How to Adjust Your W-4 Withholding for a Bigger Tax Refund?

[Last Updated on 2 months ago]

Have you ever wondered why your tax refund is smaller than expected, or why you end up owing taxes at the year’s end?

Many people find themselves in this situation because their W-4, the form used by employers to calculate tax withholding from paychecks, isn’t optimized for their financial situation.

Adjusting your W-4 can be a simple yet powerful step to ensure you’re not overpaying or underpaying your taxes throughout the year.

This is important for maximizing your tax refund and managing your finances more effectively.

TL;DR: Adjust Your W-4 for a Bigger Tax Refund

- Adjust your W-4 to avoid under- or overpaying taxes during the year.

- Use the IRS Tax Withholding Estimator to calculate accurate withholding.

- Update your filing status, dependents, and deductions on the W-4 form.

- Submit the revised form to your employer’s payroll or HR department.

- Revisit your W-4 anytime your income, job, or family situation changes.

- Check if your state requires a separate withholding form like DE-4 (CA) or IT-2104 (NY).

- Avoid common mistakes like choosing the wrong status or ignoring life changes.

- Accurate W-4 settings help maximize your refund or minimize your tax bill.

In this guide, we’ll walk you through

- The importance of adjusting your W-4,

- How adjusting W-4 impacts your tax withholding, and

- Provide actionable steps to help you optimize W-4 for better tax planning.

By the end, you’ll understand why adjusting your W-4 isn’t just about getting a refund, but about taking long-term control of your tax situation.

Table of Contents

- What is the W-4 Form and How Does It Affect Withholding?

- Why Should You Adjust Your W-4 Right Now? (Top 5 Reasons for Tax Year 2025)

- Step-by-Step Guide to Updating Your W-4 Withholding [2025-26]

- How State-Specific Taxes Affect Your W-4 Adjustments?

- How to Submit Your W-4 to Your Employer?

- What are the Common Mistakes to Avoid When Adjusting Your W-4?

- Final Checklist – Take Control of Your Tax Withholding Today

- FAQs About Adjusting Your W-4 Withholding

What is the W-4 Form and How Does It Affect Withholding?

The W-4 form, also known as the “Employee’s Withholding Certificate” is the document you submit to your employer to determine how much federal income tax should be withheld from your paycheck.

This withholding is based on factors such as:

- Your income,

- Tax filing status,

- Number of dependents, and

- Any additional adjustments you make.

The amount withheld throughout the year is then applied to your total tax liability when you file your tax return.

By properly adjusting your W-4, you ensure that the right amount of tax is withheld – meaning you avoid overpaying or underpaying.

Over-withholding results in a larger tax refund, but it also means you’re essentially giving the government an interest-free loan.

On the other hand, under-withholding can result in a larger tax bill come tax season and potential penalties for not paying enough throughout the year.

For 2025, the IRS continues to use the redesigned W-4 form, which no longer uses withholding allowances. Instead, adjustments are made directly for dependents, deductions, and other income.

Now that you understand how the W-4 controls your tax withholding, it’s important to know when and why to update it. Life changes, financial shifts, and IRS updates can all impact your tax situation. Below are the top reasons to review and adjust your W-4 to stay in control and avoid surprises at tax time.

Why Should You Adjust Your W-4 Right Now? (Top 5 Reasons for Tax Year 2025)

- Avoid Unexpected Tax Bills: Under-withholding means not enough tax is taken from your paycheck. This can lead to a surprise tax bill or IRS penalties when you file.

- Increase Monthly Cash Flow: Over-withholding gives the IRS more money than necessary during the year. Adjusting your W-4 can put more money in your pocket each payday.

- Reflect Major Life Changes: Events like marriage, divorce, having a child, or changing jobs all affect your tax situation. Update your W-4 to match your current life status.

- Maximize Tax Credits and Deductions: Claiming the right dependents and deductions on your W-4 helps reduce withholding and increases your take-home pay throughout the year.

- Stay Aligned with IRS Guidelines: The IRS recommends reviewing your W-4 annually or after major changes. Using their Tax Withholding Estimator ensures your withholding is accurate and up to date.

Once you know why you need to adjust your W-4, the next step is to update the form to match your current income, dependents, and deductions. Use the guide below to optimize your withholding and avoid tax-time surprises.

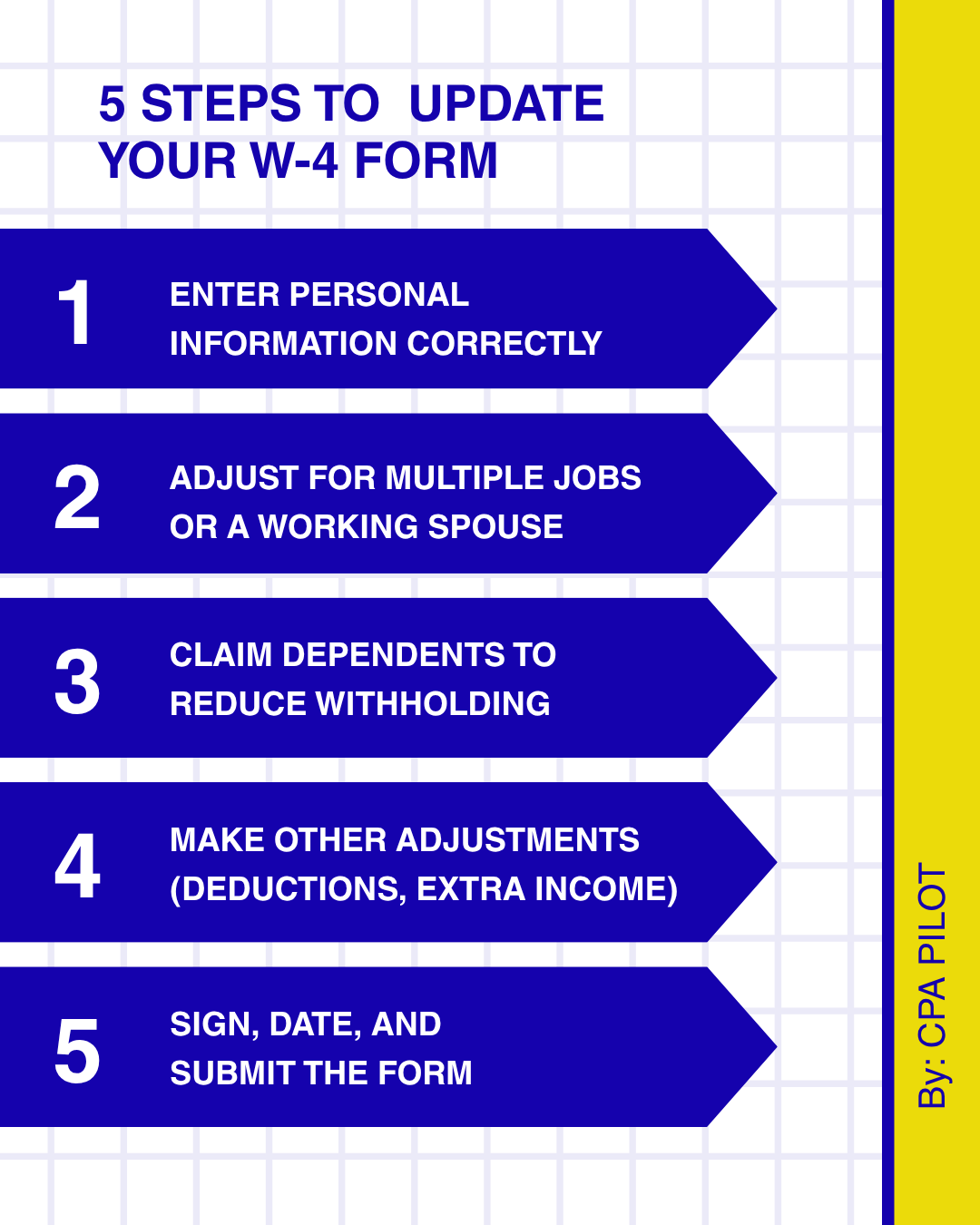

Step-by-Step Guide to Updating Your W-4 Withholding [2025-26]

Let’s break down the process of adjusting your W-4 for better tax planning so you can take the necessary steps to ensure you’re paying the right amount of taxes throughout the year.

Where Can You Find the Latest IRS W-4 Form?

The IRS W-4 form is available for download directly from the IRS website. It’s important to use the most up-to-date version of the W-4 to ensure accuracy, as older versions may not reflect recent tax changes.

Employers will also provide a copy of the W-4 for you to fill out when you start a new job or need to make adjustments.

Step 1 – Enter Personal Information Correctly

In this section, you’ll provide basic details such as:

- Your name,

- Social Security number (SSN),

- Address, and

- Filing status (Single, Married, Head of Household).

Why It Matters: Your filing status impacts the tax rate applied to your income. If you’re married, you may choose to file as “Married” or “Single” depending on your preferences and financial situation. This can have a direct effect on the amount of withholding.

Tip: Double-check your personal information to avoid delays or errors.

Step 2 – Adjust for Multiple Jobs or a Working Spouse

Having multiple jobs means that the income from each job is taxed at a rate based on your total combined income. Without adjusting your withholding to account for this additional income, you may end up underpaying and owing taxes when you file your return.

- Option 1: Use the IRS Tax Withholding Estimator: The IRS recommends using its Tax Withholding Estimator for the most accurate calculation. This online tool helps you estimate how much should be withheld based on your combined income and family situation, providing personalized results.

- Option 2: Multiple Jobs Worksheet: If you prefer a manual approach, you can use the Multiple Jobs Worksheet in the W-4 instructions, which provides a more detailed breakdown of how to adjust your withholding based on the number of jobs you or your spouse has.

- Option 3: Check the Box: For a simpler solution, you can check a box to adjust for multiple jobs automatically. This method may result in higher withholding and a larger refund, but it could also lead to over-withholding if the incomes are different.

Step 3 – Claim Dependents to Reduce Withholding

In this step, you can claim any dependents that qualify for tax credits, which will reduce your withholding.

- Child Tax Credit: For each child under 17, you can claim a $2,000 credit. This credit will lower your withholding amount, meaning less tax is taken out of your paycheck.

- Other Dependents: You can also claim $500 for other dependents who do not qualify for the Child Tax Credit (such as older children or elderly parents).

By claiming your dependents, you lower the amount of federal income tax withheld from your paycheck. This means more of your earnings remain in your pocket throughout the year, rather than being overpaid to the IRS and refunded later. It’s a smart strategy for parents or caregivers who want to adjust their withholding to better match their tax liability.

Step 4 – Make Other Adjustments (Deductions, Extra Income)

This section lets you fine-tune your withholding further by adjusting for additional income, deductions, or extra withholding.

- 4a – Other Income: Report other sources of income that aren’t subject to withholding, like interest, dividends, or retirement income. This will help ensure the right amount of tax is withheld to cover that income.

- 4b – Deductions: If you plan to itemize deductions instead of taking the standard deduction (e.g., for mortgage interest, charitable donations), you can report this here. This will reduce your withholding, as it estimates how much tax you will save through these deductions.

- 4c – Extra Withholding: If you prefer to have extra tax withheld to avoid a potential tax bill, you can specify an additional amount to be deducted from each paycheck. This is useful if you have substantial other income or want a larger refund.

Tip: Consider using the IRS Tax Withholding Estimator to determine whether any additional withholding is necessary, based on your specific circumstances.

Step 5 – Sign, Date, and Submit the Form

Once you’ve completed all the sections, sign and date the W-4 form. This step is essential to validate the form for your employer.

Submit the Form to Your Employer

Finally, submit the updated W-4 to your employer’s payroll or HR department. After submitting, don’t forget to monitor your paychecks to ensure the new withholding amounts are correctly applied.

If the new withholding doesn’t show immediately, follow up with your employer to confirm that they have processed the updated form.

Pro tip — When in doubt, model first, then write the number:

- Run the Estimator, note its specific dollar suggestion for Step 4(c), then enter that exact amount on your W-4. This aligns your form with an IRS-calibrated projection and reduces surprises at filing time.

How State-Specific Taxes Affect Your W-4 Adjustments?

While the W-4 helps you adjust your federal withholding, it’s important to remember that state taxes may affect your total withholding as well. Each state has its own rules, rates, and deductions that might not align with federal law, which is why you may need to make additional adjustments for your state’s taxes.

1. Why State-Specific Adjustments are Important?

Some states have progressive tax rates similar to the federal system, while others have flat rates or no income tax at all. If you’re living in a state with higher taxes, such as California or New York, adjusting your W-4 to reflect your state withholding is critical to avoid over- or underpayment at the end of the year.

2. Do You Need a Separate State W-4 Form?

While the IRS W-4 form covers federal withholding, many states require their own state-specific withholding form to calculate the correct amount of state tax to withhold from your paycheck. For example:

- California: Requires a separate DE-4 form, which includes additional details like marital status and the number of exemptions.

- New York: Uses the IT-2104 form, which allows for adjustments based on filing status, dependents, and other credits specific to New York State tax laws.

3. How State Taxes Affect Your Withholding?

In most cases, state taxes will be calculated separately from federal withholding, but the concept remains the same. If you live in a high-tax state, such as California or New York, you may want to adjust your W-4 to reflect more withholding upfront.

For states without an income tax, like Florida or Texas, this step may not be necessary, and you may only need to worry about federal withholding.

4. How to Account for State Taxes on Your W-4?

Some states automatically base their withholding on your federal withholding information, while others require a separate form to complete.

Be sure to consult your state’s specific form to ensure accuracy, and don’t forget to adjust your W-4 to match your current tax situation. You can find most state forms online or through your employer’s HR or payroll department.

How to Submit Your W-4 to Your Employer?

Once you’ve made the necessary adjustments to your W-4, the next step is to submit it to your employer, but this process can vary depending on your employer’s systems. Here’s what to keep in mind:

1. Online vs Paper Submission:

If your employer uses an online payroll system, you can usually submit your updated W-4 through their portal. This allows faster processing and ensures that the adjustments are applied to your paycheck immediately.

Alternatively, if your employer requires a paper form, you will need to submit a signed copy to your HR department or payroll department.

2. What to Do If Withholding Doesn’t Update?

After submitting the updated W-4, verify that the changes are reflected in your paycheck. If the withholding doesn’t change, follow up with your employer or payroll department to make sure they processed the form correctly.

3. Common Issues with W-4 Submission

Some employers may not process changes immediately, which could lead to a delay in the adjustments being reflected on your paycheck. If this happens, it’s important to follow up with HR to ensure that the W-4 has been properly updated in the payroll system.

While adjusting your W-4 can significantly improve your tax withholding and cash flow, there are common mistakes that could affect your tax situation if not carefully avoided.

What are the Common Mistakes to Avoid When Adjusting Your W-4?

Understanding these potential pitfalls can help ensure that your withholding is as accurate as possible and that you’re not caught off guard during tax season.

1. Under- or Over-Withholding

One of the most common mistakes people make when adjusting their W-4 is under-withholding or over-withholding.

- Under-withholding: This occurs when not enough tax is withheld throughout the year. It might seem like you’re getting more take-home pay now, but it could result in a surprise tax bill when you file your return.

- Over-withholding: While it might feel good to get a larger refund, over-withholding means you’re essentially giving the government an interest-free loan. It’s better to have that money in your pocket throughout the year rather than waiting for a refund.

2. Choosing the Wrong Filing Status:

Choosing the wrong filing status on your W-4 can significantly impact how much tax is withheld.

- Single vs. Married: If you’re married but select “Single” on your W-4, it could result in higher withholding. Conversely, choosing “Married” when you’re actually single can lead to under-withholding.

- Head of Household: If you’re a single parent or have a dependent, you may qualify for the “Head of Household” status, which can lower your tax rate. Always double-check this section to ensure your withholding aligns with your actual situation.

3. Not Updating W-4 After Major Life Events

It’s essential to review and update your W-4 after major life events such as:

- Getting married or divorced

- Having children or other dependents

- Changing jobs or increasing income

- Buying a home or making large deductions (e.g., student loan interest, medical expenses)

Failing to update your W-4 after such changes can lead to inaccurate withholding, either resulting in a higher-than-necessary tax bill or unnecessarily small refunds.

4. Skipping the IRS Tax Withholding Estimator

The IRS Tax Withholding Estimator is one of the most accurate tools available for adjusting your withholding. Many people neglect to use it and end up relying on guesswork. Using this tool helps ensure that you are withholding the correct amount based on your financial situation, income, dependents, and deductions.

5. Ignoring State-Specific Withholding Requirements

In addition to federal withholding, some states have their own rules and forms for tax withholding. For example, states like California and New York require additional forms, while others, such as Florida and Texas, do not have state income taxes.

Make sure you’re aware of both federal and state requirements when adjusting your W-4, and don’t forget to account for local taxes if applicable.

Final Checklist – Take Control of Your Tax Withholding Today

Adjusting your W-4 can be a simple yet powerful step to ensure that you’re neither overpaying nor underpaying your taxes throughout the year.

By accurately setting your withholding, you not only avoid a surprise tax bill but also have more control over your financial situation. The process is straightforward, but it’s important to carefully review each section, especially as your life circumstances change.

Recap of Key Steps:

- Review your personal information to ensure your filing status is accurate.

- Adjust for multiple jobs or a spouse’s income using the IRS Tax Withholding Estimator or the Multiple Jobs Worksheet.

- Claim any eligible dependents to lower your withholding.

- Make adjustments for deductions or extra withholding based on your financial situation.

- Submit your W-4 to your employer and verify that the changes are reflected in your paychecks.

By taking the time to adjust your W-4 today, you can ensure that your withholding is optimized for your needs—whether you’re aiming for a larger refund, a smaller tax bill, or more balanced paychecks throughout the year.

If you’re unsure about the best withholding strategy for your unique situation, or if you need expert guidance on tax planning, CPA Pilot is here to help.

We specialize in leveraging advanced AI Tax Assistant to provide tax professionals with automated research, tax-saving strategies, and personalized 1040 planning. Our AI-powered platform simplifies the complexities of tax preparation, helping you save time, improve accuracy, and maximize client satisfaction.

Book a demo with CPA Pilot today to explore how our innovative tools can transform your tax workflows and optimize your firm’s operations. Let us guide you through the tax season and beyond, ensuring your taxes work smarter, not harder.

FAQs About Adjusting Your W-4 Withholding

How often should I update my W-4?

Update your W-4 whenever your income, job status, or dependents change.

Does W-4 affect my paycheck frequency?

No, your W-4 controls tax withholding, not paycheck frequency.

Can freelancers or contractors use a W-4?

No, freelancers use Form W-9 or 1099; W-4 applies only to employees.

What happens if I don’t submit a W-4?

If no W-4 is filed, employers withhold taxes at the highest single rate.

Is W-4 withholding the same as estimated tax payments?

No, W-4 is for paycheck withholding; estimated taxes are paid separately by self-employed individuals.

Disclaimer: This article is provided by CPA Pilot for educational purposes. While we may offer tax software/services, the information here is general and may not address your specific facts and circumstances. It does not constitute individual tax, legal, or accounting advice. U.S. federal and State Tax laws change frequently; please consult a qualified tax professional before acting on any information.

![Last-Minute Mid-Year & Year-End Tax Planning Using AI – [2026 GUIDE]](https://www.cpapilot.com/blog/wp-content/uploads/2025/09/Last-Minute-Mid-Year-Year-End-Tax-Planning-Using-AI.png)