Equity Comp / RSUs (ISO AMT Check)

Question: RSUs vest this quarter—AMT exposure? Withholding adjustments? State sourcing issues?

CoCounsel: Memo on ordinary income timing, AMT (if ISOs), multistate sourcing; references.

CPA Pilot : Vesting brief with recognized income, incremental tax, AMT trigger check, state workday sourcing notes, and recommended withholding %.

Next Steps

- Send vest-day client email with amounts → 2) Update W-4/estimates → 3) Capture assumptions in workpaper → 4) Schedule post-vest review.

Which One Should You Use – CoCounsel Tax or CPA Pilot?

Choose CoCounsel Tax if…

- You’re research-heavy: most hours on precedent, memos, controversy prep.

- Your last mile (emails, notices, templates) is already covered by staff/process.

- You prefer a research-first tool and will package outputs manually.

Choose CPA Pilot if…

- Your bottleneck is deliverables, not discovery: client emails, notice drafts, and modeled scenarios.

- You want sendable, cited outputs and SOPs/checklists so juniors ship partner-level drafts.

- You need tax-software how-tos (Drake, Lacerte, UltraTax, ProSeries, ProConnect, QBO) to implement decisions quickly.

- You care about accessible pricing for solos and small teams, with room to scale.

If your value is unlocked by finding authority, a research-first tool fits. If your value is unlocked by finishing work, choose a practice assistant that turns rules + facts into cited, numeric, client-ready deliverables.

FAQs – CoCounsel Tax Alternative

What’s the core difference between CoCounsel Tax and CPA Pilot?

CoCounsel Tax is research-first (authority discovery, synthesis, research memos). CPA Pilot is a practice assistant that extends research into client-ready deliverables, numeric scenarios, SOPs, and software how-tos.

Is CPA Pilot suitable for small firms?

Yes—built for the last mile of work with accessible pricing for solos and small teams.

Will I still need a research tool with CPA Pilot?

Maybe for edge cases/controversy. For everyday throughput—client comms, notices, modeled choices—CPA Pilot typically replaces it.

Are outputs cited?

Yes—IRS/state citations with clear assumptions so partners can approve in one pass.

How do they differ on multi-state and other complex scenarios?

CoCounsel helps you find and explain rules. CPA Pilot also models outcomes (e.g., part-year residency, apportionment, credits) and renders a sendable summary with next steps.

Can CPA Pilot draft IRS/state notice responses?

Yes—fact prompts, authority references, and a ready-to-send reply with checklists and timelines.

What about S-Corp’s reasonable compensation?

CoCounsel provides defensibility factors. CPA Pilot compares salary/distribution mixes with payroll/QBI/take-home effects and a client-facing recommendation.

Does CPA Pilot support Drake, Lacerte, UltraTax, ProSeries, ProConnect, QBO?

Yes—how-to steps to implement plans inside common tax and accounting suites.

How does team training differ?

CoCounsel supports research literacy. CPA Pilot adds SOPs, checklists, and guided prompts so new hires produce partner-level drafts faster.

What outcomes should we expect in a busy season?

Fewer rewrites, faster client sign-off, and measurable time savings from converting rules → numbers → sendable documents (with audit-friendly citations).

Conclusion & Next Steps

For CPA firms that need to finish—not just research—CPA Pilot is the best CoCounsel Tax alternative because it turns authority into sendable, cited deliverables backed by numbers and SOPs your whole team can use.

Ready when you are: Move from finding authority to shipping outcomes—cited, numeric, and client-ready.

Disclaimer: This article is provided by CPA Pilot for educational purposes. While we may offer tax software/services, the information here is general and may not address your specific facts and circumstances. It does not constitute individual tax, legal, or accounting advice. U.S. federal and State Tax laws change frequently; please consult a qualified tax professional before acting on any information.

![Florida Tax Planning – Residency, IRS & Multi-State Risk [2026 Guide]](https://www.cpapilot.com/blog/wp-content/uploads/2026/02/Florida-Tax-Planning.png)

![CPA Pilot vs TaxGPT vs ChatGPT: Best AI Assistant For Tax Planning [2026]](https://www.cpapilot.com/blog/wp-content/uploads/2025/09/ChatGPT-vs-TaxGPT-vs-CPA-Pilot-Comparison.png)