How to Automate & Optimize Your 1040 Tax Preparation using AI?

[Last Updated on 3 months ago]

Automate and optimize your 1040 tax preparation using AI by integrating smart intake systems, AI-powered document extraction, review-by-exception protocols, and e-file automation into a standardized workflow.

Start by digitizing client intake with a secure portal and enforcing a 90%-document rule for Form W-2, 1099-INT, 1099-NEC, 1099-K, and 1099-B. Use AI to organize and extract data for key schedules including Schedule A (itemized deductions), Schedule C (sole proprietor), Schedule D (capital gains/losses), and Schedule SE (self-employment). Let the system pre-flag complexity triggers like AMT (Form 6251), NIIT (Form 8960), and basis/QBI issues tied to K-1s from partnerships (1065) and S corps (1120-S).

Automate reconciliation for major credits such as §199A Qualified Business Income Deduction, Foreign Tax Credit (Form 1116), Education Credit (Form 8863), Energy Credit (Form 5695), and HSA (Form 8889). Apply AI-driven tax research to identify red flags across multi-state residency, crypto lot matching, and equity comp.

TL;DR – Automate Your 1040 Tax Workflow Using AI

- What It Is: A complete guide for CPA firms to modernize and automate their 1040 individual income tax preparation using AI and standardized workflows.

- Why It Matters: A well-defined 1040 workflow reduces rework, improves turnaround time (TAT), increases realization rates, and ensures IRS compliance.

- Core Components:

- Intake with 90%-documents rule

- Review-by-exception using checklists (AMT, NIIT, QBI, etc.)

- AI-driven tax research and document handling

- Clear reviewer roles and complexity scoring

- Standardized SOPs, secure portals, and tech stack planning

- Who It’s For:

- Tech-forward firm partners looking to scale efficiently

- Solo/small-firm CPAs juggling prep, review, and client comms

- Junior staff who need micro-SOPs and IRS-linked checklists

- Key Benefits: Faster cycle times, fewer notices, stronger documentation, cleaner client experience, and tighter audit trails.

- Final Result: Higher profitability, reduced chaos, and a scalable, repeatable tax prep process powered by AI.

Complete the workflow with Form 8879 e-file authorization, automated payment enforcement (“no pay, no file”), and locked-down archival protocols. Firms that implement this approach see faster cycle times, tighter AGI/taxable income calculations, fewer IRS notices, and cleaner client communication—without increasing staff burden.

This guide shows how AI powers every phase of 1040 tax prep, whether you’re a tech-forward firm owner, a solo CPA managing every step, or a junior tax pro learning the ropes.

Table of Contents

- What is a 1040 Tax Workflow & Why Does It Matter for CPA Firm Profitability?

- How Do You Set Up Pre-Season 1040 Readiness, Routing, & Policies?

- What Are the 6 Core Steps to Automate 1040 Tax Preparation Using AI?

- How Do You Secure Data and Maintain a 1040 Tax Audit Trail?

- How Do You Measure 1040 Workflow ROI With Key Metrics (Time Saved, TAT, Margin per Return)?

- FAQs: Common 1040 Tax Workflow Questions Answered

What is a 1040 Tax Workflow & Why Does It Matter for CPA Firm Profitability?

It’s a standardized, end-to-end process for preparing and delivering an individual income tax return. Clear steps. Clear owners. Clear rules. One way of working for everyone on the team.

What Does a High-Performing 1040 Tax Workflow Include?

- Policies (start/stop rules).

- Roles (prep vs. review).

- Handoffs (who touches what, when).

- Documentation standards (what lives in the workpaper, how it’s evidenced).

- Timing targets (SLA for each step). Metrics you track every week.

Why Does 1040 Tax Workflow Drive Profitability for CPA Firms?

Because it

- Shrinks cycle time,

- Lessens rework and protects the scope.

- Fewer back-and-forths.

- Fewer second reviews.

- More first-pass approvals.

That means more returns per staff hour, higher realization, and steadier cash flow.

Which KPIs Best Measure Workflow Performance?

- Turnaround Time (TAT).

- First-Pass Acceptance Rate.

- Rework Rate.

- Reviewer Hours per Return.

- Realization %.

- Utilization %.

- Days Sales Outstanding (DSO).

Each KPI is a gauge that shows whether your 1040 workflow engine is running smoothly or beginning to stall.

How Does 1040 Tax Workflow Benefit Clients and Staff?

Clients get predictable updates and faster delivery. Staff get fewer fire drills and clearer expectations. You get a capacity you can actually plan.

All-in-all, A 1040 workflow is the operating system for your tax practice. By fixing the steps, owners, and metrics, you convert ad-hoc tasks into a repeatable process that scales without burning margins or people.

How Do You Set Up Pre-Season 1040 Readiness, Routing, & Policies?

This pre-season package sets guardrails for tools, routing, and commercial terms so production can run predictably under load.

By defining controls (security, access, transmission), flow (lanes, SLAs, escalations), and agreements (scope, pricing, reminders), you eliminate mid-season negotiation and protect margin.

How Should You Set Up Your Tech Stack and SOPs for Readiness?(CRM, DMS, secure client portal)

Prioritize auditability and reversibility: every tool choice needs export paths, uptime SLAs, and a written rollback plan.

Document a 1-page runbook for common outages so staff know exactly how to proceed without slowing production.

- Access & identity: Enforce MFA, least-privilege roles, and inactive-user purges; capture quarterly access attestations.

- Data protection baselines: Align your WISP and security SOPs with IRS Publication 4557 – Safeguarding Taxpayer Data

- For ongoing guidance that reinforces Pub. 4557, bookmark Protect your clients; protect yourself and the Taxes-Security-Together Checklist hubs.

- E-file readiness controls: Confirm EFIN monitoring, transmission integrity, and signature procedures per IRS Publication 1345 – Handbook for Authorized IRS e-file Providers (latest PDF), and keep the E-file for tax professionals hub handy for updates and linked pubs.

- Source-of-truth map: Define where client master data lives (CRM), where workpapers live (DMS), and which portal is used for intake—plus a field list that must be kept in sync.

- Operational runbooks: Create “break-glass” steps for portal downtime (e.g., temporary SFTP), CRM outages (CSV queue), and e-file rejects (escalation sequence + owner).

How Should You Segment and Route 1040 Returns Based on Complexity? (simple vs complex, SLAs, reviewer roles)

Use your calendar to shape workload—front-load easier files early and reserve review blocks near payment milestones. Publish exception thresholds (e.g., number of states, K-1 count) that auto-move a file to a different lane before it becomes a bottleneck.

- Complexity scoring: Assign points for states, K-1s, equity comp, crypto, rentals, foreign tax, AMT/NIIT. Lane rules: Simple (0–2), Moderate (3–5), Complex (6+).

- Routing matrix:

- Simple → junior preparer, senior spot-check; same-week SLA.

- Moderate → intermediate preparer, senior review by exception; 7–10 day SLA.

- Complex → senior prep/review; staged sign-offs; custom SLA with client.

- Capacity planning: Block calendar “review pods” for Complex files. Cap daily intake so downstream reviewers aren’t flooded.

- Auto-escalations: If a task exceeds lane SLA or crosses a risk threshold (e.g., 3+ K-1s added midstream), auto-reassign to the higher lane and notify billing.

Which engagement letters, pricing rules, and organizer/reminder templates work best?

Test variations quarterly: Shorten copy, clarify deliverables, and track acceptance, turnaround, and average fee to find winners. Add plain-language summaries and consistent visual cues so clients understand next steps without staff intervention.

- Engagement terms: State scope boundaries (states, K-1s, crypto reconciliation), change-order triggers, and consent to e-signature. Tie the filing release to the cleared payment.

- Pricing framework: Base fee by lane + menu add-ons (additional state, equity comp schedule, wash-sale reconciliation, basis work). Include rush/late-doc surcharges and a minimum for advisory pivots.

- Organizer build: Dynamic doc checklist that updates as facts change (e.g., new brokerage). Include a short “What’s new this year?” item to reduce Q&A.

- Reminder logic: Time-boxed nudges (e.g., T-14/T-7/T-3) plus event-based triggers (unopened email after 72 hours, partial upload with critical items missing).

- Payments: Offer ACH/CC with auto-reminders; apply “no pay, release hold” logic at the billing step so teams aren’t filing on credit.

With your guardrails, roles, and timelines locked in, it’s time to move from planning to production.

What Are the 6 Core Steps to Automate 1040 Tax Preparation Using AI?

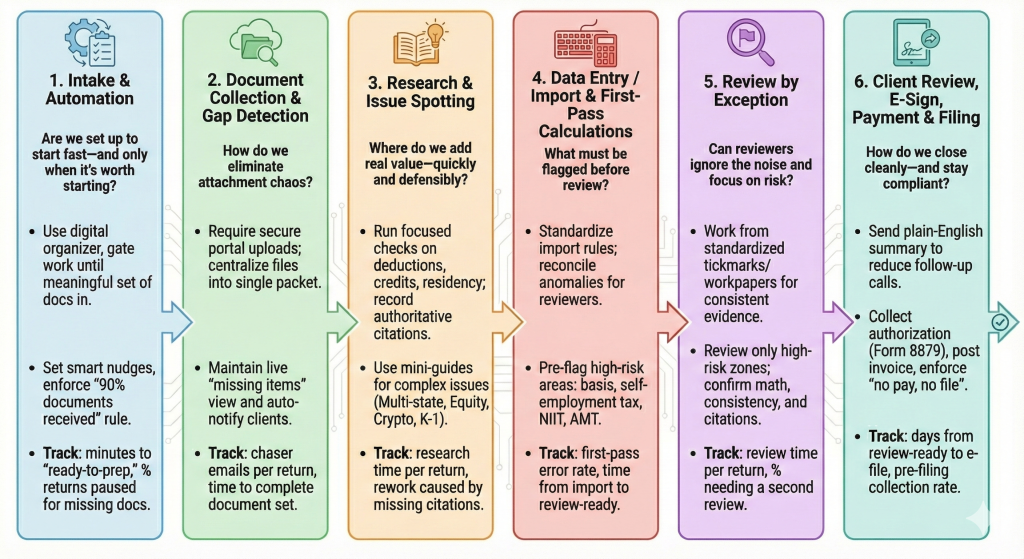

Here’s the streamlined, six-step 1040 tax preparation workflow using AI that your team can run the same way—every time:

1) Intake & Automation: Are we set up to start fast—and only when it’s worth starting?

- Use a digital organizer with a clear ID/document checklist. Gate work until a meaningful set of documents is in.

- Set smart nudges (for example, resend if unopened after 3 days) so you’re not chasing by hand.

Exceptions to watch for: Ensure your “90% documents received” rule is enforced at this step. Any incomplete documents should be flagged for follow-up and file preparation until the client uploads the missing documents.

- Track: minutes to “ready-to-prep,” % returns paused for missing docs.

- Resource: Kickoff email pack.

2) Document Collection & Gap Detection: How do we eliminate attachment chaos?

- Require secure portal uploads; centralize files into a single review-ready packet.

- Maintain a live “missing items” view and auto-notify clients when key pieces are absent.

Exceptions to watch for: If clients only upload partial documents (e.g., missing brokerage statements), enforce a policy of “no work until 90% docs received.” Have an auto-follow-up reminder sequence to reduce these gaps.

- Track: chaser emails per return, time to complete the document set.

- Resource: Missing-items email set.

3) Research & Issue Spotting: Where do we add real value—quickly and defensibly?

- Run focused checks on deductions, credits, residency, and investment activity; record authoritative citations in the workpapers.

- Use quick mini-guides when situations arise:

- Multi-state/part-year: credits for taxes paid and domicile considerations.

- Equity comp & AMT: review triggers and computations tied to Form 6251.

- Schedule C & K-1/QBI: basis support and §199A checkpoints tied to Schedule K-1 (1065) instructions and K-1 (1120-S) instructions.

- Crypto & wash sales: data sources and lot-matching documentation aligned with capital transactions on Schedule D.

Exceptions to watch for: As you review deductions or credit eligibility, spot missing or incomplete forms early, such as K-1s, which can delay the return. Use change order mechanisms to charge clients extra for any unexpected complexity.

- Track: research time per return, rework caused by missing or weak citations.

- Resource: Research prompts library.

4) Data Entry / Import & First-Pass Calculations: What must be flagged before review?

- Standardize import rules; reconcile anomalies as you go so reviewers aren’t debugging later.

- Pre-flag high-risk areas: basis, self-employment tax, NIIT (see Form 8960), and potential AMT.

Exceptions to watch for: Any missing information that triggers manual entry or complex adjustments should be flagged immediately and escalated to a senior reviewer if it alters the expected calculations significantly.

- Track: first-pass error rate, time from import to review-ready.

5) Review by Exception: Can reviewers ignore the noise and focus on risk?

- Work from standardized tickmarks/workpapers so evidence is consistent across staff.

- Review only the high-risk zones; confirm math, cross-form consistency, and the presence of citations.

Exceptions to watch for: If you spot scope creep (new K-1 forms, multi-state filings, etc.) during review, follow a defined change order process to adjust the pricing and re-route the return to a higher reviewer tier.

- Track: review time per return, % needing a second review.

- Resource: Review-by-exception checklists.

6) Client Review, E-Sign, Payment & Filing: How do we close cleanly—and stay compliant?

- Send a plain-English summary (or short screen-record) to reduce follow-up calls.

- Collect authorization via Form 8879, post invoice, and enforce a clear “no pay, no file” rule. Archive once filed and log who reviewed what and when.

Exceptions to watch for: Incomplete payments or clients delaying their authorization should trigger a hold on filing until payment or authorization is received, ensuring compliance with the “no pay, no file” policy.

- Track: days from review-ready to e-file, pre-filing collection rate.

- Resource: Payment/e-sign email set + post-filing checklist.

How Do You Secure Data and Maintain a 1040 Tax Audit Trail?

When you protect your client’s data and ensure a clear audit trail, you safeguard both your firm’s reputation and compliance standing. Secure document retention, role-based permissions, and properly logged reviewer actions create a defense in case of an audit and prevent unauthorized access to confidential information.

What are the IRS Retention Rules and Approved Storage Practices?

- Retention schedules: Follow IRS guidelines for record retention. For most tax documents, retain for 3 years after the filing date (the standard audit window), but extend this period for returns involving fraud or substantial underreporting.

- State requirements: Review your state’s specific retention rules for tax records (e.g., in California, certain records may need to be retained for 7 years).

- Approved storage locations: Keep client data in secure cloud storage that’s backed by encryption in transit and at rest. Ensure your data storage service complies with IRS security guidelines and best practices for sensitive data.

- Documentation backup: Store copies of Form 8879 (e-signatures), final returns, and any correspondence with clients in both cloud storage and an encrypted, offline backup to mitigate ransomware risks.

- Immutable backups: Use WORM (Write Once, Read Many) technology to ensure stored data can’t be modified once it’s archived. This helps safeguard against accidental or malicious alterations.

How Do Role-Based Permissions Protect Client Data?

- Limit data access: Only provide access to client data on a need-to-know basis. Use role-based access controls (RBAC) to restrict who can view, modify, or delete sensitive documents like tax returns and W-2 forms.

- Monitor access: Audit log access to ensure that users only access data that pertains to their role, and conduct regular access reviews to ensure compliance.

- Encryption at all levels: Use strong encryption to protect Personally Identifiable Information (PII) stored in the client portal, including scanned documents like W-2s, 1099s, and K-1s, as well as workpapers containing client-specific data.

- Segregation of duties: Implement a separation of duties policy that ensures one person cannot prepare, review, and file a return without checks from other staff members.

- Just-in-time access: Implement SSO (Single Sign-On) with device posture checks, requiring managed devices for remote access, and enforce session timeouts after periods of inactivity.

What Must Be Logged in a Reviewer Audit Trail?

- Reviewer actions: Keep a log of who reviewed what (name, role, date/time), what items were flagged, what changes were made, and the citation or law that supports each review action.

- Final approval: Document the final approval of the return by the senior reviewer, including their acknowledgment of the reviewed items.

- IRS compliance: Store records that show your reviewers checked the tax law citations applicable to deductions, credits, and income inclusions. This audit trail ensures your return is fully defensible during any audit.

- Immutable versioning: Each document should be linked to a timestamp and a cryptographic hash to ensure integrity and prove that files were not altered after the review. Cross-reference each adjustment with the supporting authority or law (e.g., IRS publications or IRS forms like Form 8960).

How Do You Measure 1040 Workflow ROI With Key Metrics (Time Saved, TAT, Margin per Return)?

Measuring ROI is about proving that each process change converts into faster cycle time, fewer redo loops, and higher realized fees. A clean baseline, lane-level comparison, and a weekly dashboard make improvements visible and repeatable.

Optimizing your 1040 workflow isn’t just about speeding up tax season—it’s about creating a sustainable, error-free system that maximizes efficiency and profitability year after year.

With an AI-powered assistant like CPA Pilot, you can streamline your entire process—from secure document collection to e-filing, while reducing bottlenecks, minimizing rework, and maintaining compliance.

As the year-end approaches, now’s the perfect time to implement a smart, automated 1040 workflow for the next tax season. Let CPA Pilot be your AI tax assistant, guiding you through every step and keeping you ahead of the curve.

Ready to revolutionize your 1040 prep process? Start your free demo with CPA Pilot today and experience the future of tax preparation. Schedule a demo now!!

FAQs: Common 1040 Tax Workflow Questions Answered

How Should You Handle Prior-Year Carryovers?

Import prior-year data, verify carryforward worksheets, and reconcile Schedule D/AMT/QBI carryovers before calc.

Should you auto-generate estimated tax vouchers (Form 1040-ES)?

Compute safe harbor (100%/110% of prior-year tax or 90% of current) and issue quarterly vouchers with reminders.

How do IP PINs affect e-filing?

Confirm the client’s six-digit IP PIN annually via the IRS IP PIN tool; returns are rejected without it.

What’s the right workflow for extensions (Form 4868)?

Estimate balance due, transmit 4868, and collect payment authorization; set a post-season delivery SLA.

How do you I prevent underpayment penalties (Form 2210)?

Run the annualized method if the income is uneven; adjust Q2–Q4 estimates to meet safe harbor and document rationale.

How Do You Reconcile ACA Marketplace Forms (Form 1095-A & Form 8962)?

Match 1095-A to 8962, reconcile APTC, and request corrected forms if SLCSP is wrong.

How Do You Report 1099-K and Platform Income?

Tie 1099-K to books, separate hobby vs. Schedule C, and track basis for resale items.

How Do You Resolve Filing-Status and Dependency Conflicts?

Apply tiebreaker rules, document residency/support tests, and lock status before computations.

How do I manage passive activity losses (Form 8582) on rentals?

Assess active participation, PAL limits, and disposition rules; maintain basis & at-risk records.

What year-end tax strategies should be part of the 1040 workflow?

Incorporate year-end tax strategies like timing capital gains/losses, accelerating deductions, deferring income, and maximizing retirement contributions. These actions reduce taxable income before filing deadlines and should be captured during intake and issue-spotting.

Disclaimer: This article is provided by CPA Pilot for educational purposes. While we may offer tax software/services, the information here is general and may not address your specific facts and circumstances. It does not constitute individual tax, legal, or accounting advice. U.S. federal and State Tax laws change frequently; please consult a qualified tax professional before acting on any information.

![Florida Tax Planning – Residency, IRS & Multi-State Risk [2026 Guide]](https://www.cpapilot.com/blog/wp-content/uploads/2026/02/Florida-Tax-Planning.png)

![Last-Minute Mid-Year & Year-End Tax Planning Using AI – [2026 GUIDE]](https://www.cpapilot.com/blog/wp-content/uploads/2025/09/Last-Minute-Mid-Year-Year-End-Tax-Planning-Using-AI.png)