How AI is Transforming IRS Notice Response & Compliance Workflows?

[Last Updated on 3 months ago]

Do your clients panic when an IRS letter hits their mailbox—and can AI really help you handle these notices faster, safer, and with fewer penalties?

The answer is yes. AI tools can now read IRS notices like CP2000 and CP14, identify the issue in plain English, and generate a professional response letter. They also create client-ready checklists for required documents (e.g. a corrected 1099-DIV per the IRS 1099-DIV Instructions and General Instructions for Information Returns, or a copy of Schedule B (Form 1040) ) and track deadlines so nothing slips. This reduces panic for clients and busywork for staff.

TL;DR: AI for IRS Notice Response & Compliance

- AI helps CPAs respond to IRS notices faster by auto-classifying letters (CP2000, CP14, 12C), extracting key facts, and drafting professional response packets.

- It builds IRS-compliant letters, checklists, and attachments using cited sources like IRS Pub 594 and Forms 9465 or 843.

- Client panic drops with auto-generated plain-English emails, clear deadlines, and document requests tailored to each notice.

- AI tracks every deadline and submission, ensuring responses are sent securely and on time—with an audit trail to protect your firm.

- The IRS is modernizing with online uploads and smarter targeting, so firms must move from manual, reactive work to proactive, standardized workflows.

- CPA Pilot automates the full IRS response process—triage, draft, review, send—giving CPAs time back while keeping responses accurate, fast, and secure.

Common Notices AI Can Handle (CP2000, CP14, CP504, 12C, 5071C)

AI systems manage a wide range of IRS notices, including:

- CP2000 (underreported income)

- CP14 (balance due)

- CP501/CP503/CP504 (collection follow-ups)

- Letter 12C (missing info)

- CP5071C (identity verification)

These AI Tax Assistants guide firms through each step—triage, document collection, and response—using IRS guidelines to ensure accuracy.

Keeping Compliance Clean with Documented Paper Trails

When the IRS needs to verify identity or request missing info, AI can generate a clear client email and a document checklist for CP5071 identity verification (with the IRS’s Verify your return service) or Letter 12C. It also tracks dates, so nothing slips through the cracks.

If your client can’t pay in full, you can point them to Form 9465 — Installment Agreement Request (or file it for them) or apply via the IRS Online Payment Agreement tool—and document your advice against the IRS’s collections guidance in Publication 594. AI won’t replace your judgment, but it will reduce busywork and standardize your process.

Table of Contents

- IRS Modernization and AI Enforcement Trends

- Manual Processes vs Standardized AI Workflows

- What “AI for Compliance” Actually Does — From Triage to Advisory?

- How AI Streamlines IRS Notice Handling? [Step-by-Step SOP]

- Security, Compliance and ROI Proof

- CPA Pilot – AI-Powered IRS Notice Assistant

- FAQs – AI for IRS Notices

IRS Modernization and AI Enforcement Trends

How the Inflation Reduction Act Drives AI Adoption

The IRS is using funds from the Inflation Reduction Act to modernize its technology and analytics systems. This includes hiring data experts and upgrading systems to detect compliance issues faster, resulting in earlier and more frequent notices for taxpayers. Firms need tools that keep up with this accelerated pace.

Simple Notice Initiative and Online Document Uploads

The IRS sends 170+ million notices yearly and is simplifying the most common ones through the “Simple Notice Initiative.” Many now support secure online uploads, which eliminates back-and-forth mail delays. AI tools integrate with these systems to suggest the correct upload path based on notice type.

Smarter Case Selection and Risk-Based Targeting

AI and machine learning are being used by the IRS to prioritize complex or high-risk cases—such as large partnerships or income mismatches—while minimizing “no-change” audits. Tax firms must adapt by using AI themselves to flag potential issues, prepare accurate responses, and avoid unnecessary examinations.

Manual Processes vs Standardized AI Workflows

Why Standardization Wins in a High-Volume Environment

Manual, ad-hoc approaches struggle under the weight of notice volume, shorter timelines, and complex submission processes. Standardized workflows powered by AI ensure consistency, reduce errors, and allow firms to delegate tasks confidently to junior staff while preserving senior oversight.

AI-Driven Workflows Create Review-Ready Outputs

AI moves work from scratch drafting to structured, editable responses. It generates letters, exhibits, and client communications that are aligned with IRS instructions. Each output is built with citations and templates that reviewers can approve quickly, making your team faster and more reliable with every notice handled.

What “AI for Compliance” Actually Does — From Triage to Advisory?

Building on the modernization you just saw, here’s how AI fits into a real firm’s day-to-day—moving work from manual, ad-hoc tasks to a documented, review-ready flow.

1) Triage & classify (fast, consistent intake)

- Auto-detects the notice type (e.g., CP2000 vs CP14) and pulls key facts (tax year, proposed changes, due dates).

- Routes the case to the right queue with a standard checklist (what to review, what to request from the client).

2) Research with Citable IRS Sources

- Suggests relevant authorities to cite (IRS publications, instructions, IRM sections) right inside the draft.

- Common authorities staff rely on: Publication 594 – Collection Process (PDF) and the Taxpayer Bill of Rights.

3) Draft Professional Response Letters

- Produces a polished letter that you edit and sign—aligned to the notice type and requested action.

4) Auto-Build Evidence and Attachments

- Generates a tailored list of attachments: corrected 1099-DIV, brokerage statements, Schedule B, prior correspondence, proof of payment, etc.

- Prompts the client for exactly what’s missing and tracks receipt.

- When transcripts help the case, it flags Get Transcript options.

5) Confirm Facts, Deadlines, and Submission Paths

- Validates facts (amounts, years), confirms the response window, and proposes the correct submission path—mail, secure upload (when offered on a notice page), or online tools the IRS provides.

- Keep an audit trail (versions, reviewer notes, time stamps) to protect your firm and speed future reviews.

6) Simplify Client Communication

- Creates a plain-English email that explains the situation, what you’ll send, what you need from them, and the date you must respond by.

- Saves everything (letters, exhibits, emails) to your system so the file is complete for follow-up or future exams.

7) Move from Compliance to Advisory Services

- Surfaces planning opportunities (withholdings/estimates, reasonable-cause narratives, payment options) and suggests next-year guardrails.

- Standardizes SOPs for junior staff so senior reviewers spend time on decisions—not rebuilding the process.

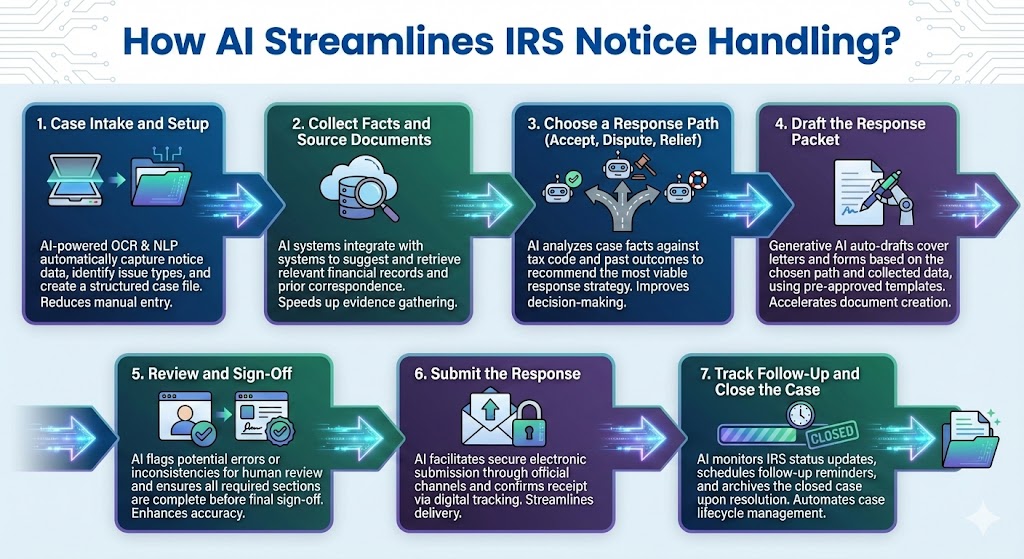

How AI Streamlines IRS Notice Handling? [Step-by-Step SOP]

Use this as a copy-ready SOP. Assign each step to a role (Intake, Preparer, Reviewer) and attach it to your task template.

Step 1: Case Intake and Setup

- Open a case with the notice code, tax year, “Respond by” date, and client contact.

- Verify authority (if needed): request/confirm Form 2848 (Power of Attorney) or Form 8821 (Tax Information Authorization) is on file.

- Create a one-line summary in plain English for the case title (e.g., “2024 CP2000 – 1099-DIV mismatch”).

Step 2: Collect Facts and Source Documents

- Request documents from the client using a checklist tied to the notice (broker statements, W-2/1099s, prior correspondence, proof of payments).

- Pull IRS data if authorized: Get Transcript (Account/Return/Wage & Income) to confirm what the IRS received.

- Note any special flags (ID theft, amended return pending, disaster relief).

Step 3: Choose a Response Path (Accept, Dispute, Relief)

- Accept (agree with the IRS) → calculate the impact and outline payment options.

- Dispute (all/part) → list each discrepancy and the evidence you’ll attach.

- Request penalty relief (when appropriate):

- Penalty relief (overview hub):

- Administrative penalty relief (includes First-Time Abate policy):

- Reasonable cause relief:

- Appeals info (if relief is denied)

- Form 843 (request abatement/refund): see Instructions for Form 843 when drafting.

Step 4: Draft the Response Packet

- Letter: header (taxpayer + masked TIN), notice number, clear issue statement, facts, conclusion, and desired resolution.

- Exhibits: number and label each attachment so it matches the letter (A, B, C…).

- If paying over time: include Form 9465 (Installment Agreement Request) or plan to use the Online Payment Agreement tool.

- If identity issues arise: follow the IRS Verify Your Return workflow or the CP5071 instructions; if ID theft is suspected, consider Form 14039 (Identity Theft Affidavit).

Step 5: Review and Sign-Off

- Recalculate dollar amounts; check tax year, names, notice code, and deadlines.

- Citations check: ensure references (forms, pubs, instructions) align with your argument (e.g., Publication 594 – Collection Process for payment/collection matters).

- Tone & clarity: confirm the letter is respectful, factual, and concise.

Step 6: Submit the Response

- Follow the notice’s submission channel: secure upload portal (if available on that notice), fax number listed on the letter, or mail to the address provided.

- Use the IRS guidance on Responding to a Letter or Notice for format and timing.

- Log the send (method, date/time, tracking/fax confirmation).

Step 7: Track Follow-Up and Close the Case

- Diary follow-ups (e.g., 30–45 days) and set reminders until the IRS posts a resolution or asks for more information.

- If balance remains: advise on payment options and due dates; update the client file with receipts or plan approvals.

- Close the case with a final summary (what changed, why, exhibits attached) and store everything in your DMS.

Security, Compliance and ROI Proof

Now that your SOP is set, here’s how you prove it’s safe, compliant, and worth the time.

How to Build Trust Using IRS and FTC Guidelines

- Build your written security plan around Publication 4557 – Safeguarding Taxpayer Data (PDF).

- Know your incident steps using Publication 5293 – Data Security Resource Guide

- Comply with the FTC Safeguards Rule (GLBA) and maintain a firm WISP (Written Information Security Plan).

- Request vendor assurance via AICPA SOC 2 reports (ask for the current report + bridge letter).

- Use official IRS channels referenced in Responding to a Letter or Notice and the guidance in Understanding Your IRS Notice or Letter.

Essential Technical and Procedural Safeguards

- Encryption in transit/at rest, MFA, role-based access, and least-privilege.

- Version history and audit trails on drafts and attachments.

- Automatic masking for TIN/SSN in templates; annual training logged.

- Vendor due diligence file (SOC 2, pen test summary, WISP review).

- Clear client data request/deletion process, documented and time-bound.

Calculate ROI from Time Saved and Penalties Avoided

- Inputs: Notices/month × minutes saved/notice = hours saved/month.

- Example: 30 × 45 minutes = 22.5 hours/month (~270 hours/year).

- Convert to value: hours saved × billable rate; include avoided penalties/interest due to faster, accurate replies.

- Secondary gains: fewer escalations, quicker payment arrangements, higher CSAT/NPS (capture with a short post-case survey).

What to Present in Demos and Sales Calls

- A redacted timeline showing faster resolution (e.g., 14 days vs 35).

- A one-page security summary citing Pub 4557, FTC Safeguards, and your vendor’s SOC 2.

- An SOP excerpt proving consistent steps (intake → review → submission → follow-up).

- A log of submissions aligned with Responding to a Letter or Notice and Understanding Your IRS Notice or Letter.

CPA Pilot – AI-Powered IRS Notice Assistant

Built for tax pros, not DIY. CPA Pilot helps your team process notice work the way you already practice—organized, citable, and review-ready—so seniors decide, juniors execute, and nothing slips.

Automate Classification, Drafting, and Exhibit Creation

- Classify & route: Detect the notice code and push it into the right task template with the response-by date already set.

- Generate review-ready drafts: Spin up letters matched to the notice type (CP2000, CP14 chains, 12C, 5071C, LT11), with placeholders for facts and a numbered exhibits list.

- Embed source references: Drop IRS links (forms, pubs, instructions) directly in the draft so reviewers see the “why” behind each checkbox.

- Collect exactly what’s needed: Auto-request the right docs from clients (corrected 1099-DIV, brokerage statements, Schedule B, payment proof) and track receipt.

- Keep an audit trail: Every draft, edit, approval, and send event is time-stamped to protect your file.

Why CPA Pilot Scales with Your Practice?

- SOPs you can reuse: Save your best response patterns as templates—one click for the next notice.

- Onboarding uplift: Junior staff follow the guided steps while reviewers focus on judgment calls.

- Security-first posture: Role-based access, PII safeguards, version history—so your WISP and documentation stay tight.

- Measurable outcomes: See time saved per notice and cycle times by notice family to guide staffing and pricing.

Why does this fit your roadmap?

- Agentic-ready: Turn multi-step tasks (draft → exhibits → client email → submission) into a single, approval-based flow.

- Transcript-aware future: Add transcript checkpoints to cut rework when the IRS posts new data.

- State-ready playbooks: Clone your federal SOPs for CA/NY/TX/FL with state links and checklists.

So, stop wrestling with the one-off notices. Turn them into a repeatable, citable workflow your whole team can run—so clients get calm, speedy answers and you get back hours every month.

- One inbox → one workflow → one clean file.

- Drafts that are review-ready, not blank pages.

- The right exhibits, first time—no back-and-forth.

- Built-in guardrails for deadlines, documentation, and privacy.

Try CPA Pilot on a real notice this week.

FAQs – AI for IRS Notices

What systems does AI notice response software integrate with?

AI tax notice systems integrate with practice management tools, secure document portals, and IRS transcript APIs to automate intake, track client docs, and sync deadlines with your firm’s workflow.

How accurate is AI in interpreting IRS notices like CP2000?

AI achieves high accuracy in parsing CP2000 and other IRS letters by using NLP to extract notice type, tax year, and due dates, minimizing human error and improving first-pass response success.

What is the cost of AI-powered tax notice response tools?

Pricing varies by volume and firm size, but AI tax platforms typically use per-user or per-notice models, offering scalable plans with ROI based on time saved, accuracy, and penalty avoidance.

Can AI be used for state tax notices like from California or New York?

Yes. AI systems can replicate federal IRS workflows for CA, NY, TX, and FL notices by swapping in state-specific codes, links, and checklists—ensuring local compliance at scale.

Who is liable for errors in an AI-generated IRS response?

The tax professional remains legally responsible. AI aids drafting and compliance but doesn’t replace human review, aligning with IRS guidance and ethical practice standards for accuracy.

Disclaimer: This article is provided by CPA Pilot for educational purposes. While we may offer tax software/services, the information here is general and may not address your specific facts and circumstances. It does not constitute individual tax, legal, or accounting advice. U.S. federal and State Tax laws change frequently; please consult a qualified tax professional before acting on any information.

![Florida Tax Planning – Residency, IRS & Multi-State Risk [2026 Guide]](https://www.cpapilot.com/blog/wp-content/uploads/2026/02/Florida-Tax-Planning.png)

![Last-Minute Mid-Year & Year-End Tax Planning Using AI – [2026 GUIDE]](https://www.cpapilot.com/blog/wp-content/uploads/2025/09/Last-Minute-Mid-Year-Year-End-Tax-Planning-Using-AI.png)